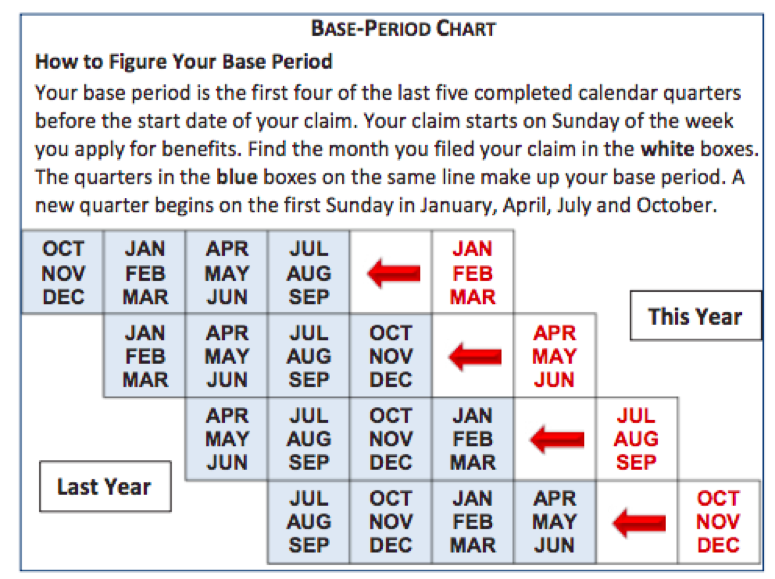

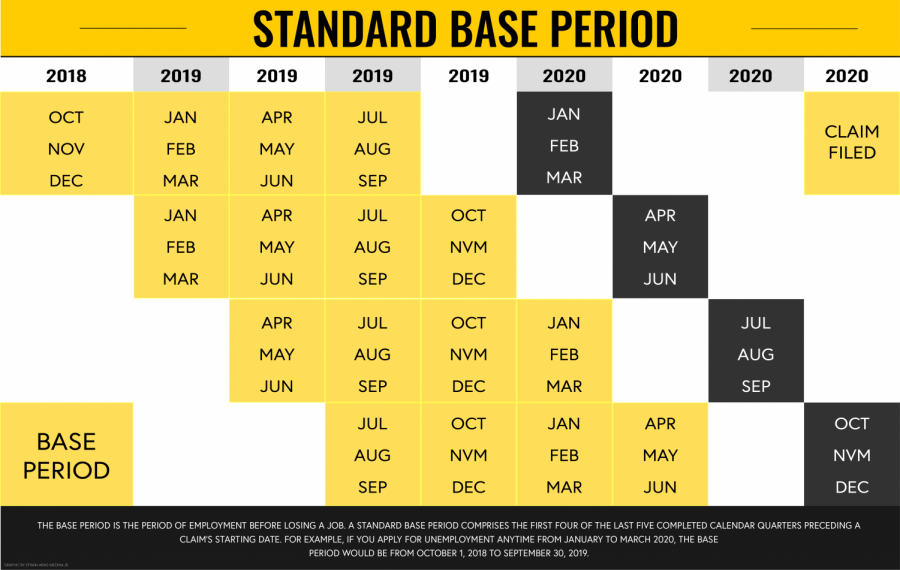

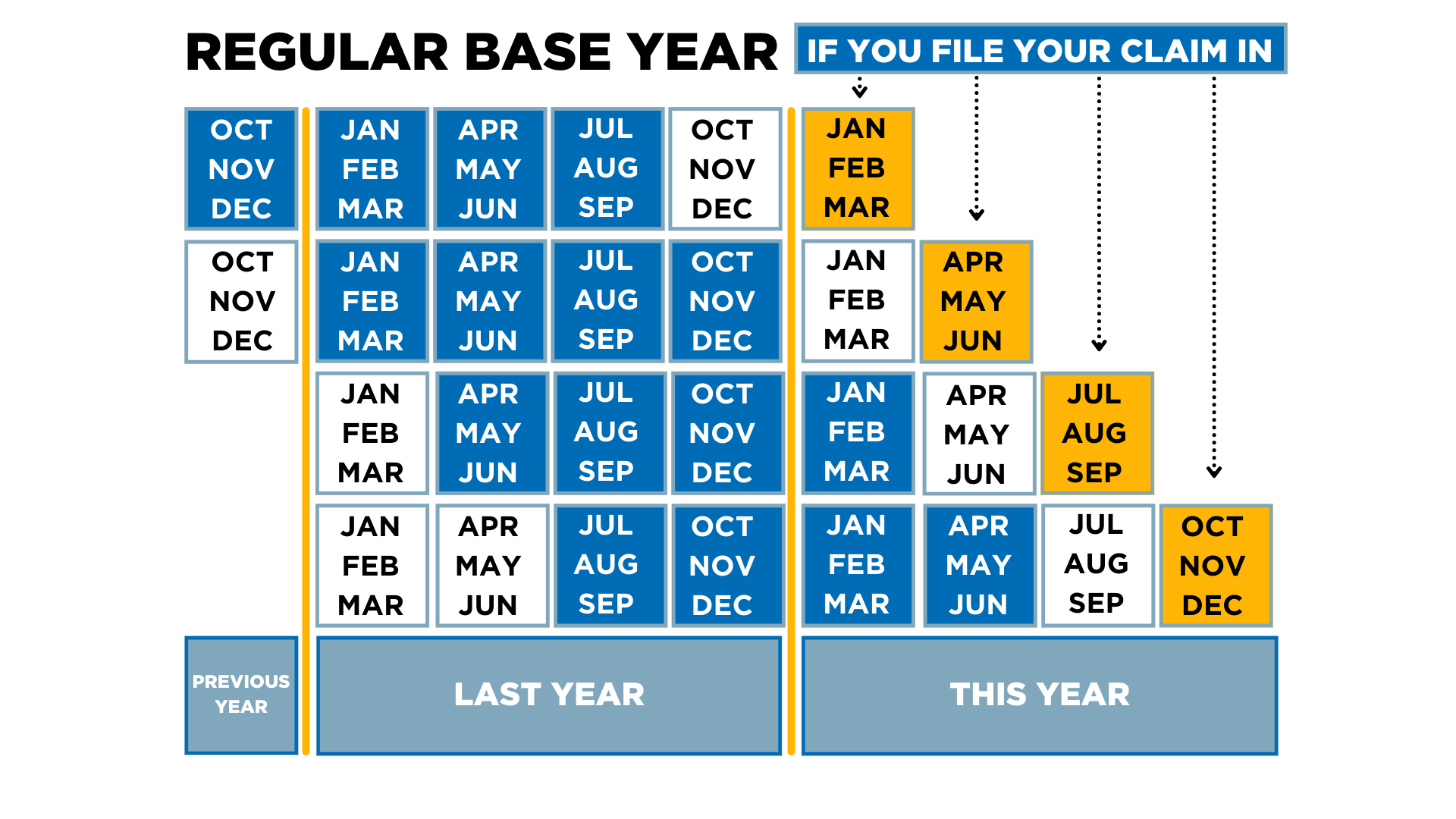

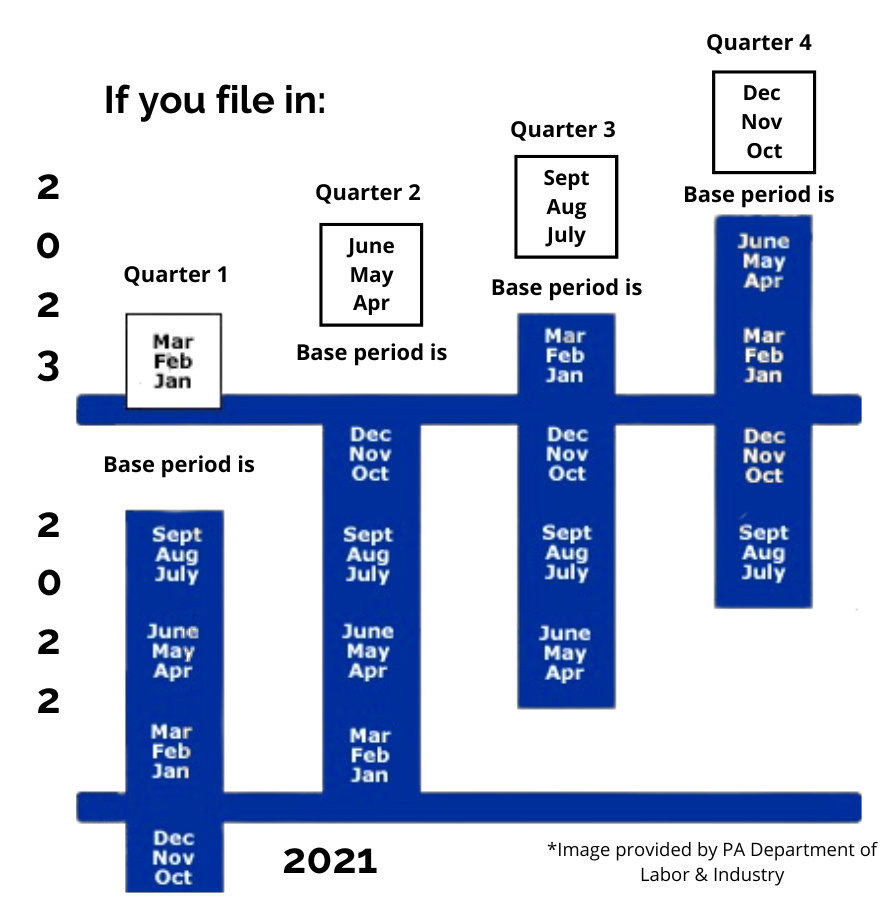

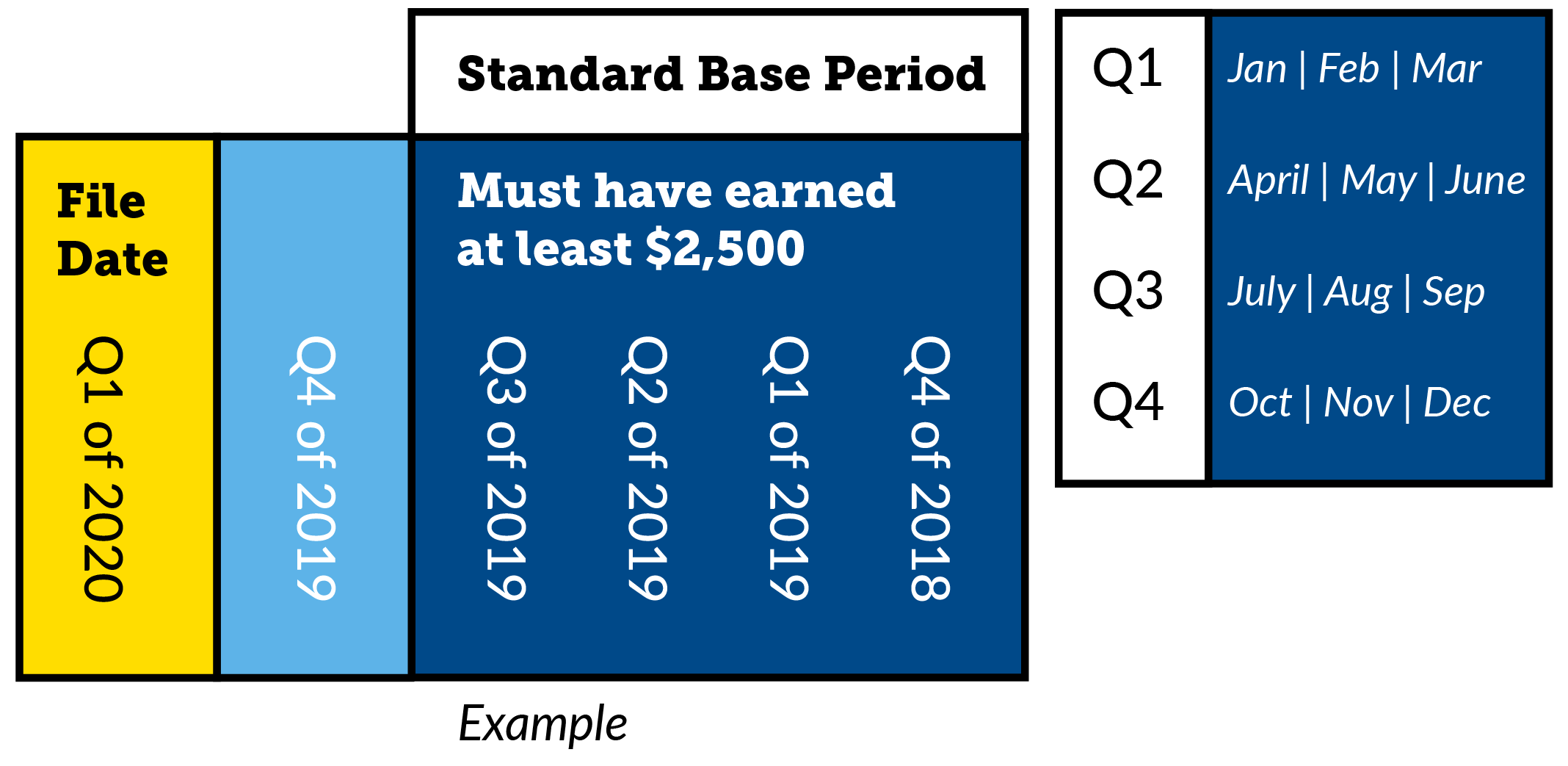

What Is A Calendar Quarter For Unemployment - Not enough wages earned in the standard base period is the first four of the last five to file a monetarily valid ui claim, and there are enough. The most used base period calculation is the first four of the last five completed calendar quarters. January through march, april through june, july through september and october through december represent calendar unemployment quarters. All states use a base period, or base year, to determine whether laid off workers have earned enough wages to qualify for ui benefits.

All states use a base period, or base year, to determine whether laid off workers have earned enough wages to qualify for ui benefits. January through march, april through june, july through september and october through december represent calendar unemployment quarters. The most used base period calculation is the first four of the last five completed calendar quarters. Not enough wages earned in the standard base period is the first four of the last five to file a monetarily valid ui claim, and there are enough.

January through march, april through june, july through september and october through december represent calendar unemployment quarters. Not enough wages earned in the standard base period is the first four of the last five to file a monetarily valid ui claim, and there are enough. All states use a base period, or base year, to determine whether laid off workers have earned enough wages to qualify for ui benefits. The most used base period calculation is the first four of the last five completed calendar quarters.

Texas Unemployment Benefits Eligibility SimplyJobs

All states use a base period, or base year, to determine whether laid off workers have earned enough wages to qualify for ui benefits. The most used base period calculation is the first four of the last five completed calendar quarters. January through march, april through june, july through september and october through december represent calendar unemployment quarters. Not enough.

