What Are Calendar Spreads - What is a calendar spread? In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. Calendar spreads combine buying and selling two contracts with different expiration dates. With calendar spreads, time decay is. A calendar spread is an options or futures strategy where an investor simultaneously enters long.

A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. With calendar spreads, time decay is. A calendar spread is an options or futures strategy where an investor simultaneously enters long. Calendar spreads combine buying and selling two contracts with different expiration dates. In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. What is a calendar spread?

In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. With calendar spreads, time decay is. Calendar spreads combine buying and selling two contracts with different expiration dates. A calendar spread is an options or futures strategy where an investor simultaneously enters long. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. What is a calendar spread?

Calendar Spread Options Examples Mavra Sibella

A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. What is a calendar spread? Calendar spreads combine buying and selling two contracts with.

Calendar Call Spread Option Strategy Heida Kristan

A calendar spread is an options or futures strategy where an investor simultaneously enters long. In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. What is a calendar spread? Calendar spreads combine buying and selling two contracts with different expiration dates. A calendar spread, also known.

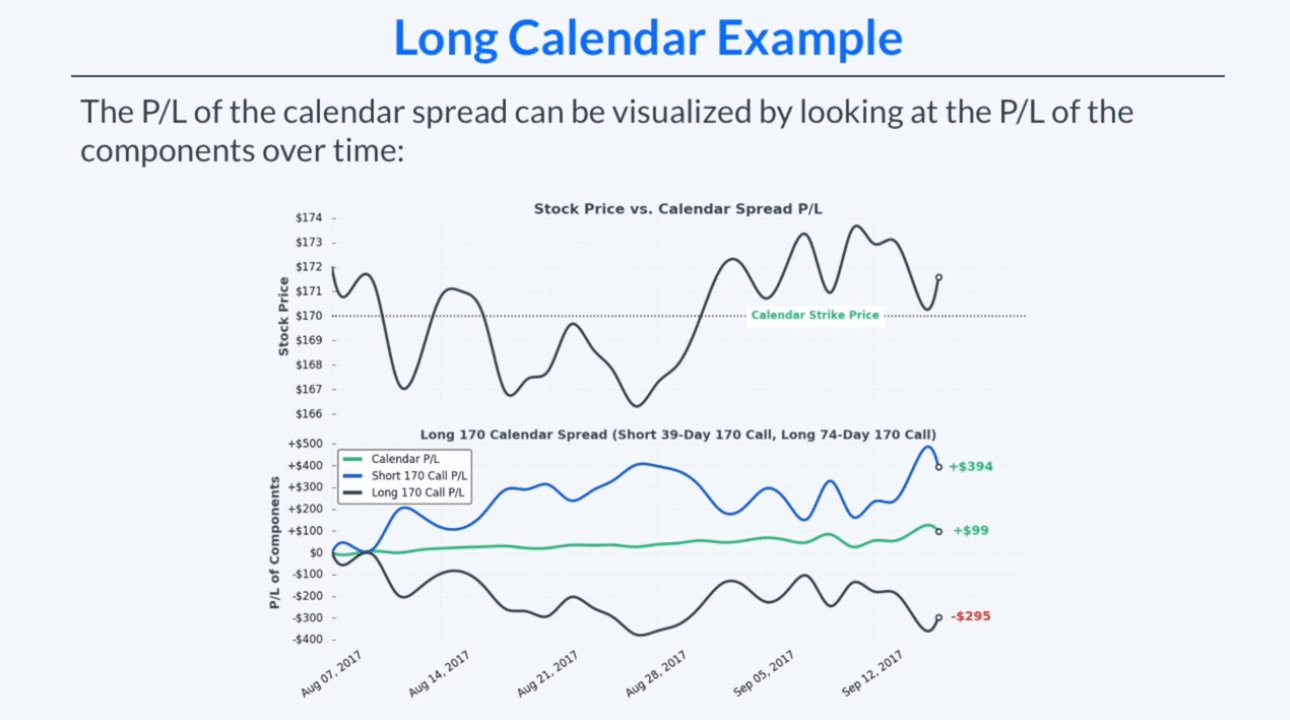

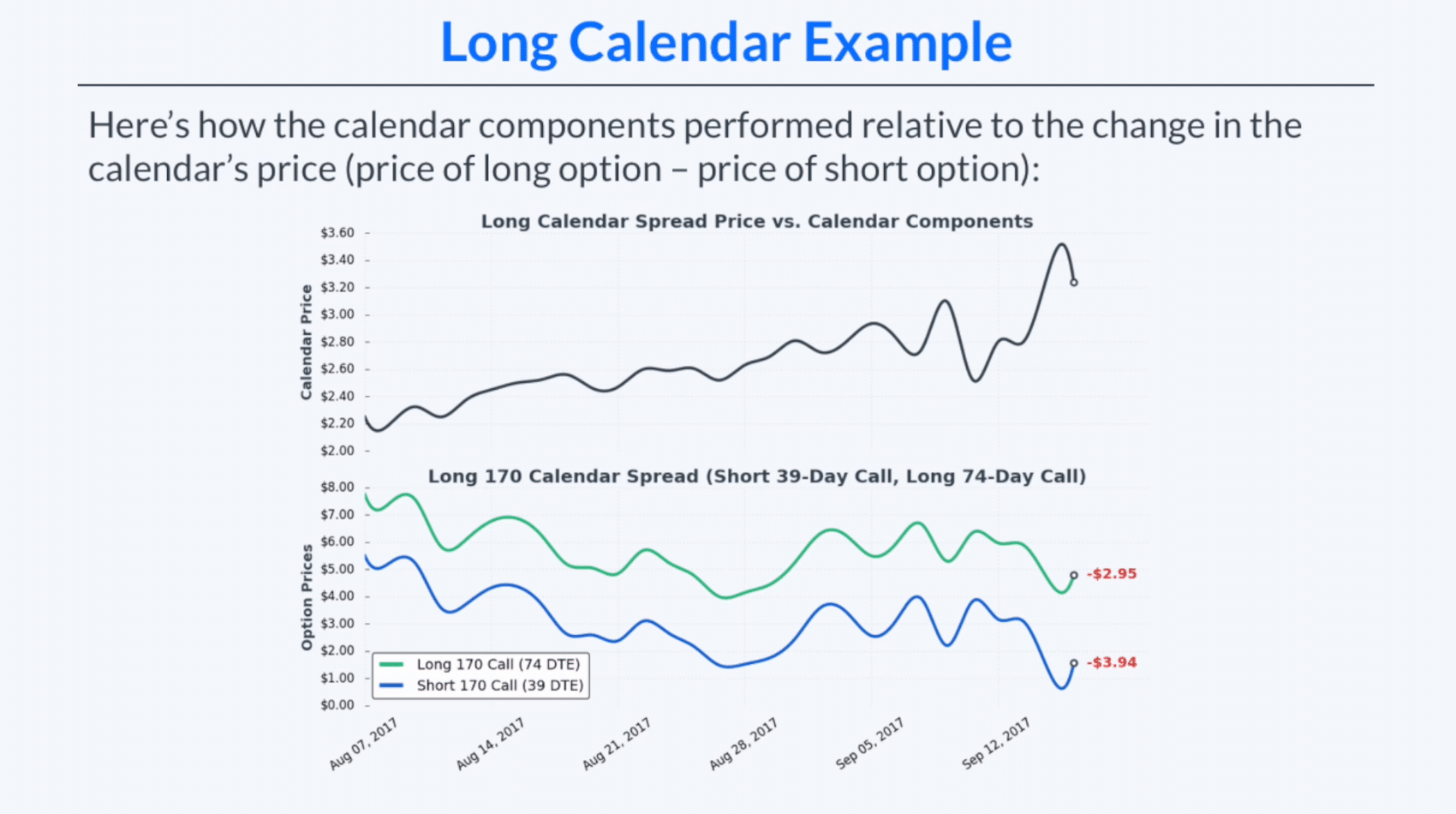

Long Calendar Spreads for Beginner Options Traders projectfinance

In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. What is a calendar spread? Calendar spreads combine buying and selling two contracts with different expiration dates. With calendar spreads, time decay is. A calendar spread, also known as a time spread, is an options trading strategy.

