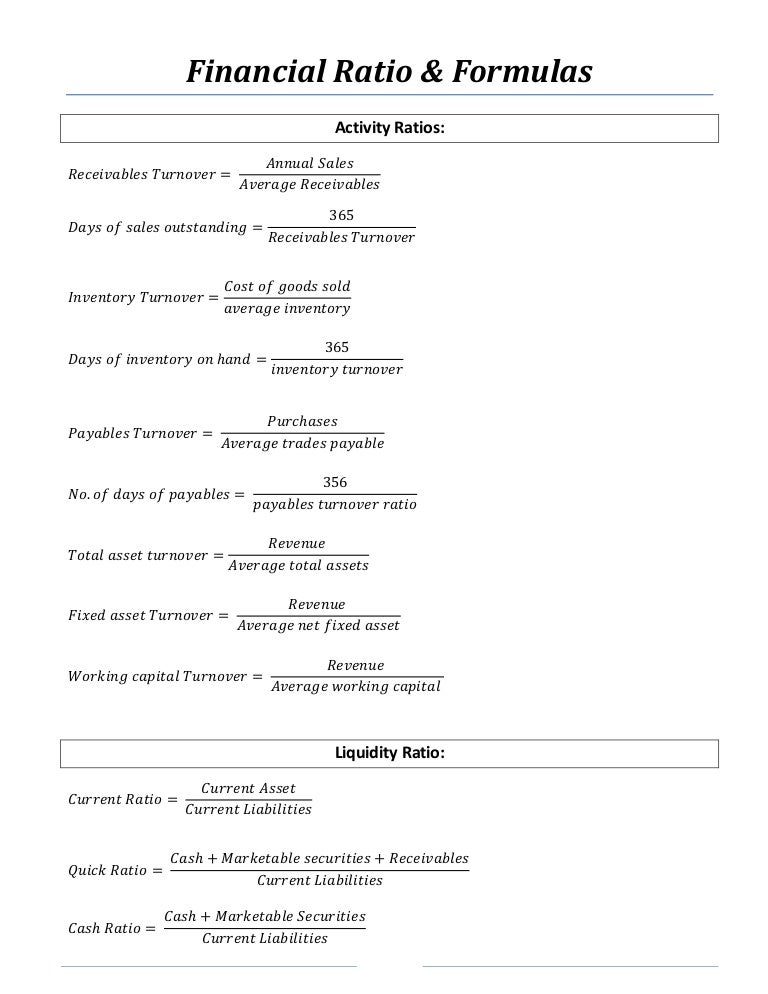

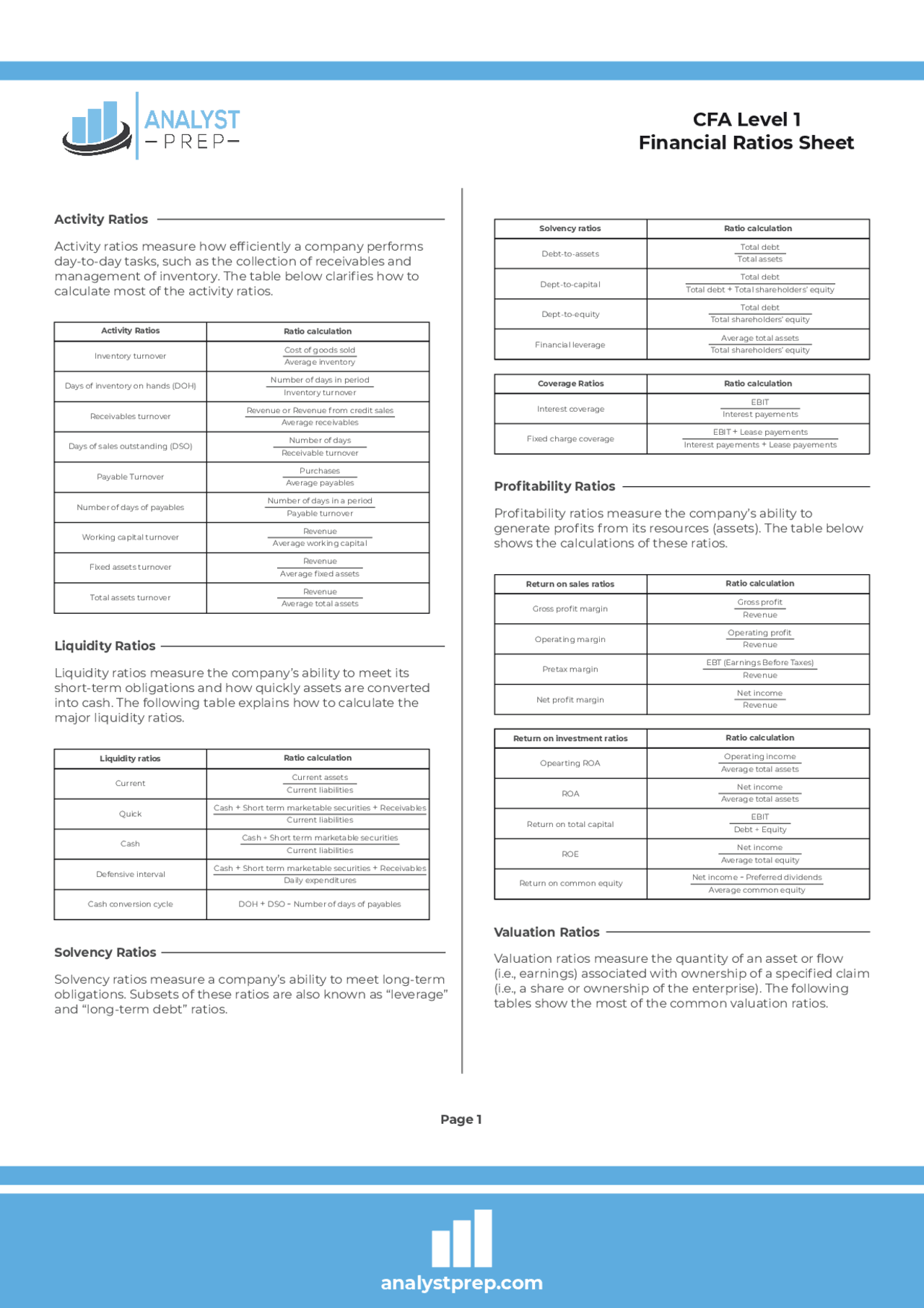

Finance Ratios Cheat Sheet - Corporate finance ratios are quantitative measures that are used to assess businesses. Current ratio = current assets current liabilities meaning ability to meet current liabilities (with total current assets) quick ratio = cash +. Gross profit margin = gross profit sales (times) attempt to. These ratios are used by financial analysts,. Measure operating effectiveness by comparing income to sales, assets and equity.

Current ratio = current assets current liabilities meaning ability to meet current liabilities (with total current assets) quick ratio = cash +. Measure operating effectiveness by comparing income to sales, assets and equity. Corporate finance ratios are quantitative measures that are used to assess businesses. These ratios are used by financial analysts,. Gross profit margin = gross profit sales (times) attempt to.

Measure operating effectiveness by comparing income to sales, assets and equity. These ratios are used by financial analysts,. Current ratio = current assets current liabilities meaning ability to meet current liabilities (with total current assets) quick ratio = cash +. Gross profit margin = gross profit sales (times) attempt to. Corporate finance ratios are quantitative measures that are used to assess businesses.

