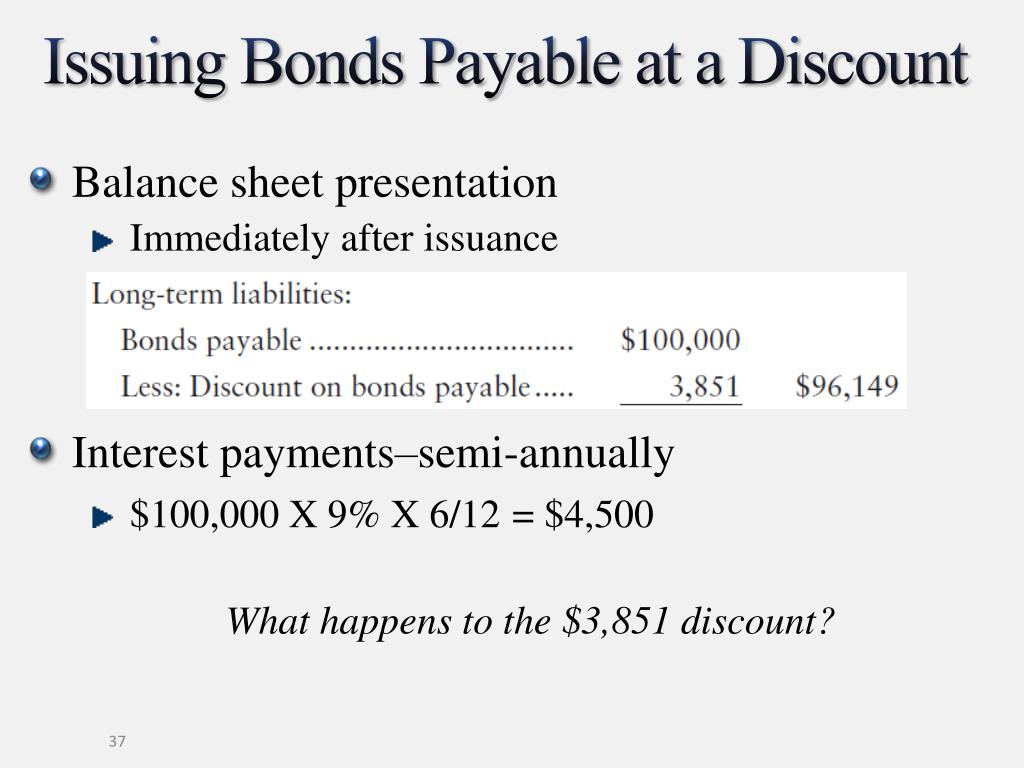

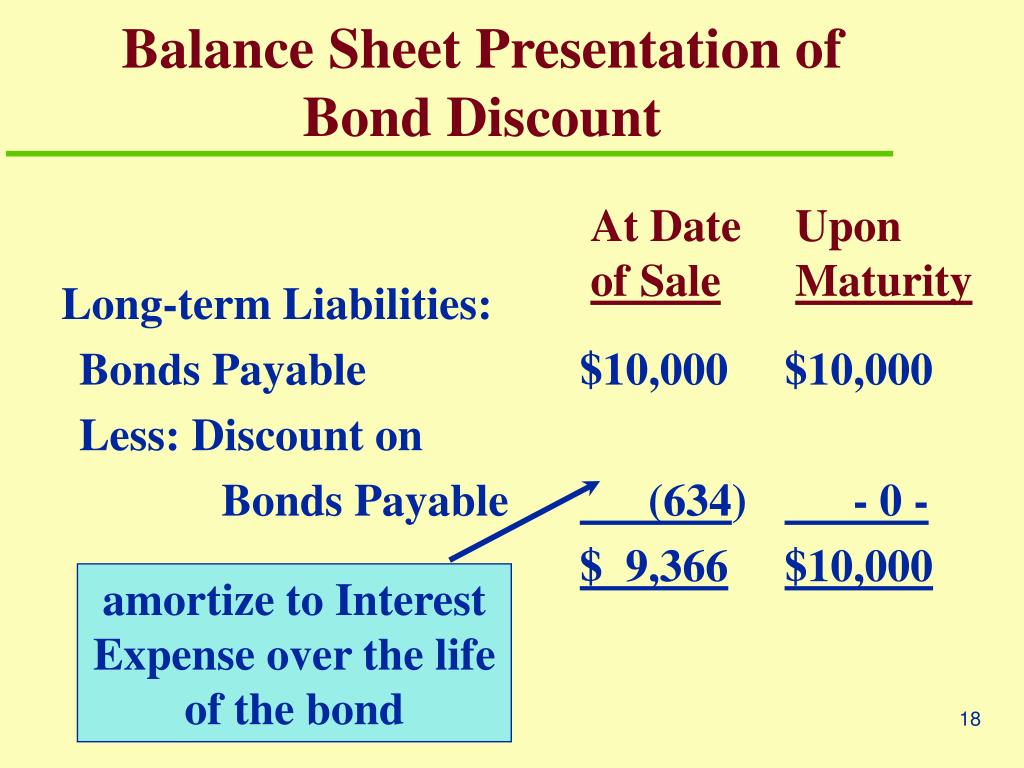

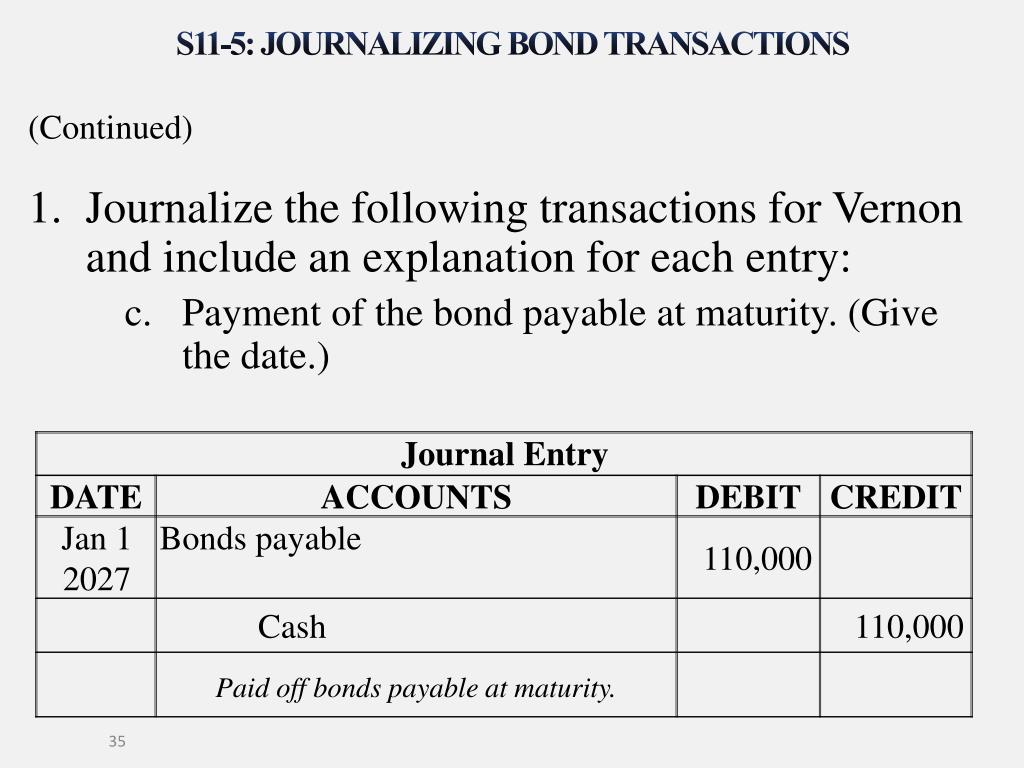

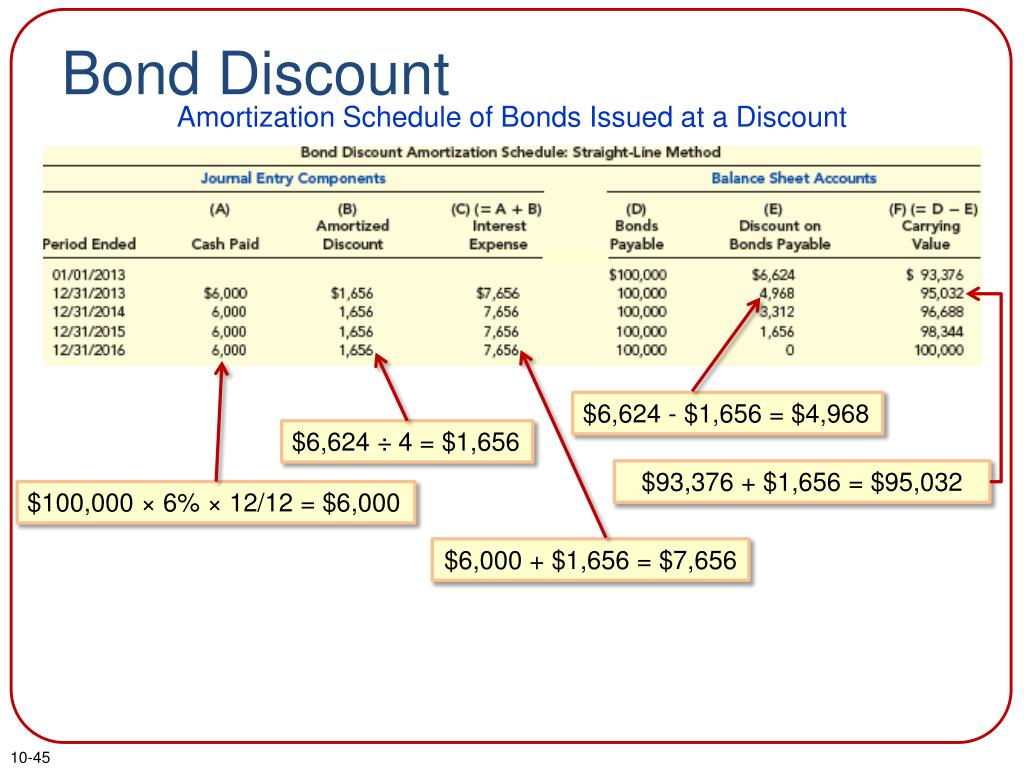

Discount On Bonds Payable Balance Sheet - The discount on bonds payable account is a. Here’s how the bonds payable. Be able to describe when a bond is issued at a discount, and prepare journal entries for its issuance. The difference of $7,024 is debited to an account called discount on bonds payable. The premium or the discount on bonds payable that has not yet been amortized to interest expense will be reported immediately after the. Discount bonds payable are the bonds issued at a discount by the companies and happen when the coupon rate is less than the prevailing market. Discount on bonds payable is a contra liability account as it subtracts from its control account, bonds payable.

Be able to describe when a bond is issued at a discount, and prepare journal entries for its issuance. Discount bonds payable are the bonds issued at a discount by the companies and happen when the coupon rate is less than the prevailing market. The premium or the discount on bonds payable that has not yet been amortized to interest expense will be reported immediately after the. Discount on bonds payable is a contra liability account as it subtracts from its control account, bonds payable. Here’s how the bonds payable. The discount on bonds payable account is a. The difference of $7,024 is debited to an account called discount on bonds payable.

Here’s how the bonds payable. Discount on bonds payable is a contra liability account as it subtracts from its control account, bonds payable. The discount on bonds payable account is a. The difference of $7,024 is debited to an account called discount on bonds payable. Discount bonds payable are the bonds issued at a discount by the companies and happen when the coupon rate is less than the prevailing market. The premium or the discount on bonds payable that has not yet been amortized to interest expense will be reported immediately after the. Be able to describe when a bond is issued at a discount, and prepare journal entries for its issuance.

