Tax Cheat Sheet - A comprehensive list of documents and information you need to prepare your income tax return. Individual taxpayers are liable for a 3.8% net investment income tax on the lesser of their net investment income, or the amount by which. This quick reference guide provides tax brackets and key deductions, credits, and retirement plan contribution limits for 2025. Find out what to include for personal.

Find out what to include for personal. This quick reference guide provides tax brackets and key deductions, credits, and retirement plan contribution limits for 2025. A comprehensive list of documents and information you need to prepare your income tax return. Individual taxpayers are liable for a 3.8% net investment income tax on the lesser of their net investment income, or the amount by which.

Individual taxpayers are liable for a 3.8% net investment income tax on the lesser of their net investment income, or the amount by which. Find out what to include for personal. This quick reference guide provides tax brackets and key deductions, credits, and retirement plan contribution limits for 2025. A comprehensive list of documents and information you need to prepare your income tax return.

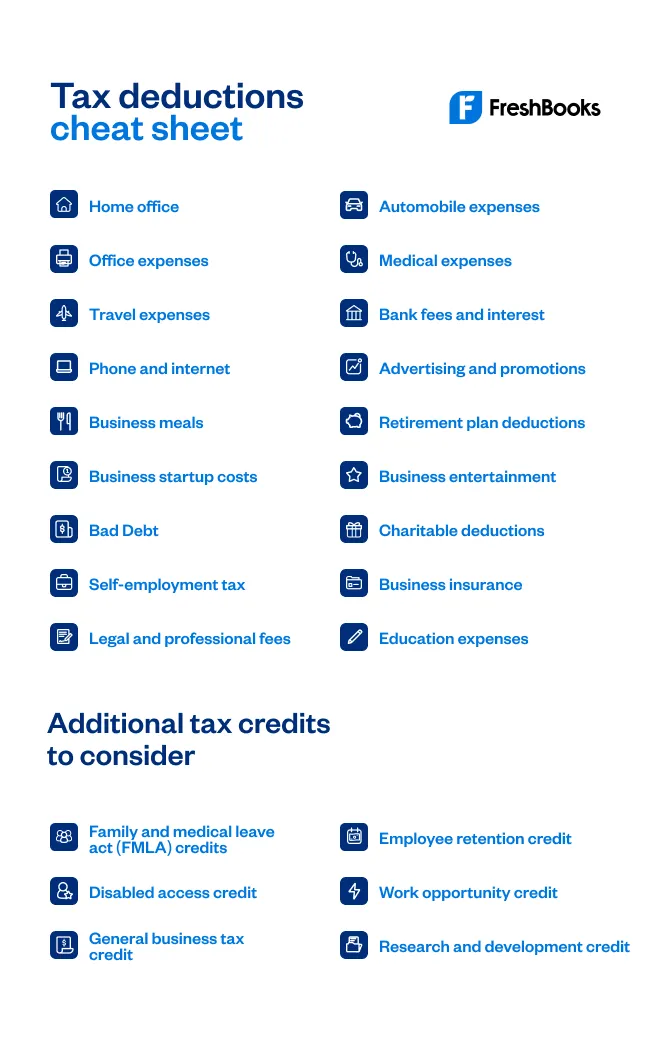

18 Tax Deductions Cheat Sheet for 2025

Find out what to include for personal. This quick reference guide provides tax brackets and key deductions, credits, and retirement plan contribution limits for 2025. Individual taxpayers are liable for a 3.8% net investment income tax on the lesser of their net investment income, or the amount by which. A comprehensive list of documents and information you need to prepare.

Tax Cheat Sheet 1658832732 PDF

This quick reference guide provides tax brackets and key deductions, credits, and retirement plan contribution limits for 2025. Individual taxpayers are liable for a 3.8% net investment income tax on the lesser of their net investment income, or the amount by which. A comprehensive list of documents and information you need to prepare your income tax return. Find out what.

Business Tax Deductions Cheat Sheet Excel Deductible Tax Etsy Canada

Individual taxpayers are liable for a 3.8% net investment income tax on the lesser of their net investment income, or the amount by which. This quick reference guide provides tax brackets and key deductions, credits, and retirement plan contribution limits for 2025. A comprehensive list of documents and information you need to prepare your income tax return. Find out what.

