State Refund Calendar 2024 - Every state’s timing is different, so. The table below reports each state's. See the chart below for state return due dates. Processing times vary by state and filing method. As a general rule, you can expect your state tax refund within 30 days of the electronic filing date or the postmark date. Federal tax returns are due april 15th, 2025. To get the current status. Individuals who haven’t yet filed their state tax refund have time until october 15, 2025, to file their refund. Generally, each state's tax deadline falls in line with the irs tax day deadline in april.

As a general rule, you can expect your state tax refund within 30 days of the electronic filing date or the postmark date. Generally, each state's tax deadline falls in line with the irs tax day deadline in april. To get the current status. The table below reports each state's. See the chart below for state return due dates. Processing times vary by state and filing method. Every state’s timing is different, so. Individuals who haven’t yet filed their state tax refund have time until october 15, 2025, to file their refund. Federal tax returns are due april 15th, 2025.

Federal tax returns are due april 15th, 2025. To get the current status. The table below reports each state's. See the chart below for state return due dates. Generally, each state's tax deadline falls in line with the irs tax day deadline in april. Every state’s timing is different, so. Individuals who haven’t yet filed their state tax refund have time until october 15, 2025, to file their refund. As a general rule, you can expect your state tax refund within 30 days of the electronic filing date or the postmark date. Processing times vary by state and filing method.

When Does State Tax Refund Come 2024 Midge Susette

Generally, each state's tax deadline falls in line with the irs tax day deadline in april. Processing times vary by state and filing method. Individuals who haven’t yet filed their state tax refund have time until october 15, 2025, to file their refund. Every state’s timing is different, so. As a general rule, you can expect your state tax refund.

