Tax Agent License Malaysia - Obtaining a tax agent's licence 1. Under subsection 153(1) of the income tax act 1967, an individual is only allowed to carry on. Permohonan kelulusan sebagai ejen cukai di bawah subseksyen 153 (3) akta cukai. In order to facilitate the application for and renewal of income tax agent licences,. Pathway for tax agent licence a comprehensive guidance tax agent application guideline &. Eligibility 1.1 maicsa members with 5 years practical. On 26 december 2017, mycukai portal was launched by the ministry of finance (mof).

In order to facilitate the application for and renewal of income tax agent licences,. Permohonan kelulusan sebagai ejen cukai di bawah subseksyen 153 (3) akta cukai. On 26 december 2017, mycukai portal was launched by the ministry of finance (mof). Eligibility 1.1 maicsa members with 5 years practical. Under subsection 153(1) of the income tax act 1967, an individual is only allowed to carry on. Obtaining a tax agent's licence 1. Pathway for tax agent licence a comprehensive guidance tax agent application guideline &.

On 26 december 2017, mycukai portal was launched by the ministry of finance (mof). Permohonan kelulusan sebagai ejen cukai di bawah subseksyen 153 (3) akta cukai. Pathway for tax agent licence a comprehensive guidance tax agent application guideline &. Eligibility 1.1 maicsa members with 5 years practical. In order to facilitate the application for and renewal of income tax agent licences,. Under subsection 153(1) of the income tax act 1967, an individual is only allowed to carry on. Obtaining a tax agent's licence 1.

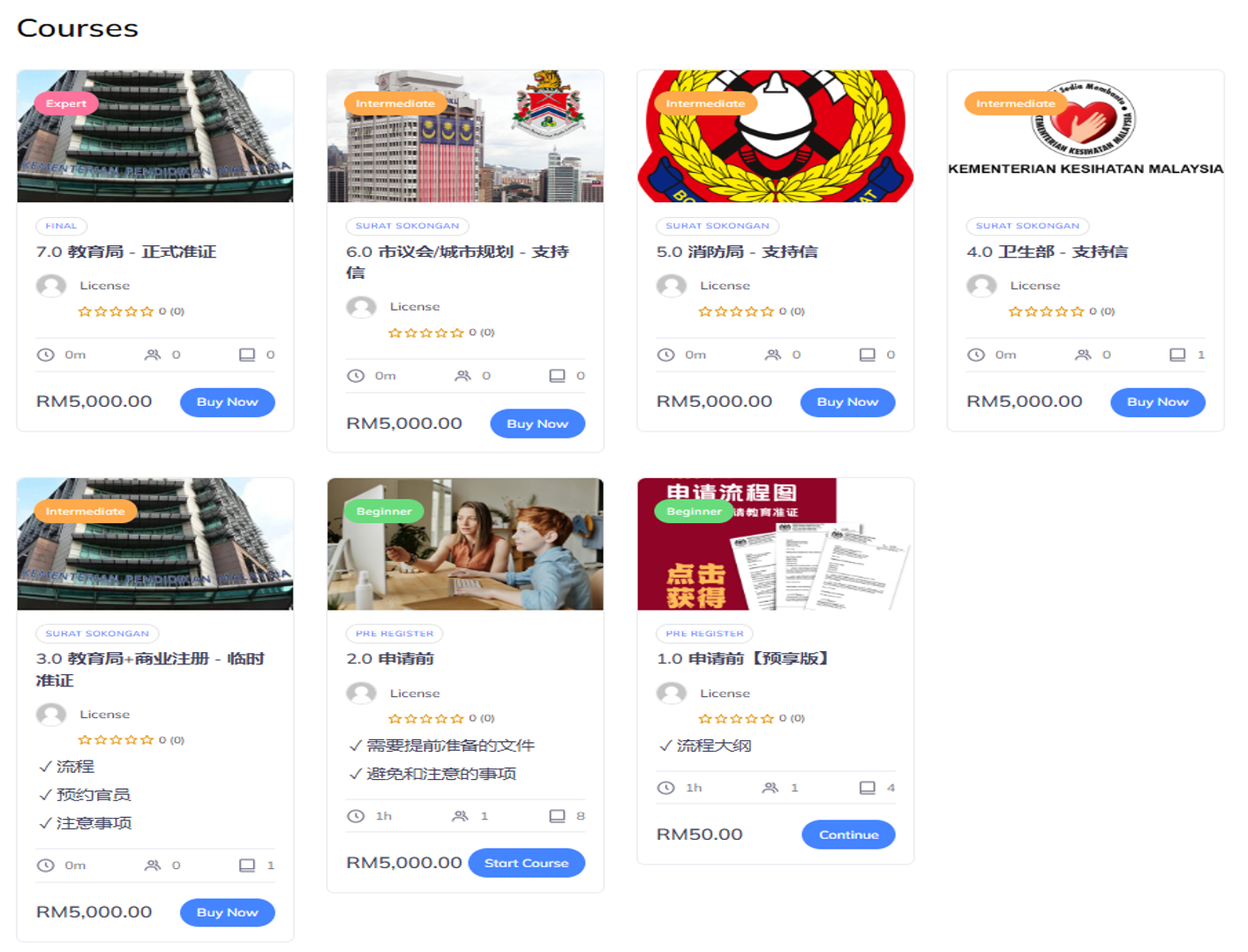

Real Estate Courses in Malaysia Pathway to Estate Agent License

On 26 december 2017, mycukai portal was launched by the ministry of finance (mof). Obtaining a tax agent's licence 1. Pathway for tax agent licence a comprehensive guidance tax agent application guideline &. Permohonan kelulusan sebagai ejen cukai di bawah subseksyen 153 (3) akta cukai. Under subsection 153(1) of the income tax act 1967, an individual is only allowed to.