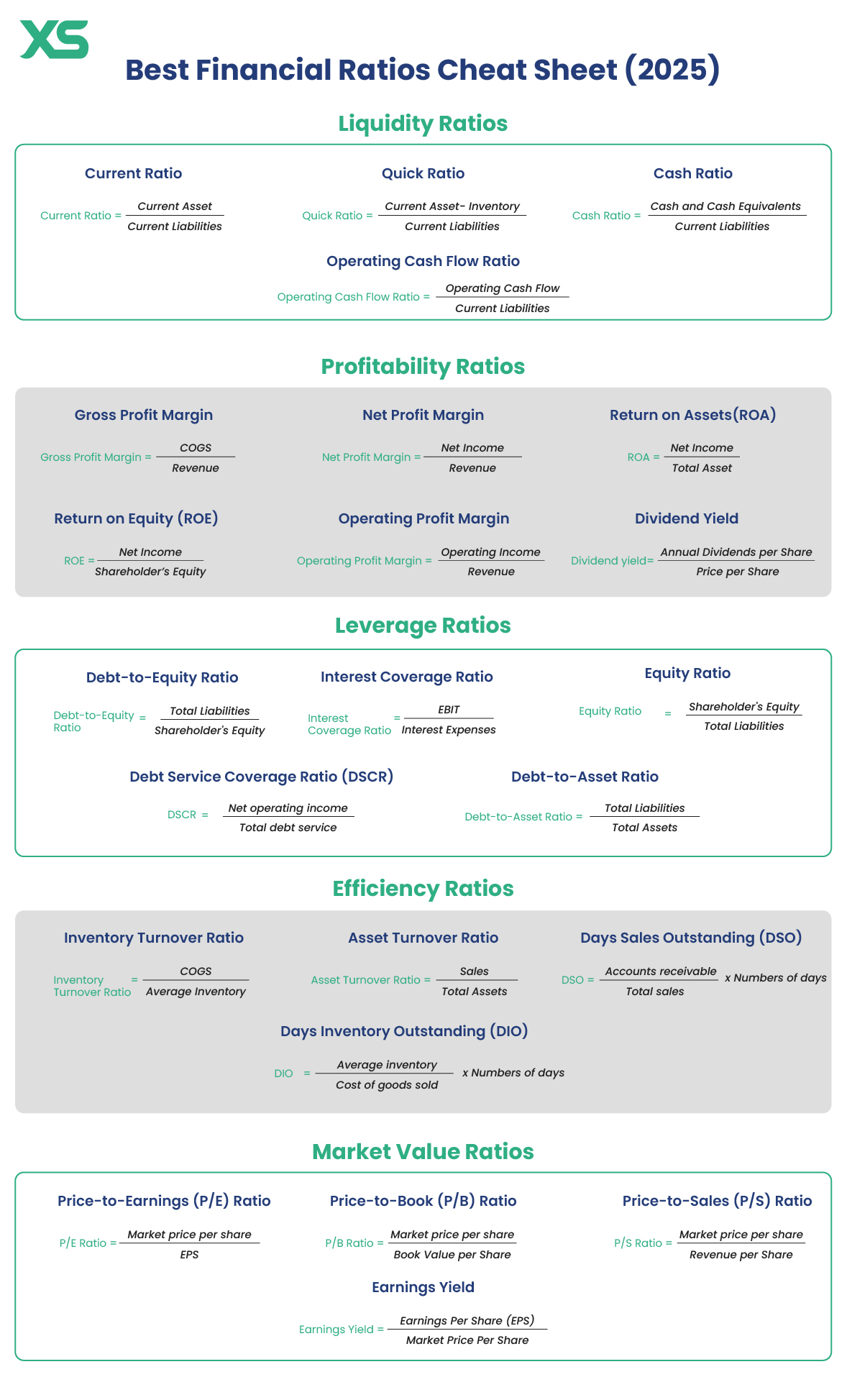

Best Financial Ratios Cheat Sheet (2025) XS

Corporate finance ratios are quantitative measures that are used to assess businesses. Gross profit margin = gross profit sales (times) attempt to. These ratios are used by financial analysts,. Current ratio = current assets current liabilities meaning ability to meet current liabilities (with total current assets) quick ratio = cash +. Measure operating effectiveness by comparing income to sales, assets.