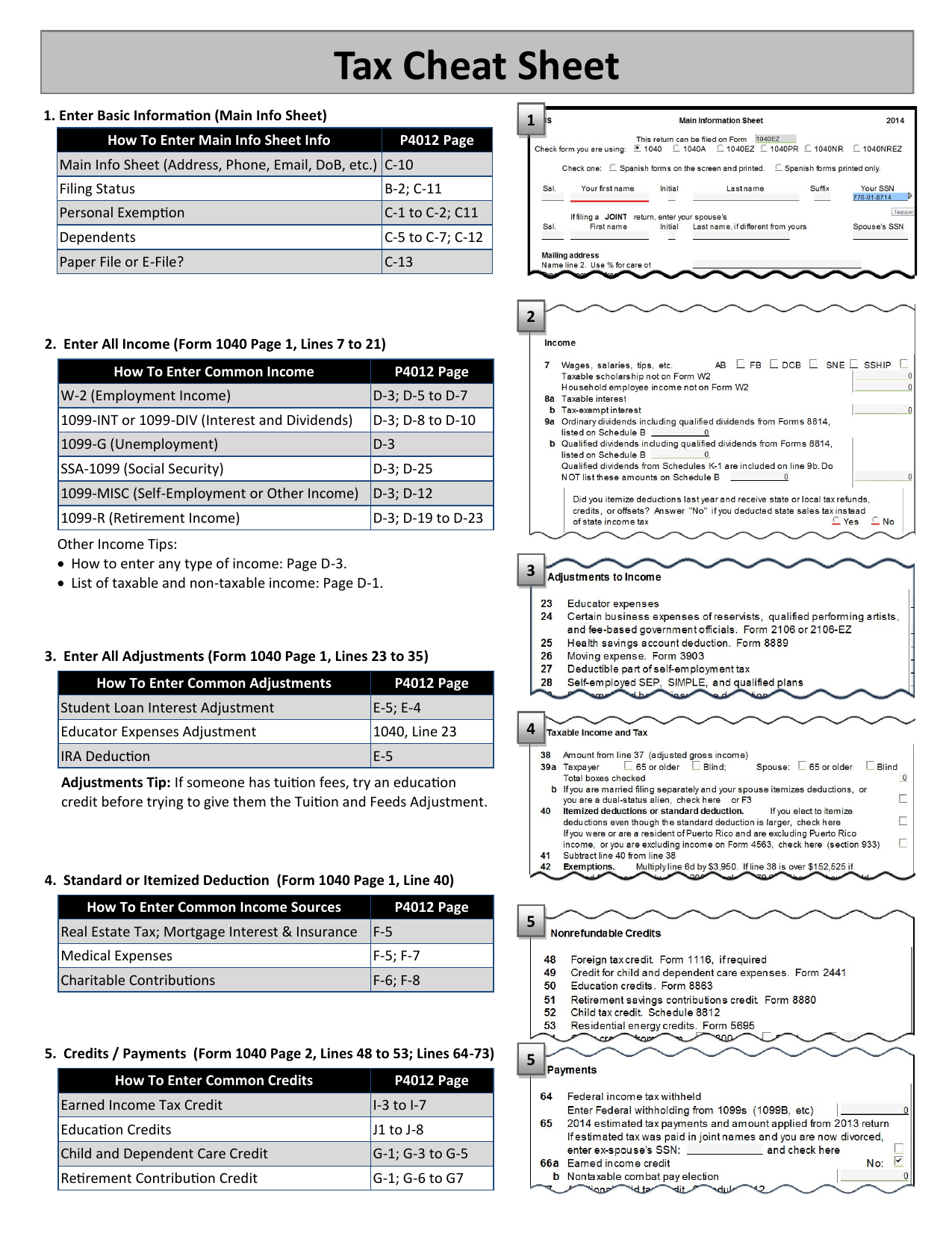

Tax Cheat Sheet

A comprehensive list of documents and information you need to prepare your income tax return. Find out what to include for personal. Individual taxpayers are liable for a 3.8% net investment income tax on the lesser of their net investment income, or the amount by which. This quick reference guide provides tax brackets and key deductions, credits, and retirement plan.