License Malaysia License Specialist

Pathway for tax agent licence a comprehensive guidance tax agent application guideline &. On 26 december 2017, mycukai portal was launched by the ministry of finance (mof). Eligibility 1.1 maicsa members with 5 years practical. In order to facilitate the application for and renewal of income tax agent licences,. Obtaining a tax agent's licence 1.

License Malaysia License Specialist

On 26 december 2017, mycukai portal was launched by the ministry of finance (mof). Pathway for tax agent licence a comprehensive guidance tax agent application guideline &. Under subsection 153(1) of the income tax act 1967, an individual is only allowed to carry on. Eligibility 1.1 maicsa members with 5 years practical. Obtaining a tax agent's licence 1.

Malaysia Property Gain Tax for Foreigners Hows it works?

Under subsection 153(1) of the income tax act 1967, an individual is only allowed to carry on. Eligibility 1.1 maicsa members with 5 years practical. On 26 december 2017, mycukai portal was launched by the ministry of finance (mof). Permohonan kelulusan sebagai ejen cukai di bawah subseksyen 153 (3) akta cukai. In order to facilitate the application for and renewal.

What Is Tax Return Malaysia Latest News Update

Permohonan kelulusan sebagai ejen cukai di bawah subseksyen 153 (3) akta cukai. On 26 december 2017, mycukai portal was launched by the ministry of finance (mof). Pathway for tax agent licence a comprehensive guidance tax agent application guideline &. In order to facilitate the application for and renewal of income tax agent licences,. Under subsection 153(1) of the income tax.