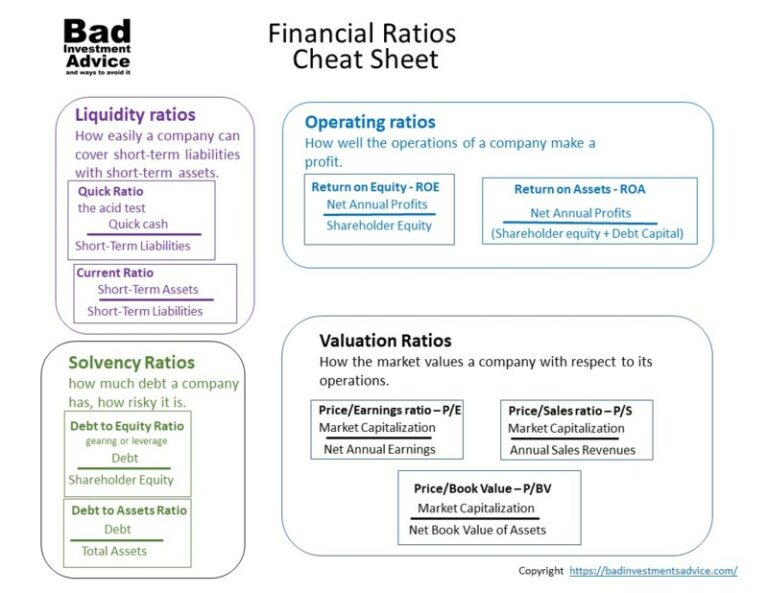

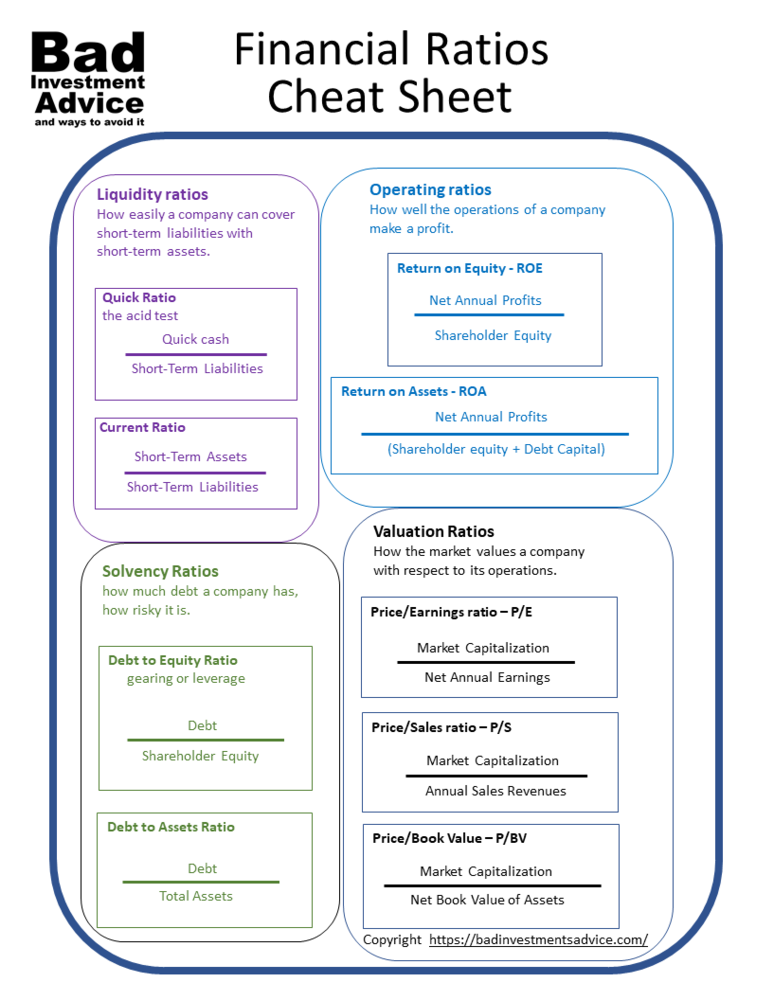

Financial ratios cheat sheet the key ratios explained Bad

Corporate finance ratios are quantitative measures that are used to assess businesses. Gross profit margin = gross profit sales (times) attempt to. Current ratio = current assets current liabilities meaning ability to meet current liabilities (with total current assets) quick ratio = cash +. These ratios are used by financial analysts,. Measure operating effectiveness by comparing income to sales, assets.