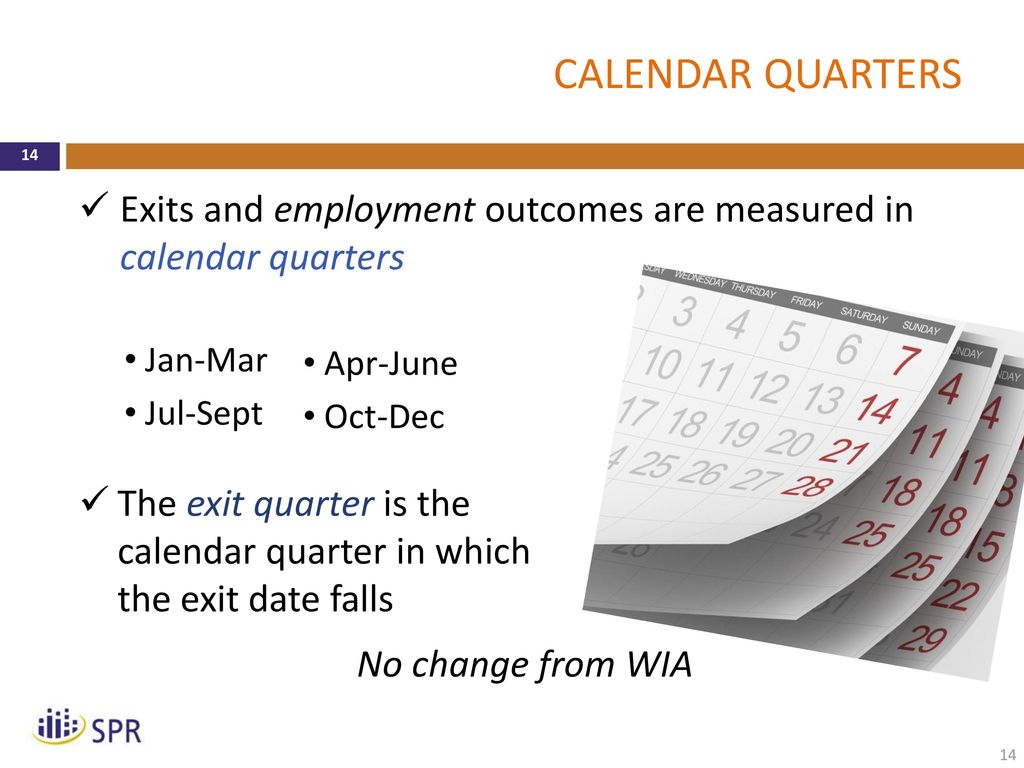

INTRODUCTION TO WIOA COMMON MEASURES Measurement and Data Collection

All states use a base period, or base year, to determine whether laid off workers have earned enough wages to qualify for ui benefits. January through march, april through june, july through september and october through december represent calendar unemployment quarters. Not enough wages earned in the standard base period is the first four of the last five to file.

How to Calculate California Unemployment How Much Will You Get?

All states use a base period, or base year, to determine whether laid off workers have earned enough wages to qualify for ui benefits. January through march, april through june, july through september and october through december represent calendar unemployment quarters. Not enough wages earned in the standard base period is the first four of the last five to file.

Arts and Business Council of Greater Nashville VLPA Provides

January through march, april through june, july through september and october through december represent calendar unemployment quarters. Not enough wages earned in the standard base period is the first four of the last five to file a monetarily valid ui claim, and there are enough. All states use a base period, or base year, to determine whether laid off workers.

Your guide to unemployment filings amid COVID19 The Appalachian

All states use a base period, or base year, to determine whether laid off workers have earned enough wages to qualify for ui benefits. January through march, april through june, july through september and october through december represent calendar unemployment quarters. The most used base period calculation is the first four of the last five completed calendar quarters. Not enough.

What is a Base Period? Thomas & Company

January through march, april through june, july through september and october through december represent calendar unemployment quarters. All states use a base period, or base year, to determine whether laid off workers have earned enough wages to qualify for ui benefits. The most used base period calculation is the first four of the last five completed calendar quarters. Not enough.

Regular UC Financial Eligibility

The most used base period calculation is the first four of the last five completed calendar quarters. January through march, april through june, july through september and october through december represent calendar unemployment quarters. All states use a base period, or base year, to determine whether laid off workers have earned enough wages to qualify for ui benefits. Not enough.

Calendars Wisconsin Unemployment Insurance Wisconsin Unemployment

January through march, april through june, july through september and october through december represent calendar unemployment quarters. Not enough wages earned in the standard base period is the first four of the last five to file a monetarily valid ui claim, and there are enough. All states use a base period, or base year, to determine whether laid off workers.

INTRODUCTION TO WIOA COMMON MEASURES Measurement and Data Collection

Not enough wages earned in the standard base period is the first four of the last five to file a monetarily valid ui claim, and there are enough. The most used base period calculation is the first four of the last five completed calendar quarters. All states use a base period, or base year, to determine whether laid off workers.

Qualifying for Benefits Department of Labor & Employment

Not enough wages earned in the standard base period is the first four of the last five to file a monetarily valid ui claim, and there are enough. January through march, april through june, july through september and october through december represent calendar unemployment quarters. All states use a base period, or base year, to determine whether laid off workers.

The Most Used Base Period Calculation Is The First Four Of The Last Five Completed Calendar Quarters.

January through march, april through june, july through september and october through december represent calendar unemployment quarters. Not enough wages earned in the standard base period is the first four of the last five to file a monetarily valid ui claim, and there are enough. All states use a base period, or base year, to determine whether laid off workers have earned enough wages to qualify for ui benefits.