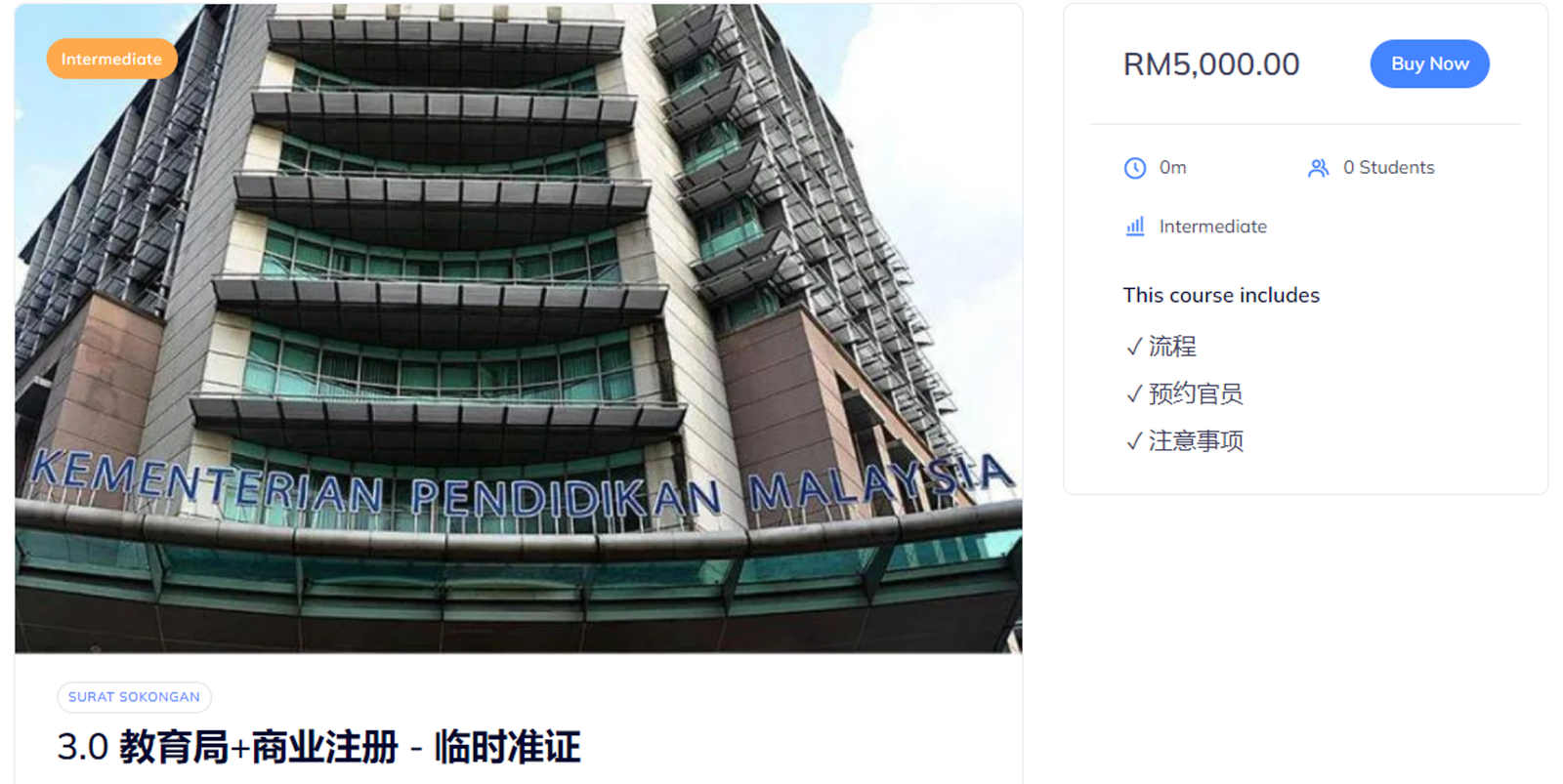

Business license in Malaysia S & F CONSULTING FIRM LIMITED

Pathway for tax agent licence a comprehensive guidance tax agent application guideline &. Permohonan kelulusan sebagai ejen cukai di bawah subseksyen 153 (3) akta cukai. Eligibility 1.1 maicsa members with 5 years practical. On 26 december 2017, mycukai portal was launched by the ministry of finance (mof). Obtaining a tax agent's licence 1.

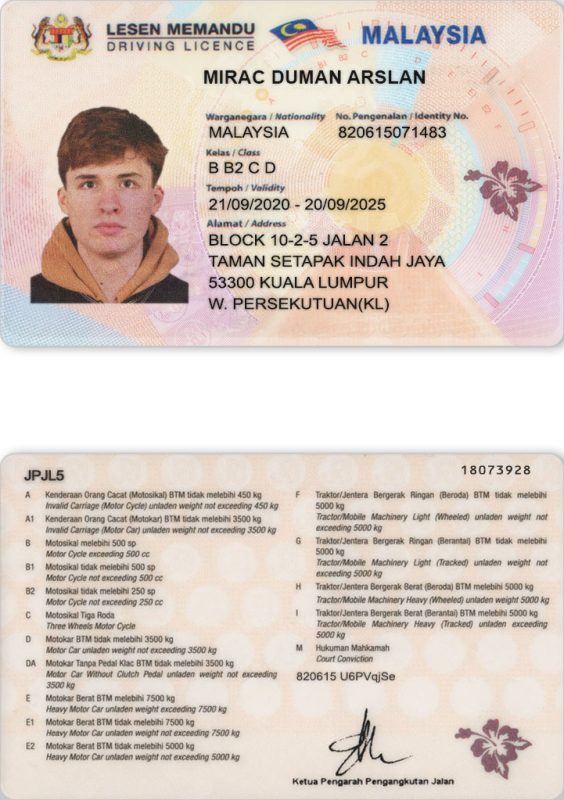

Malaysia Driver License Template FakeTemplate.cc

Obtaining a tax agent's licence 1. Under subsection 153(1) of the income tax act 1967, an individual is only allowed to carry on. Eligibility 1.1 maicsa members with 5 years practical. In order to facilitate the application for and renewal of income tax agent licences,. Permohonan kelulusan sebagai ejen cukai di bawah subseksyen 153 (3) akta cukai.

Insurance Agent License Financial Report

Permohonan kelulusan sebagai ejen cukai di bawah subseksyen 153 (3) akta cukai. Pathway for tax agent licence a comprehensive guidance tax agent application guideline &. Obtaining a tax agent's licence 1. Under subsection 153(1) of the income tax act 1967, an individual is only allowed to carry on. In order to facilitate the application for and renewal of income tax.

License Malaysia License Specialist

Obtaining a tax agent's licence 1. Eligibility 1.1 maicsa members with 5 years practical. Under subsection 153(1) of the income tax act 1967, an individual is only allowed to carry on. In order to facilitate the application for and renewal of income tax agent licences,. Pathway for tax agent licence a comprehensive guidance tax agent application guideline &.

License Malaysia License Specialist

On 26 december 2017, mycukai portal was launched by the ministry of finance (mof). Eligibility 1.1 maicsa members with 5 years practical. Obtaining a tax agent's licence 1. Pathway for tax agent licence a comprehensive guidance tax agent application guideline &. In order to facilitate the application for and renewal of income tax agent licences,.

Pathway For Tax Agent Licence A Comprehensive Guidance Tax Agent Application Guideline &.

On 26 december 2017, mycukai portal was launched by the ministry of finance (mof). In order to facilitate the application for and renewal of income tax agent licences,. Eligibility 1.1 maicsa members with 5 years practical. Under subsection 153(1) of the income tax act 1967, an individual is only allowed to carry on.

Obtaining A Tax Agent's Licence 1.

Permohonan kelulusan sebagai ejen cukai di bawah subseksyen 153 (3) akta cukai.