Operating Lease Balance Sheet - An operating lease is different from a. By renting and not owning, operating leases enable companies to keep from recording an asset on their balance sheets by treating them as operating expenses. Especially when you have to sift through multiple financial statements to quantify its impact. All leases that are 12 months or longer must be recognized on the balance sheet. They also state that companies must record a liability for. Gaap rules govern accounting for operating leases. Fasb asc 842 increases disclosure and visibility into the leasing obligations of both public and private organizations. Recently, accounting standards started requiring companies and businesses to show operating leases on their balance sheet. Prior to asc 842, most leases were not included on the balance. Operating lease accounting can be confusing.

All leases that are 12 months or longer must be recognized on the balance sheet. Especially when you have to sift through multiple financial statements to quantify its impact. An operating lease is different from a. They also state that companies must record a liability for. Prior to asc 842, most leases were not included on the balance. Leases shorter than 12 months can be. Fasb asc 842 increases disclosure and visibility into the leasing obligations of both public and private organizations. Operating lease accounting can be confusing. Gaap rules govern accounting for operating leases. Recently, accounting standards started requiring companies and businesses to show operating leases on their balance sheet.

Operating lease accounting can be confusing. Fasb asc 842 increases disclosure and visibility into the leasing obligations of both public and private organizations. All leases that are 12 months or longer must be recognized on the balance sheet. Prior to asc 842, most leases were not included on the balance. Recently, accounting standards started requiring companies and businesses to show operating leases on their balance sheet. Especially when you have to sift through multiple financial statements to quantify its impact. Gaap rules govern accounting for operating leases. They also state that companies must record a liability for. By renting and not owning, operating leases enable companies to keep from recording an asset on their balance sheets by treating them as operating expenses. An operating lease is different from a.

