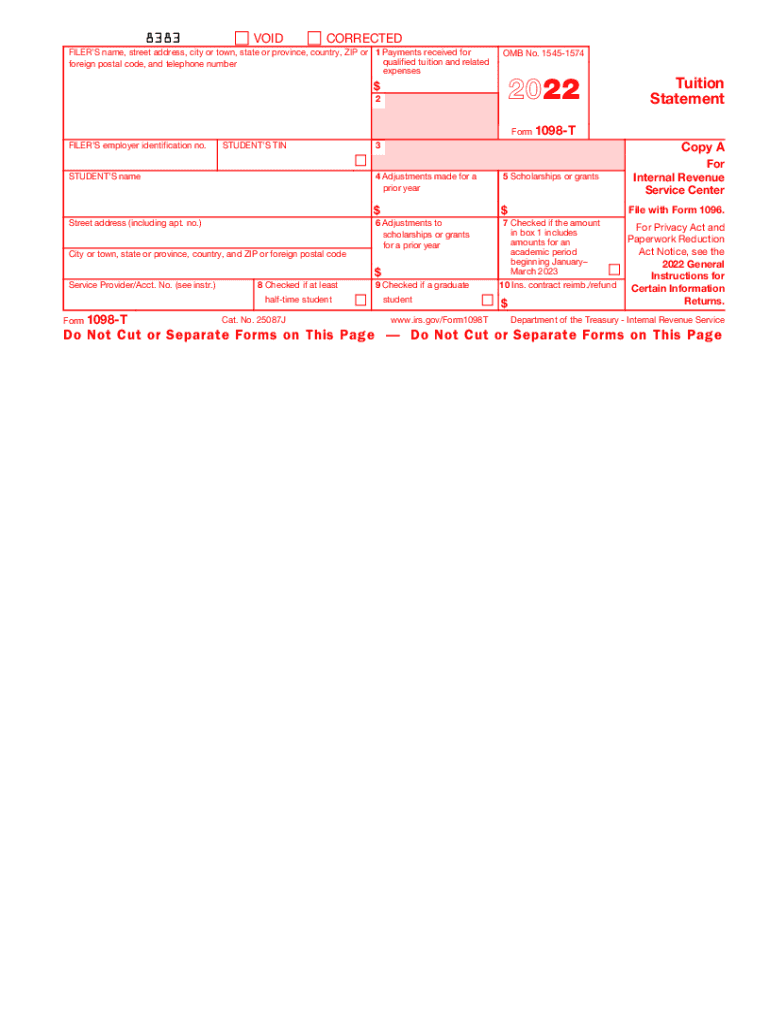

Example Of 1098 T Form - This amount may reduce any allowable education credit that you claimed for the prior year (may result in an increase in tax. This box reports the total. Payments received for qualified tuition and related expenses.

This amount may reduce any allowable education credit that you claimed for the prior year (may result in an increase in tax. Payments received for qualified tuition and related expenses. This box reports the total.

Payments received for qualified tuition and related expenses. This box reports the total. This amount may reduce any allowable education credit that you claimed for the prior year (may result in an increase in tax.