Financial Ratio Cheat Sheet Cleverly Accounting

Current ratio = current assets current liabilities meaning ability to meet current liabilities (with total current assets) quick ratio = cash +. Measure operating effectiveness by comparing income to sales, assets and equity. Corporate finance ratios are quantitative measures that are used to assess businesses. Gross profit margin = gross profit sales (times) attempt to. These ratios are used by.

Best Financial Ratios Cheat Sheet (2024) XS

Measure operating effectiveness by comparing income to sales, assets and equity. Corporate finance ratios are quantitative measures that are used to assess businesses. Current ratio = current assets current liabilities meaning ability to meet current liabilities (with total current assets) quick ratio = cash +. These ratios are used by financial analysts,. Gross profit margin = gross profit sales (times).

Financial ratios cheat sheet the key ratios explained Bad

Measure operating effectiveness by comparing income to sales, assets and equity. These ratios are used by financial analysts,. Current ratio = current assets current liabilities meaning ability to meet current liabilities (with total current assets) quick ratio = cash +. Corporate finance ratios are quantitative measures that are used to assess businesses. Gross profit margin = gross profit sales (times).

16 Financial Ratios for Analyzing a Company’s Strengths and Weaknesses

Current ratio = current assets current liabilities meaning ability to meet current liabilities (with total current assets) quick ratio = cash +. These ratios are used by financial analysts,. Gross profit margin = gross profit sales (times) attempt to. Measure operating effectiveness by comparing income to sales, assets and equity. Corporate finance ratios are quantitative measures that are used to.

Financial Ratios Cheat Sheet eFinancialModels

Corporate finance ratios are quantitative measures that are used to assess businesses. Current ratio = current assets current liabilities meaning ability to meet current liabilities (with total current assets) quick ratio = cash +. Measure operating effectiveness by comparing income to sales, assets and equity. These ratios are used by financial analysts,. Gross profit margin = gross profit sales (times).

Financial Ratios and Formulas for Analysis

Corporate finance ratios are quantitative measures that are used to assess businesses. Measure operating effectiveness by comparing income to sales, assets and equity. These ratios are used by financial analysts,. Gross profit margin = gross profit sales (times) attempt to. Current ratio = current assets current liabilities meaning ability to meet current liabilities (with total current assets) quick ratio =.

Nice Types Of Financial Ratios And Their Formulas Statement Cash Flows Ey

Corporate finance ratios are quantitative measures that are used to assess businesses. These ratios are used by financial analysts,. Gross profit margin = gross profit sales (times) attempt to. Current ratio = current assets current liabilities meaning ability to meet current liabilities (with total current assets) quick ratio = cash +. Measure operating effectiveness by comparing income to sales, assets.

Financial ratios cheat sheet Docsity

Corporate finance ratios are quantitative measures that are used to assess businesses. Gross profit margin = gross profit sales (times) attempt to. These ratios are used by financial analysts,. Current ratio = current assets current liabilities meaning ability to meet current liabilities (with total current assets) quick ratio = cash +. Measure operating effectiveness by comparing income to sales, assets.

Gross Profit Margin = Gross Profit Sales (Times) Attempt To.

Current ratio = current assets current liabilities meaning ability to meet current liabilities (with total current assets) quick ratio = cash +. Corporate finance ratios are quantitative measures that are used to assess businesses. These ratios are used by financial analysts,. Measure operating effectiveness by comparing income to sales, assets and equity.