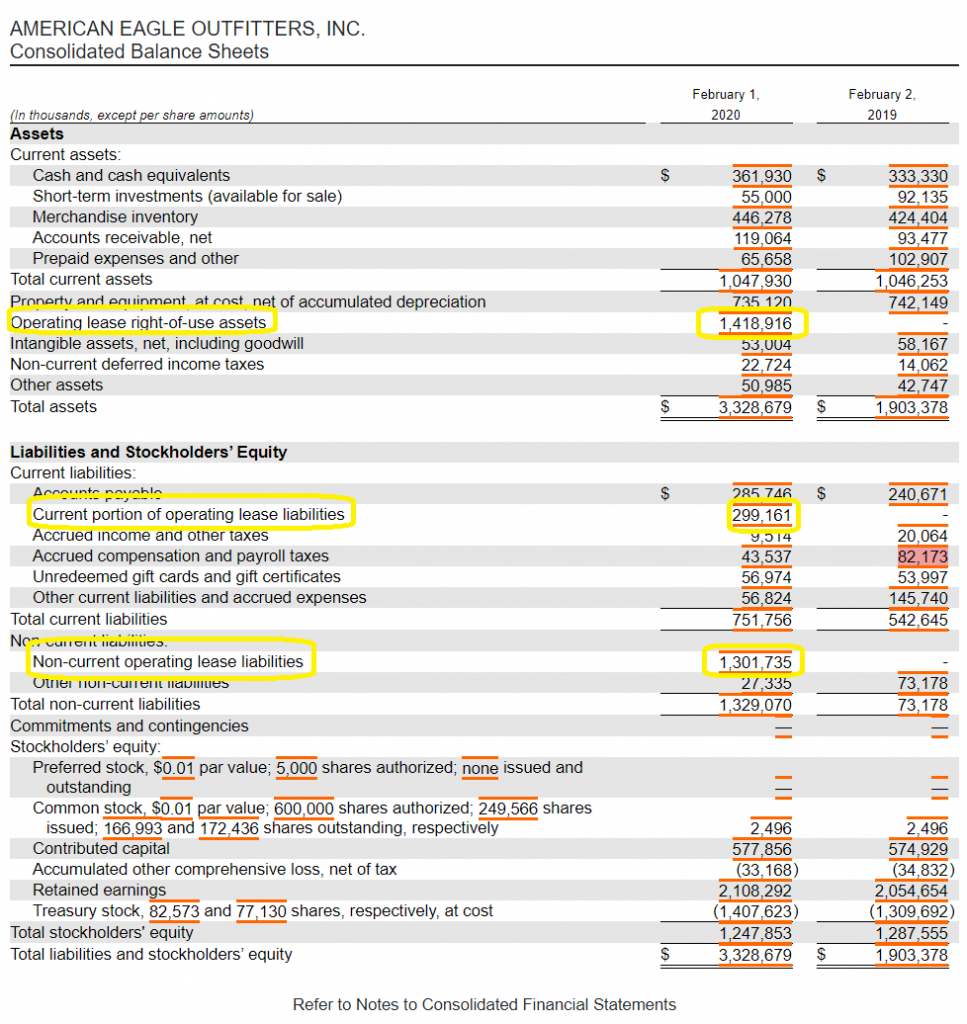

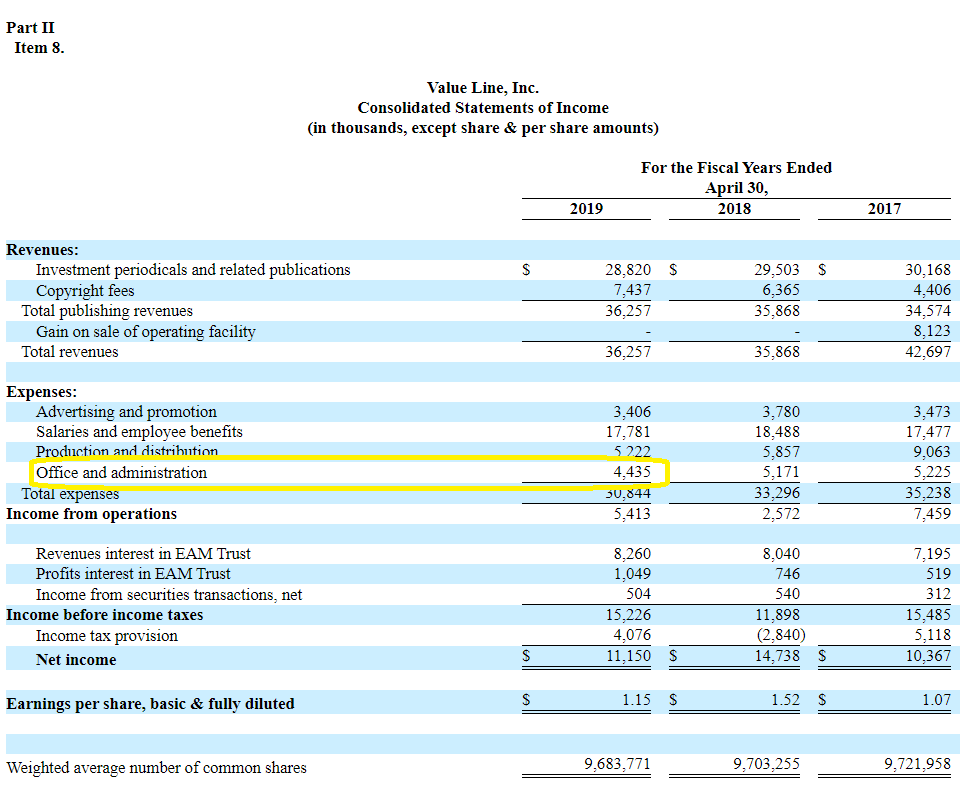

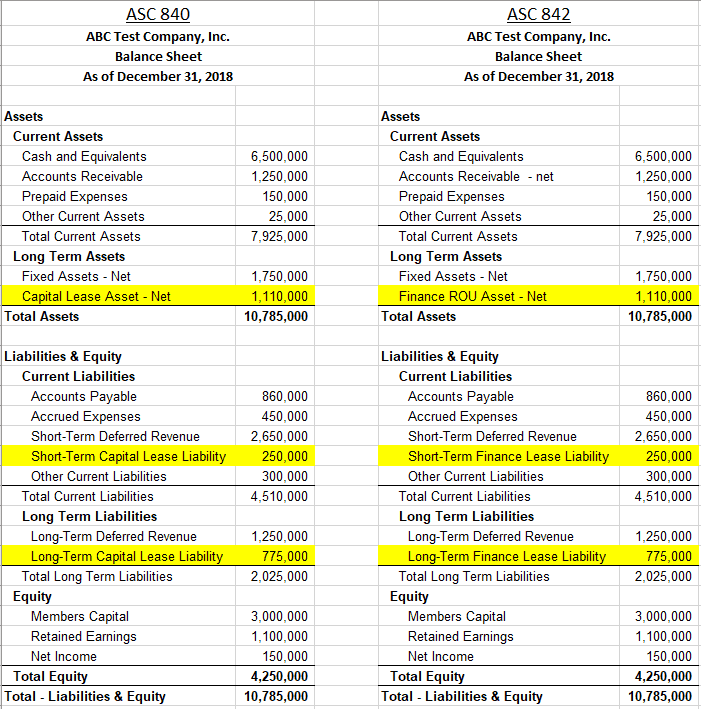

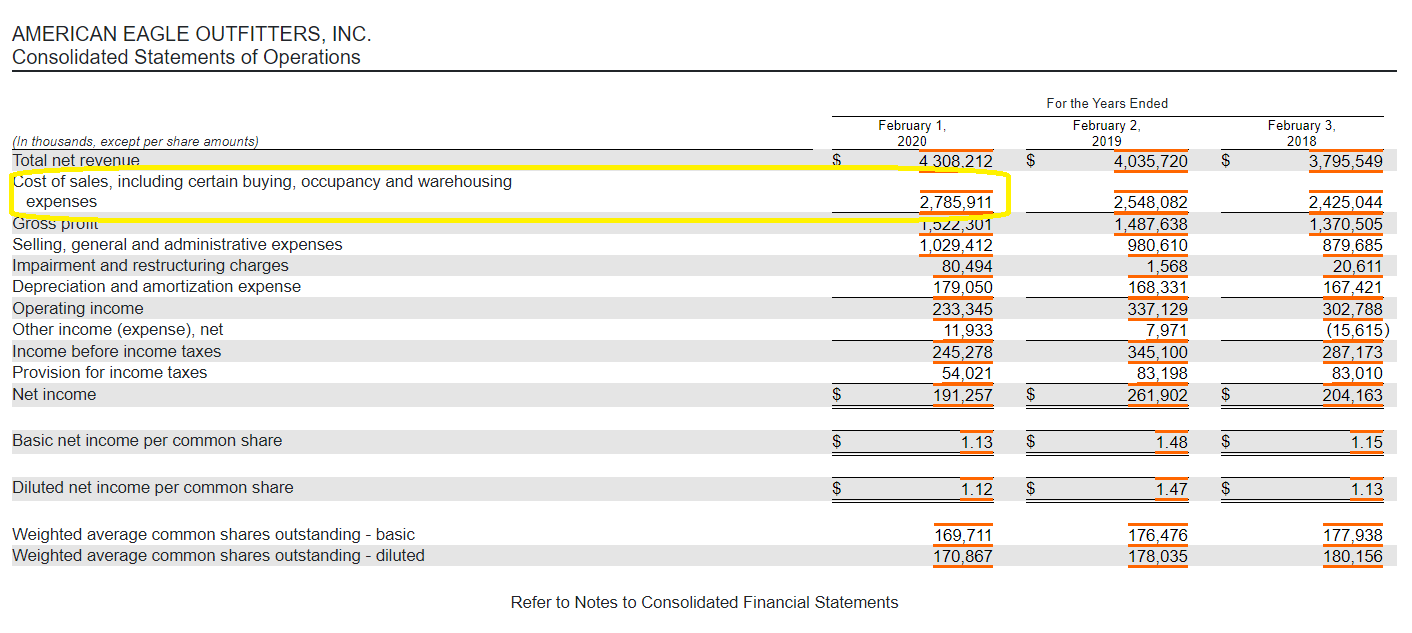

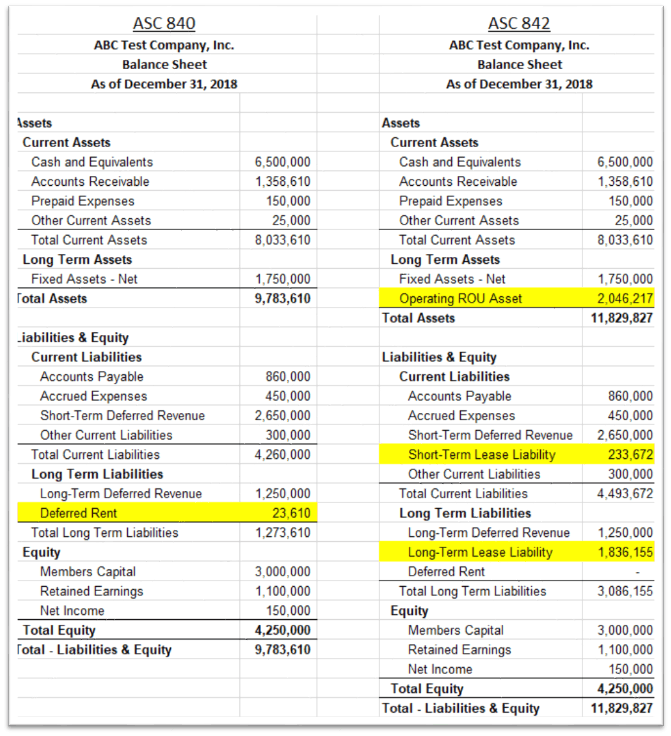

Operating Leases Now in the Balance Sheet GAAP Accounting Made Simple

Recently, accounting standards started requiring companies and businesses to show operating leases on their balance sheet. Fasb asc 842 increases disclosure and visibility into the leasing obligations of both public and private organizations. Prior to asc 842, most leases were not included on the balance. Especially when you have to sift through multiple financial statements to quantify its impact. An.

Operating Leases Now in the Balance Sheet GAAP Accounting Made Simple

Recently, accounting standards started requiring companies and businesses to show operating leases on their balance sheet. An operating lease is different from a. Operating lease accounting can be