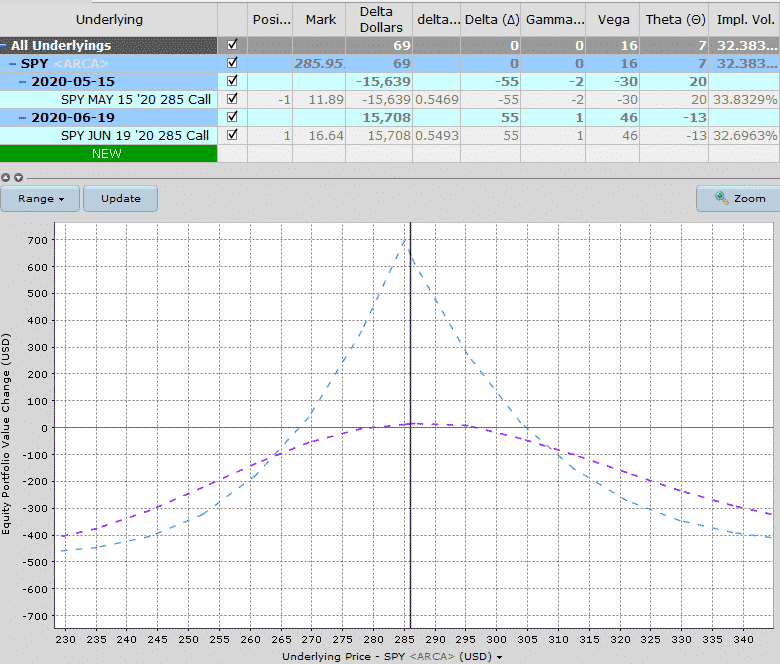

Calendar Spreads Option Trading Strategies Beginner's Guide to the

What is a calendar spread? Calendar spreads combine buying and selling two contracts with different expiration dates. With calendar spreads, time decay is. In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. A calendar spread, also known as a time spread, is an options trading strategy.

Long Calendar Spreads for Beginner Options Traders projectfinance

In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. A calendar spread is an options or futures strategy where an investor simultaneously enters.