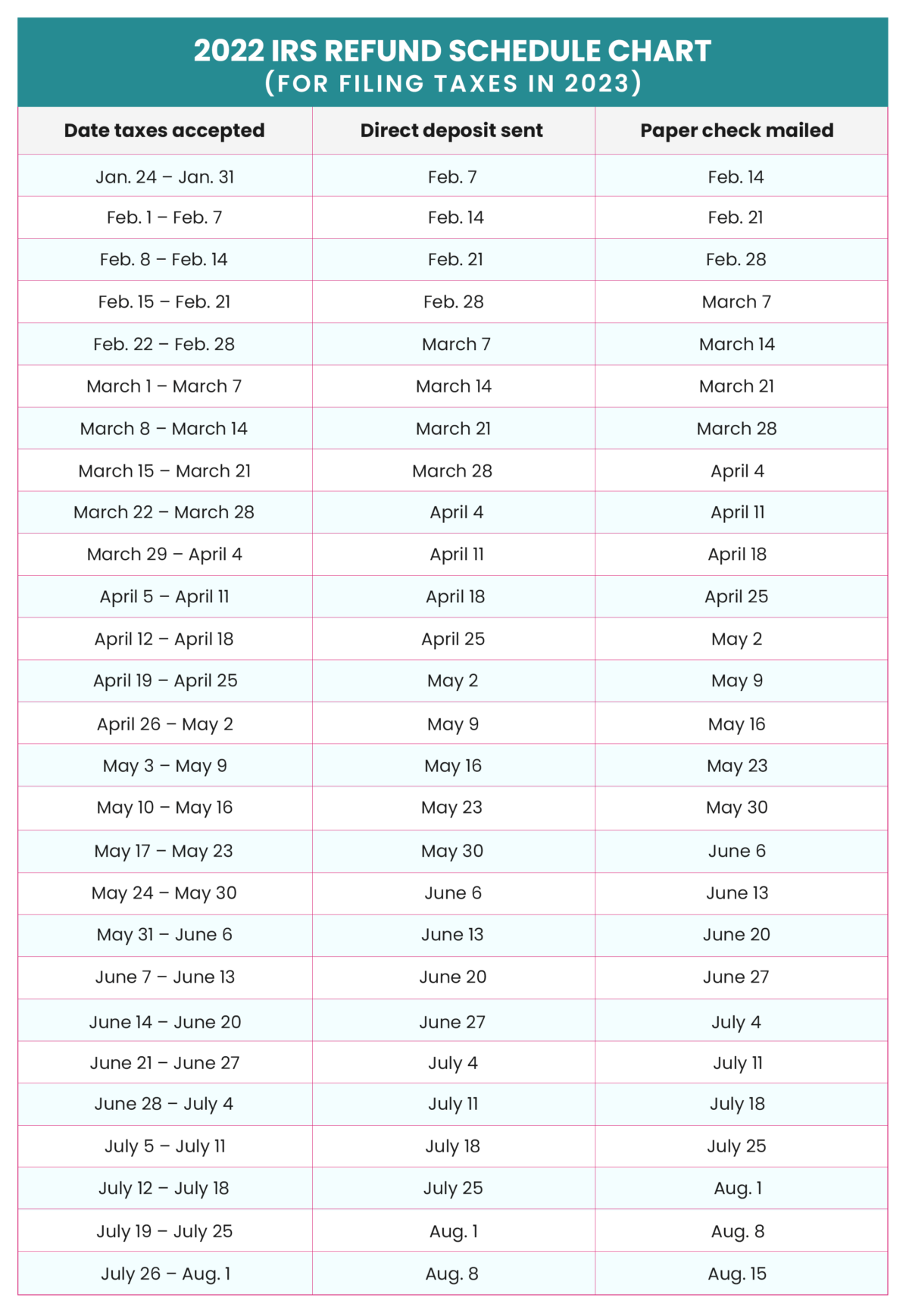

The IRS Tax Refund Schedule 2024 Where's My Refund?

Generally, each state's tax deadline falls in line with the irs tax day deadline in april. Processing times vary by state and filing method. To get the current status. Individuals who haven’t yet filed their state tax refund have time until october 15, 2025, to file their refund. Every state’s timing is different, so.

Az State Refund 2024 Mimi Susann

Processing times vary by state and filing method. Federal tax returns are due april 15th, 2025. Every state’s timing is different, so. The table below reports each state's. See the chart below for state return due dates.

Ga State Tax Refund 2024 Shara Delphine

See the chart below for state return due dates. Generally, each state's tax deadline falls in line with the irs tax day deadline in april. As a general rule, you can expect your state tax refund within 30 days of the electronic filing date or the postmark date. Federal tax returns are due april 15th, 2025. The table below reports.

NY State Tax Refund Schedule 2024 Status Check & Payment Date

Processing times vary by state and filing method. See the chart below for state return due dates. Every state’s timing is different, so. As a general rule, you can expect your state tax refund within 30 days of the electronic filing date or the postmark date. Generally, each state's tax deadline falls in line with the irs tax day deadline.

Michigan Tax Refund Schedule 2024 Didi Muriel

To get the current status. Every state’s timing is different, so. As a general rule, you can expect your state tax refund within 30 days of the electronic filing date or the postmark date. Processing times vary by state and filing method. The table below reports each state's.

Nj State Tax Refund Calendar 2024 Nj Adore Ardelis

Individuals who haven’t yet filed their state tax refund have time until october 15, 2025, to file their refund. Generally, each state's tax deadline falls in line with the irs tax day deadline in april. Processing times vary by state and filing method. To get the current status. See the chart below for state return due dates.