confusing. Especially when you have to sift through multiple financial statements to quantify its impact. By renting and not owning, operating leases enable companies to keep from recording an asset on their.

ASC 842 Balance Sheet Guide with Examples Visual Lease

Especially when you have to sift through multiple financial statements to quantify its impact. Leases shorter than 12 months can be. An operating lease is different from a. By renting and not owning, operating leases enable companies to keep from recording an asset on their balance sheets by treating them as operating expenses. All leases that are 12 months or.

Operating Leases Now in the Balance Sheet GAAP Accounting Made Simple

Leases shorter than 12 months can be. Operating lease accounting can be confusing. By renting and not owning, operating leases enable companies to keep from recording an asset on their balance sheets by treating them as operating expenses. An operating lease is different from a. Recently, accounting standards started requiring companies and businesses to show operating leases on their balance.

Do Operating Leases Go On The Balance Sheet at Laura Strong blog

Leases shorter than 12 months can be. All leases that are 12 months or longer must be recognized on the balance sheet. They also state that companies must record a liability for. Fasb asc 842 increases disclosure and visibility into the leasing obligations of both public and private organizations. Especially when you have to sift through multiple financial statements to.

Practical Illustrations of the New Leasing Standard for Lessees The

All leases that are 12 months or longer must be recognized on the balance sheet. Especially when you have to sift through multiple financial statements to quantify its impact. Leases shorter than 12 months can be. They also state that companies must record a liability for. Operating lease accounting can be confusing.