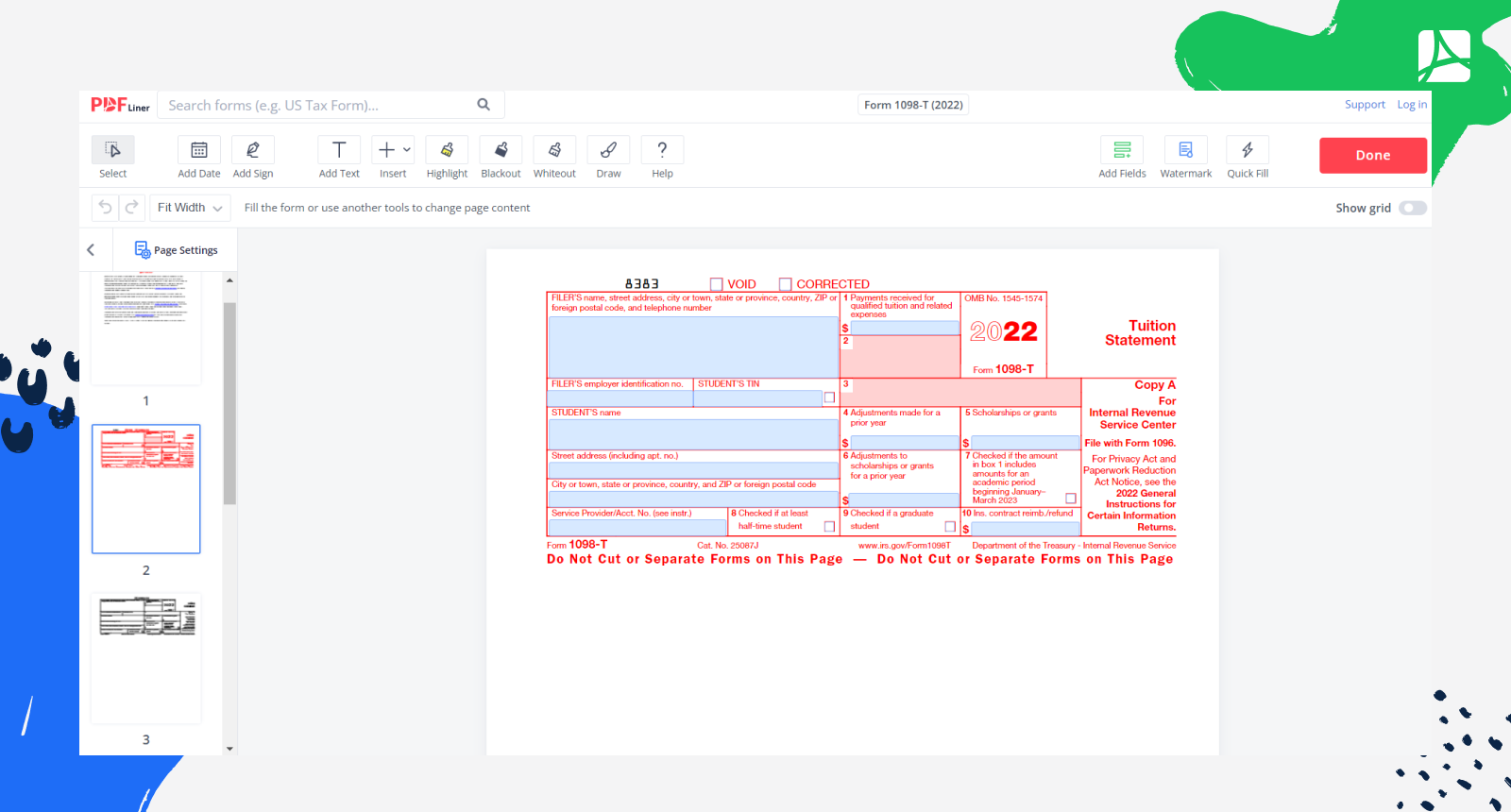

Form 1098T (2023) Print and sign Form 1098T PDFliner

This amount may reduce any allowable education credit that you claimed for the prior year (may result in an increase in tax. Payments received for qualified tuition and related expenses. This box reports the total.

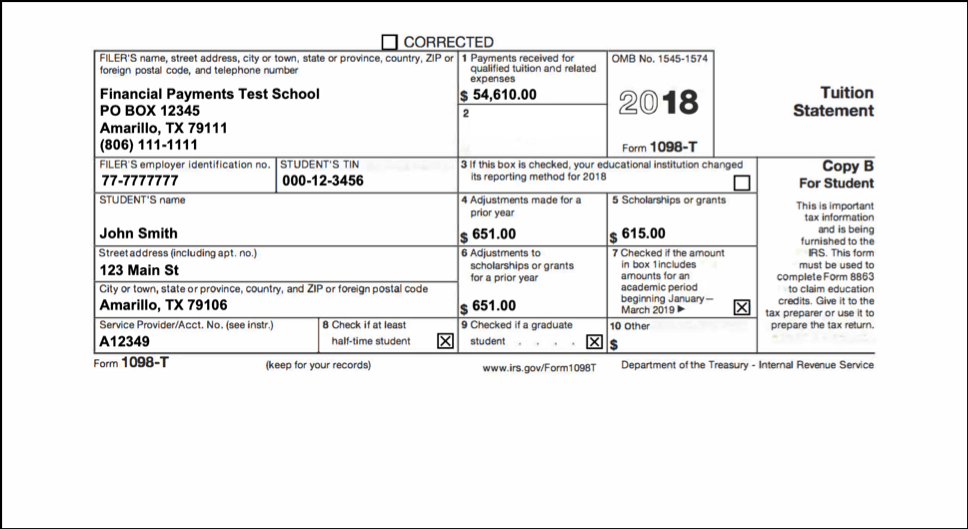

Understanding your IRS Form 1098T Student Billing

This amount may reduce any allowable education credit that you claimed for the prior year (may result in an increase in tax. This box reports the total. Payments received for qualified tuition and related expenses.