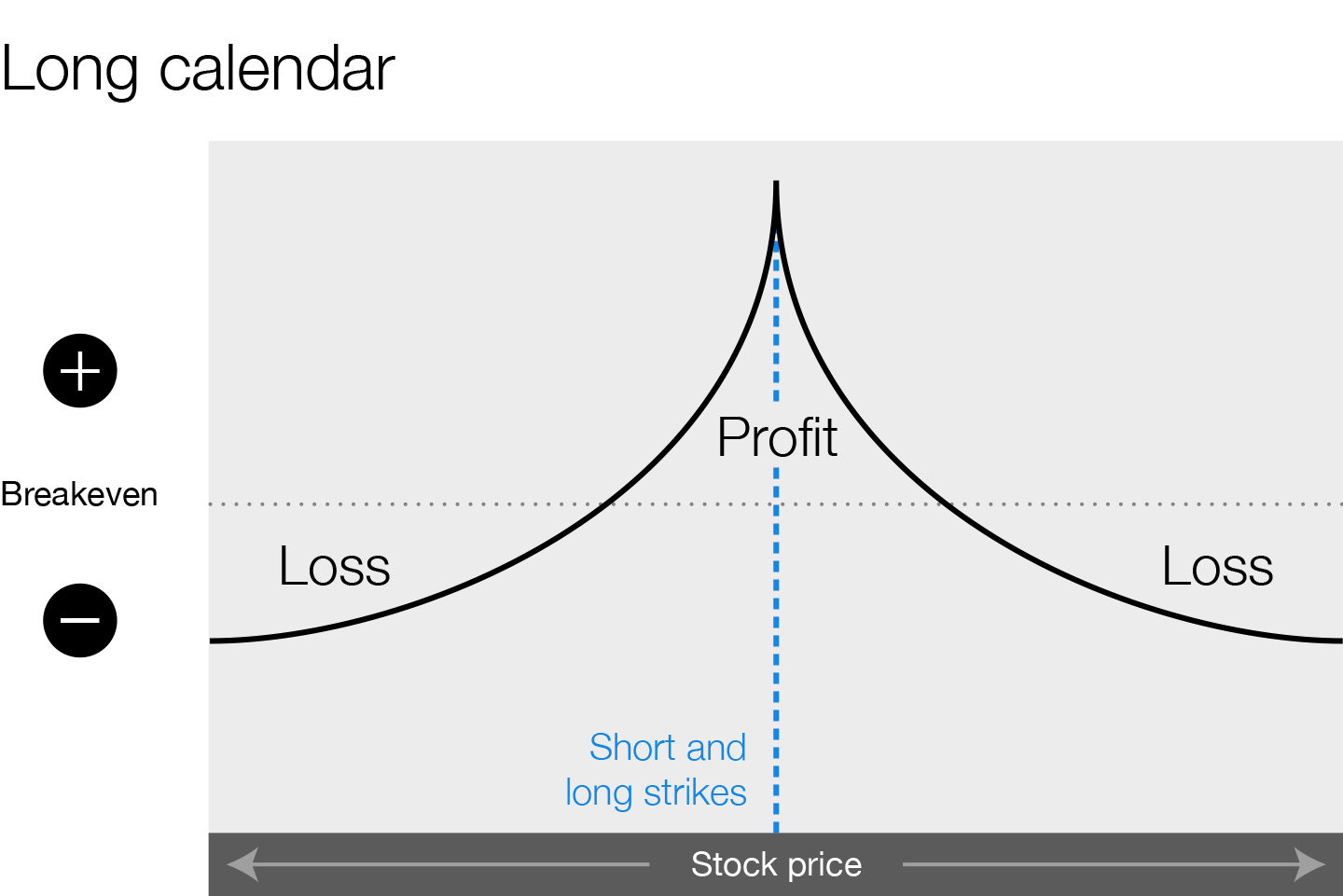

Everything You Need to Know about Calendar Spreads

In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. With calendar spreads, time decay is. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. A calendar spread is an options or futures.

How Long Calendar Spreads Work (w/ Examples) Options Trading

What is a calendar spread? A calendar spread is an options or futures strategy where an investor simultaneously enters long. Calendar spreads combine buying and selling two contracts with different expiration dates. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. In finance, a calendar spread.

Calendar Spreads 101 Everything You Need To Know

Calendar spreads combine buying and selling two contracts with different expiration dates. In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. A calendar spread is an options or futures strategy where an investor simultaneously enters long. A calendar spread, also known as a time spread, is.

How to Trade Options Calendar Spreads (Visuals and Examples)

What is a calendar spread? A calendar spread is an options or futures strategy where an investor simultaneously enters long. With calendar spreads, time decay is. Calendar spreads combine buying and selling two contracts with different expiration dates. In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of.

Long Calendar Spreads for Beginner Options Traders projectfinance

What is a calendar spread? A calendar spread is an options or futures strategy where an investor simultaneously enters long. Calendar spreads combine buying and selling two contracts with different expiration dates. In finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures. With calendar spreads, time decay.

With Calendar Spreads, Time Decay Is.

A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. A calendar spread is an options or futures strategy where an investor simultaneously enters long. What is a calendar spread? Calendar spreads combine buying and selling two contracts with different expiration dates.