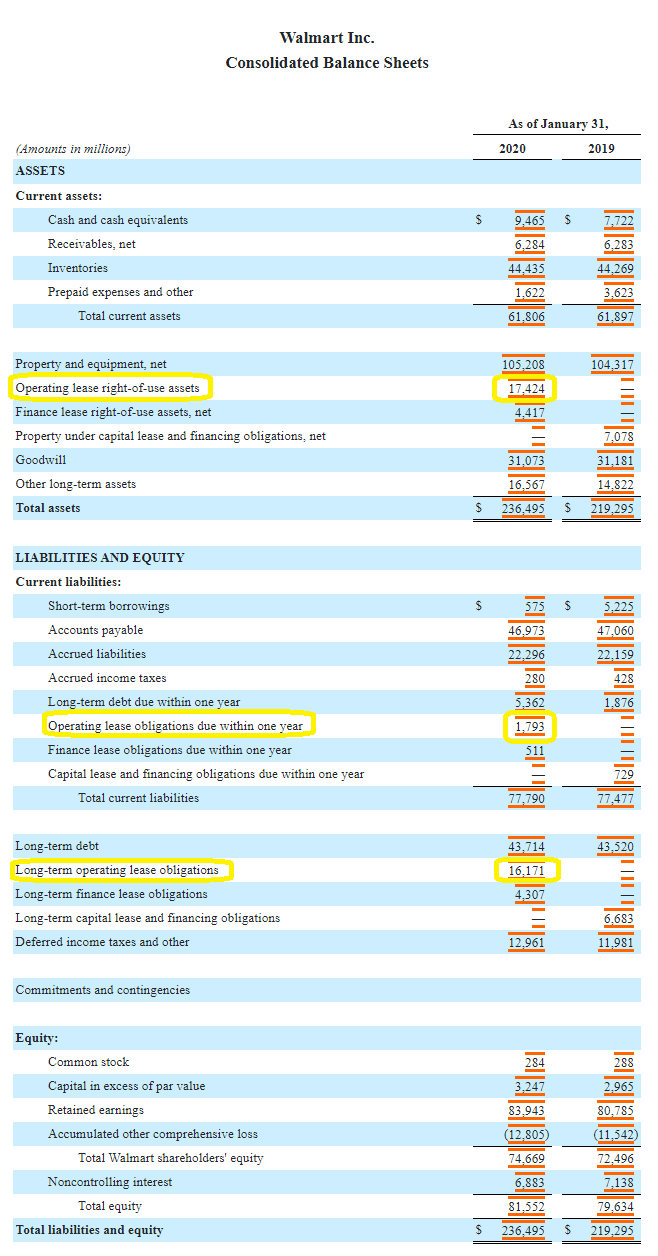

ASC 842 Summary of Balance Sheet Changes for 2020

Fasb asc 842 increases disclosure and visibility into the leasing obligations of both public and private organizations. Gaap rules govern accounting for operating leases. Recently, accounting standards started requiring companies and businesses to show operating leases on their balance sheet. Leases shorter than 12 months can be. They also state that companies must record a liability for.

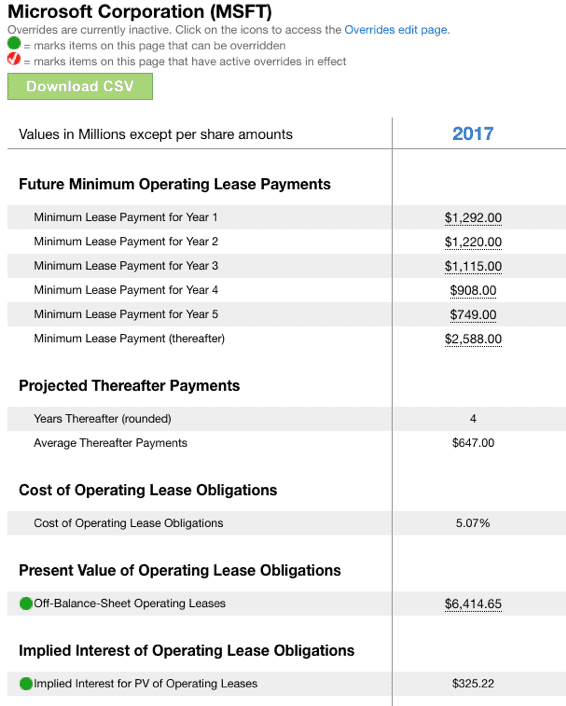

The Potential Impact of Lease Accounting on Equity Valuation The CPA

Prior to asc 842, most leases were not included on the balance. All leases that are 12 months or longer must be recognized on the balance sheet. Leases shorter than 12 months can be. They also state that companies must record a liability for. By renting and not owning, operating leases enable companies to keep from recording an asset on.

The Impacts of Operating Leases Moving to the Balance Sheet

Recently, accounting standards started requiring companies and businesses to show operating leases on their balance sheet. Leases shorter than 12 months can be. They also state that companies must record a liability for. Operating lease accounting can be confusing. Prior to asc 842, most leases were not included on the balance.

Accounting for Operating Leases in the Balance Sheet Simply Explained

Fasb asc 842 increases disclosure and visibility into the leasing obligations of both public and private organizations. By renting and not owning, operating leases enable companies to keep from recording an asset on their balance sheets by treating them as operating expenses. Prior to asc 842, most leases were not included on the balance. An operating lease is different from.

Fasb Asc 842 Increases Disclosure And Visibility Into The Leasing Obligations Of Both Public And Private Organizations.

Especially when you have to sift through multiple financial statements to quantify its impact. Operating lease accounting can be confusing. An operating lease is different from a. By renting and not owning, operating leases enable companies to keep from recording an asset on their balance sheets by treating them as operating expenses.

Leases Shorter Than 12 Months Can Be.

Gaap rules govern accounting for operating leases. Recently, accounting standards started requiring companies and businesses to show operating leases on their balance sheet. They also state that companies must record a liability for. Prior to asc 842, most leases were not included on the balance.