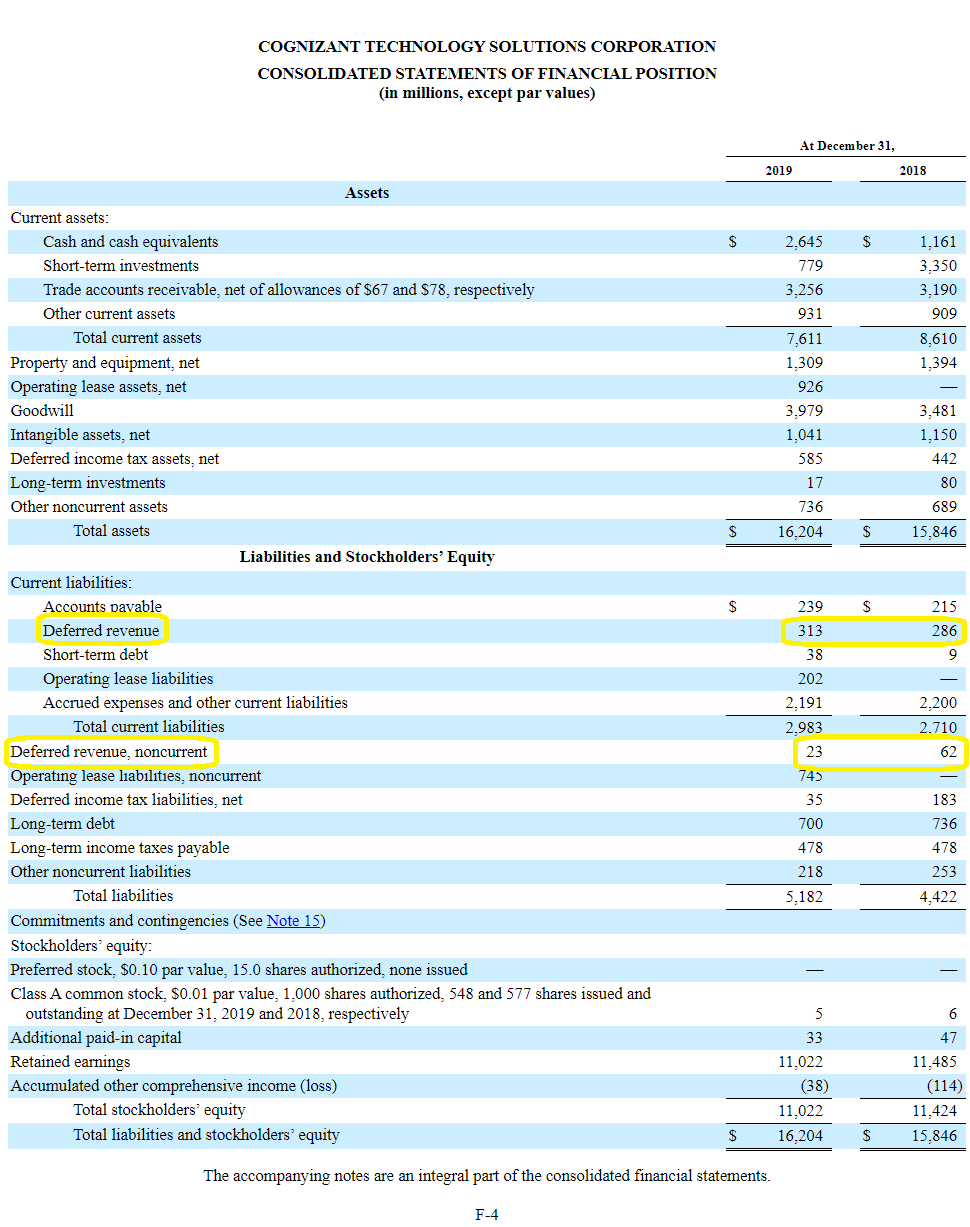

Deferred Income Balance Sheet - In simpler terms, a deferred revenue journal entry represents income that the company has received but has not yet recognized as revenue on its income statement. Learn what the difference is between accrued and deferred income, as well as how we adjust the journal entries for them, only at first intuition. In this article, we’ll explore what deferred income is, how it lands on the balance sheet, and why it’s a bigger deal than it might seem. Also called unearned revenue, it appears as a liability on a. With a fresh angle, a clear example, and. Deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or completed. Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered.