Picture13 1098T Forms

This amount may reduce any allowable education credit that you claimed for the prior year (may result in an increase in tax. This box reports the total. Payments received for qualified tuition and related expenses.

1098T IRS Tax Form Instructions 1098T Forms

This amount may reduce any allowable education credit that you claimed for the prior year (may result in an increase in tax. This box reports the total. Payments received for qualified tuition and related expenses.

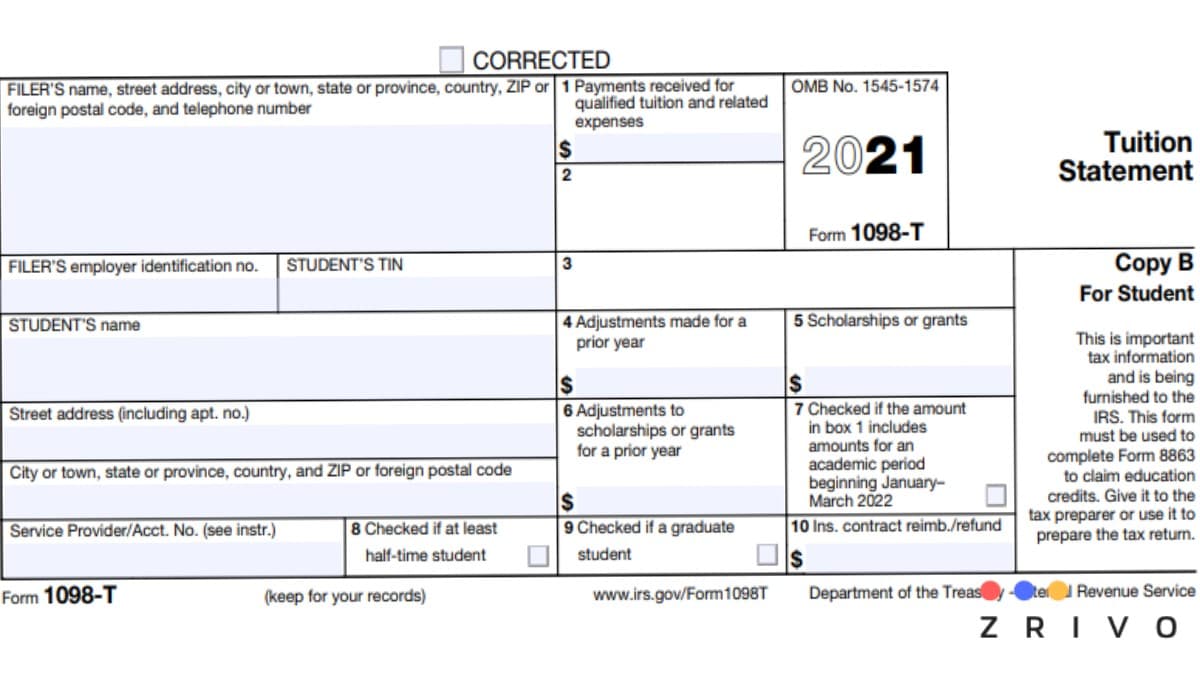

2023 Form 1098T ↳ Get IRS 1098T Tax Form & Tuition Statement

Payments received for qualified tuition and related expenses. This amount may reduce any allowable education credit that you claimed for the prior year (may result in an increase in tax. This box reports the total.

Form1098Tfeatured pdfFiller Blog

This amount may reduce any allowable education credit that you claimed for the prior year (may result in an increase in tax. Payments received for qualified tuition and related expenses. This box reports the total.

1098 T Form 2021

This amount may reduce any allowable education credit that you claimed for the prior year (may result in an increase in tax. This box reports the total. Payments received for qualified tuition and related expenses.

Form 1098T 2024 2025

This amount may reduce any allowable education credit that you claimed for the prior year (may result in an increase in tax. This box reports the total. Payments received for qualified tuition and related expenses.

Form 1098T Information Student Portal

Payments received for qualified tuition and related expenses. This amount may reduce any allowable education credit that you claimed for the prior year (may result in an increase in tax. This box reports the total.

This Amount May Reduce Any Allowable Education Credit That You Claimed For The Prior Year (May Result In An Increase In Tax.

This box reports the total. Payments received for qualified tuition and related expenses.