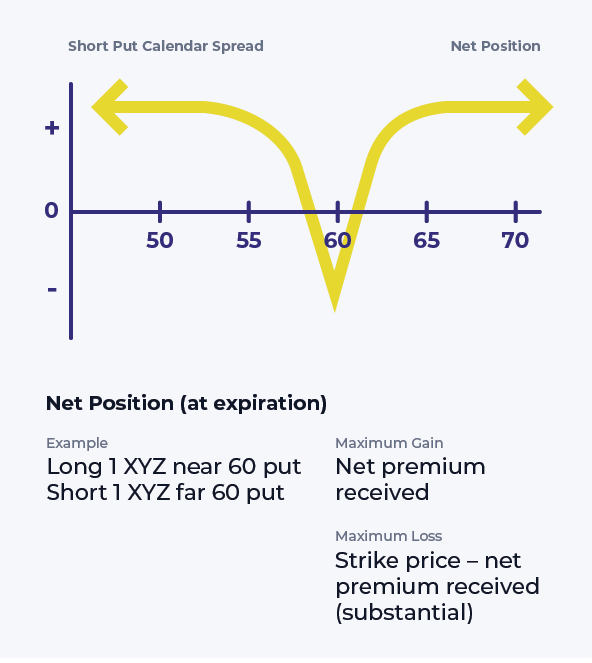

Short Put Calendar Spread - To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread.

Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change.

Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change.

Short Put Calendar Spread

Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change.

Short Put Calendar Spread Option Samurai Blog

Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change.

Short Put Calendar Spread Options Strategy

Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change.

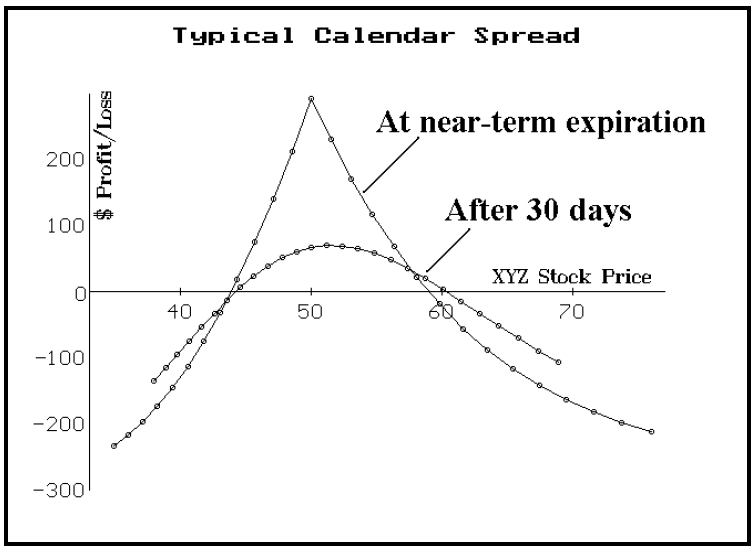

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change.

Calendar Call Spread Option Strategy Heida Kristan

Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change.

Calendar Spread Put Sena Xylina

To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread.

Short Put Calendar Short put calendar Spread Reverse Calendar

Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change.

Calendar Put Spread Options Edge

To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread.

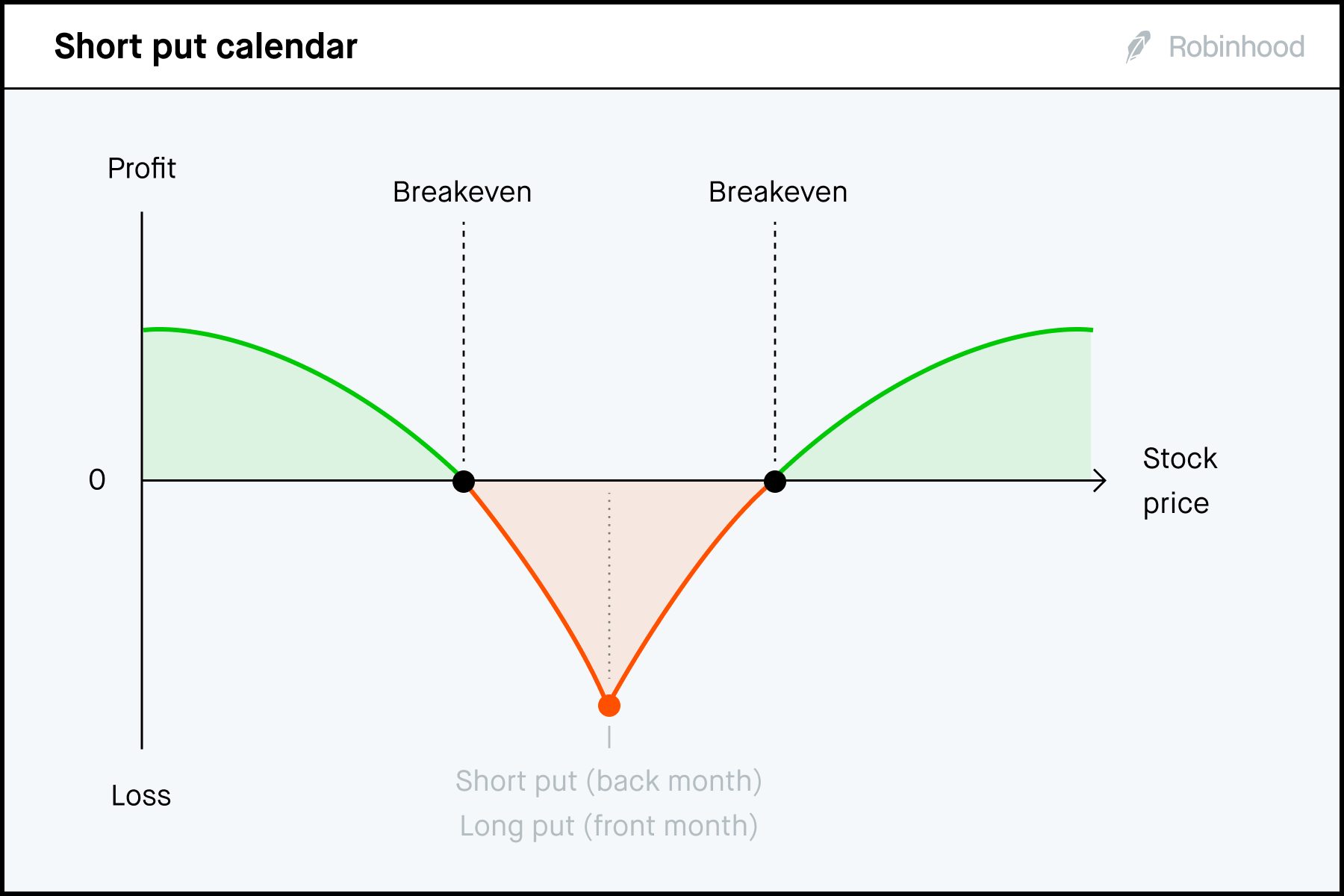

Advanced options strategies (Level 3) Robinhood

Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change.

Short Put Calendar Spread Printable Calendars AT A GLANCE

Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. To profit from a large stock price move away from the strike price of the calendar spread with limited risk if there is little or no price change.

To Profit From A Large Stock Price Move Away From The Strike Price Of The Calendar Spread With Limited Risk If There Is Little Or No Price Change.

Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)