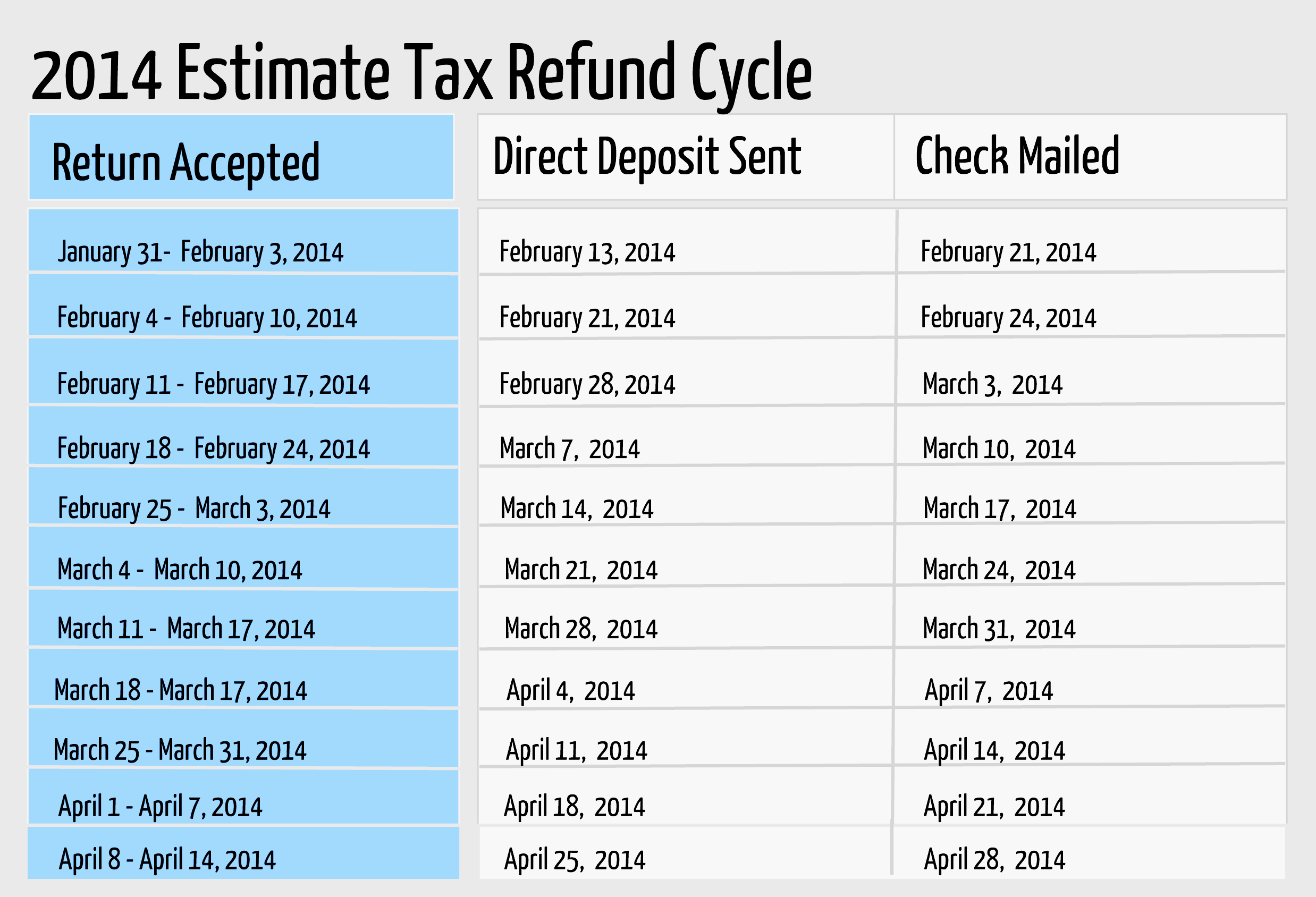

Estimate State Tax Refund 2024 Micky Imojean

Individuals who haven’t yet filed their state tax refund have time until october 15, 2025, to file their refund. To get the current status. The table below reports each state's. As a general rule, you can expect your state tax refund within 30 days of the electronic filing date or the postmark date. Processing times vary by state and filing.

The IRS Tax Refund Schedule 2024 Where's My Refund?

Every state’s timing is different, so. Federal tax returns are due april 15th, 2025. Processing times vary by state and filing method. To get the current status. See the chart below for state return due dates.

The Table Below Reports Each State's.

Processing times vary by state and filing method. To get the current status. As a general rule, you can expect your state tax refund within 30 days of the electronic filing date or the postmark date. See the chart below for state return due dates.

Individuals Who Haven’t Yet Filed Their State Tax Refund Have Time Until October 15, 2025, To File Their Refund.

Federal tax returns are due april 15th, 2025. Every state’s timing is different, so. Generally, each state's tax deadline falls in line with the irs tax day deadline in april.