PPT LongTerm Liabilities , Bonds Payable, and Classification of

The difference of $7,024 is debited to an account called discount on bonds payable. Be able to describe when a bond is issued at a discount, and prepare journal entries for its issuance. The discount on bonds payable account is a. The premium or the discount on bonds payable that has not yet been amortized to interest expense will be.

PPT LongTerm Liabilities , Bonds Payable, and Classification of

Be able to describe when a bond is issued at a discount, and prepare journal entries for its issuance. Here’s how the bonds payable. The premium or the discount on bonds payable that has not yet been amortized to interest expense will be reported immediately after the. The difference of $7,024 is debited to an account called discount on bonds.

PPT LongTerm Liabilities , Bonds Payable, and Classification of

Be able to describe when a bond is issued at a discount, and prepare journal entries for its issuance. Discount bonds payable are the bonds issued at a discount by the companies and happen when the coupon rate is less than the prevailing market. The premium or the discount on bonds payable that has not yet been amortized to interest.

PPT LongTerm Liabilities in Financial Accounting PowerPoint

Discount bonds payable are the bonds issued at a discount by the companies and happen when the coupon rate is less than the prevailing market. The premium or the discount on bonds payable that has not yet been amortized to interest expense will be reported immediately after the. Here’s how the bonds payable. The difference of $7,024 is debited to.

PPT LongTerm Liabilities , Bonds Payable, and Classification of

Discount bonds payable are the bonds issued at a discount by the companies and happen when the coupon rate is less than the prevailing market. Discount on bonds payable is a contra liability account as it subtracts from its control account, bonds payable. Here’s how the bonds payable. The premium or the discount on bonds payable that has not yet.

Bond Related Accounts on the Balance Sheet Wize University

Here’s how the bonds payable. The premium or the discount on bonds payable that has not yet been amortized to interest expense will be reported immediately after the. Discount bonds payable are the bonds issued at a discount by the companies and happen when the coupon rate is less than the prevailing market. The difference of $7,024 is debited to.

PPT Chapter 10 PowerPoint Presentation, free download ID1657867

Be able to describe when a bond is issued at a discount, and prepare journal entries for its issuance. Here’s how the bonds payable. Discount on bonds payable is a contra liability account as it subtracts from its control account, bonds payable. Discount bonds payable are the bonds issued at a discount by the companies and happen when the coupon.

Bonds Payable at Premium Balance Sheet Presentation YouTube

Discount on bonds payable is a contra liability account as it subtracts from its control account, bonds payable. The difference of $7,024 is debited to an account called discount on bonds payable. The premium or the discount on bonds payable that has not yet been amortized to interest expense will be reported immediately after the. Be able to describe when.

Accounting For Bonds Payable

Discount bonds payable are the bonds issued at a discount by the companies and happen when the coupon rate is less than the prevailing market. Here’s how the bonds payable. The premium or the discount on bonds payable that has not yet been amortized to interest expense will be reported immediately after the. The discount on bonds payable account is.

Accounting For Bonds Payable

Here’s how the bonds payable. Be able to describe when a bond is issued at a discount, and prepare journal entries for its issuance. Discount bonds payable are the bonds issued at a discount by the companies and happen when the coupon rate is less than the prevailing market. Discount on bonds payable is a contra liability account as it.

Discount On Bonds Payable Is A Contra Liability Account As It Subtracts From Its Control Account, Bonds Payable.

The premium or the discount on bonds payable that has not yet been amortized to interest expense will be reported immediately after the. The difference of $7,024 is debited to an account called discount on bonds payable. The discount on bonds payable account is a. Here’s how the bonds payable.

Discount Bonds Payable Are The Bonds Issued At A Discount By The Companies And Happen When The Coupon Rate Is Less Than The Prevailing Market.

Be able to describe when a bond is issued at a discount, and prepare journal entries for its issuance.