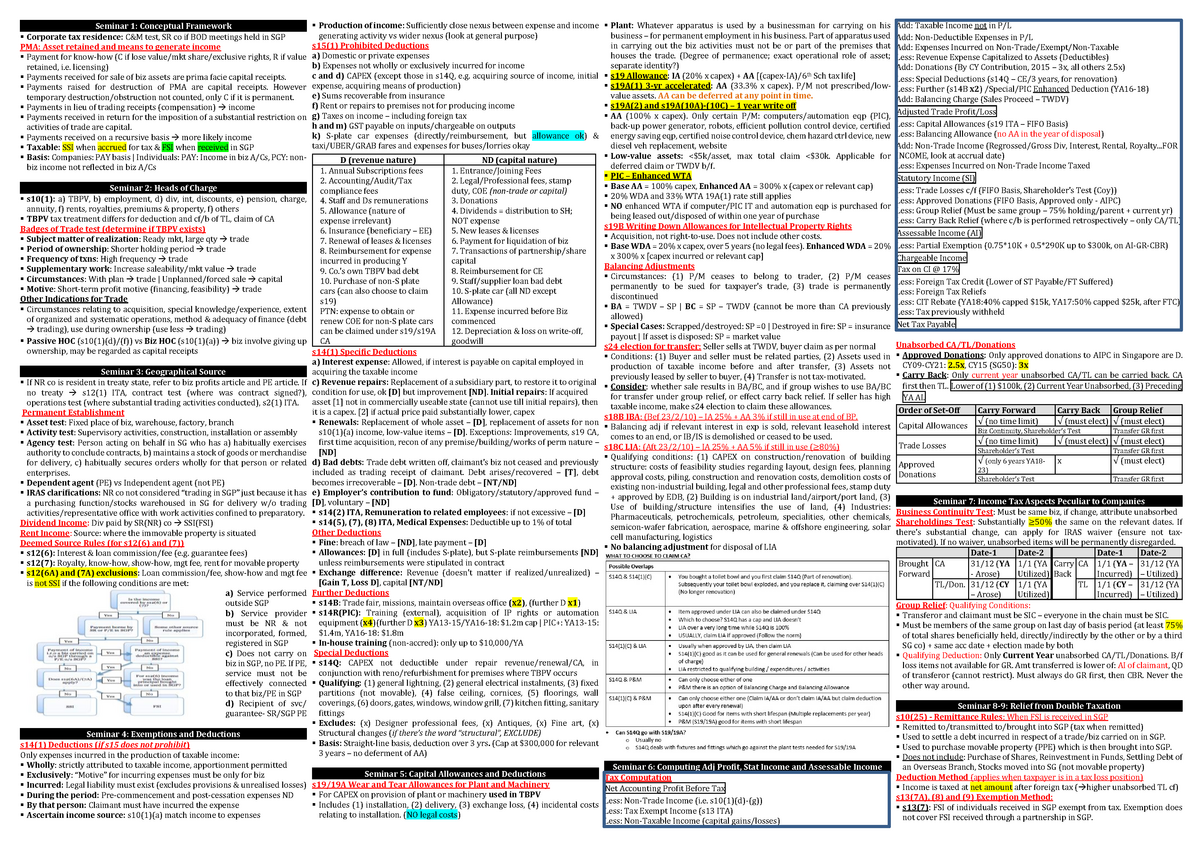

Tax Cheat Sheet Seminar 1 Conceptual Framework Corporate tax

This quick reference guide provides tax brackets and key deductions, credits, and retirement plan contribution limits for 2025. Find out what to include for personal. A comprehensive list of documents and information you need to prepare your income tax return. Individual taxpayers are liable for a 3.8% net investment income tax on the lesser of their net investment income, or.

Tax Return Cheat Sheet

Find out what to include for personal. Individual taxpayers are liable for a 3.8% net investment income tax on the lesser of their net investment income, or the amount by which. This quick reference guide provides tax brackets and key deductions, credits, and retirement plan contribution limits for 2025. A comprehensive list of documents and information you need to prepare.

Tax Cheat Sheet Tax Deduction Taxes

This quick reference guide provides tax brackets and key deductions, credits, and retirement plan contribution limits for 2025. Individual taxpayers are liable for a 3.8% net investment income tax on the lesser of their net investment income, or the amount by which. Find out what to include for personal. A comprehensive list of documents and information you need to prepare.

2021 Tax Cheat Sheet TMRW Wealth

Individual taxpayers are liable for a 3.8% net investment income tax on the lesser of their net investment income, or the amount by which. A comprehensive list of documents and information you need to prepare your income tax return. This quick reference guide provides tax brackets and key deductions, credits, and retirement plan contribution limits for 2025. Find out what.

1040 tax cheat sheet Artofit

Find out what to include for personal. This quick reference guide provides tax brackets and key deductions, credits, and retirement plan contribution limits for 2025. Individual taxpayers are liable for a 3.8% net investment income tax on the lesser of their net investment income, or the amount by which. A comprehensive list of documents and information you need to prepare.

Tax Deduction Cheat Sheet for Real Estate Agents Independence Title

Find out what to include for personal. A comprehensive list of documents and information you need to prepare your income tax return. Individual taxpayers are liable for a 3.8% net investment income tax on the lesser of their net investment income, or the amount by which. This quick reference guide provides tax brackets and key deductions, credits, and retirement plan.

This Quick Reference Guide Provides Tax Brackets And Key Deductions, Credits, And Retirement Plan Contribution Limits For 2025.

A comprehensive list of documents and information you need to prepare your income tax return. Find out what to include for personal. Individual taxpayers are liable for a 3.8% net investment income tax on the lesser of their net investment income, or the amount by which.