Also called unearned revenue, it appears as a liability on a. With a fresh angle, a clear example, and. In this article, we’ll explore what deferred income is, how it lands on the balance sheet, and why it’s a bigger deal than it might seem. Learn what the difference is between accrued and deferred income, as well as how we adjust the journal entries for them, only at first intuition. In simpler terms, a deferred revenue journal entry represents income that the company has received but has not yet recognized as revenue on its income statement. Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. Deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or completed.

Learn what the difference is between accrued and deferred income, as well as how we adjust the journal entries for them, only at first intuition. Also called unearned revenue, it appears as a liability on a. In simpler terms, a deferred revenue journal entry represents income that the company has received but has not yet recognized as revenue on its income statement. Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. With a fresh angle, a clear example, and. Deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or completed. In this article, we’ll explore what deferred income is, how it lands on the balance sheet, and why it’s a bigger deal than it might seem.

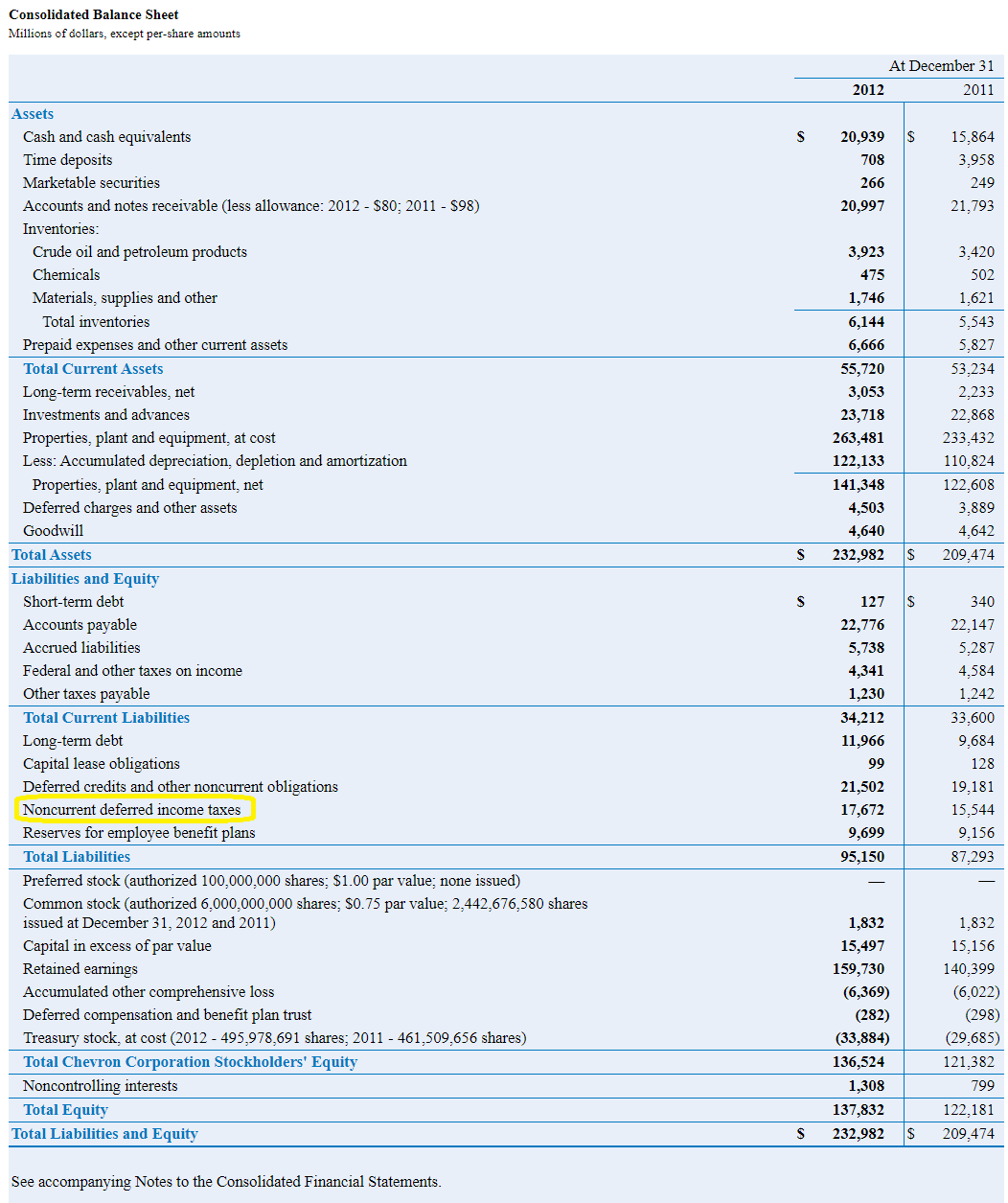

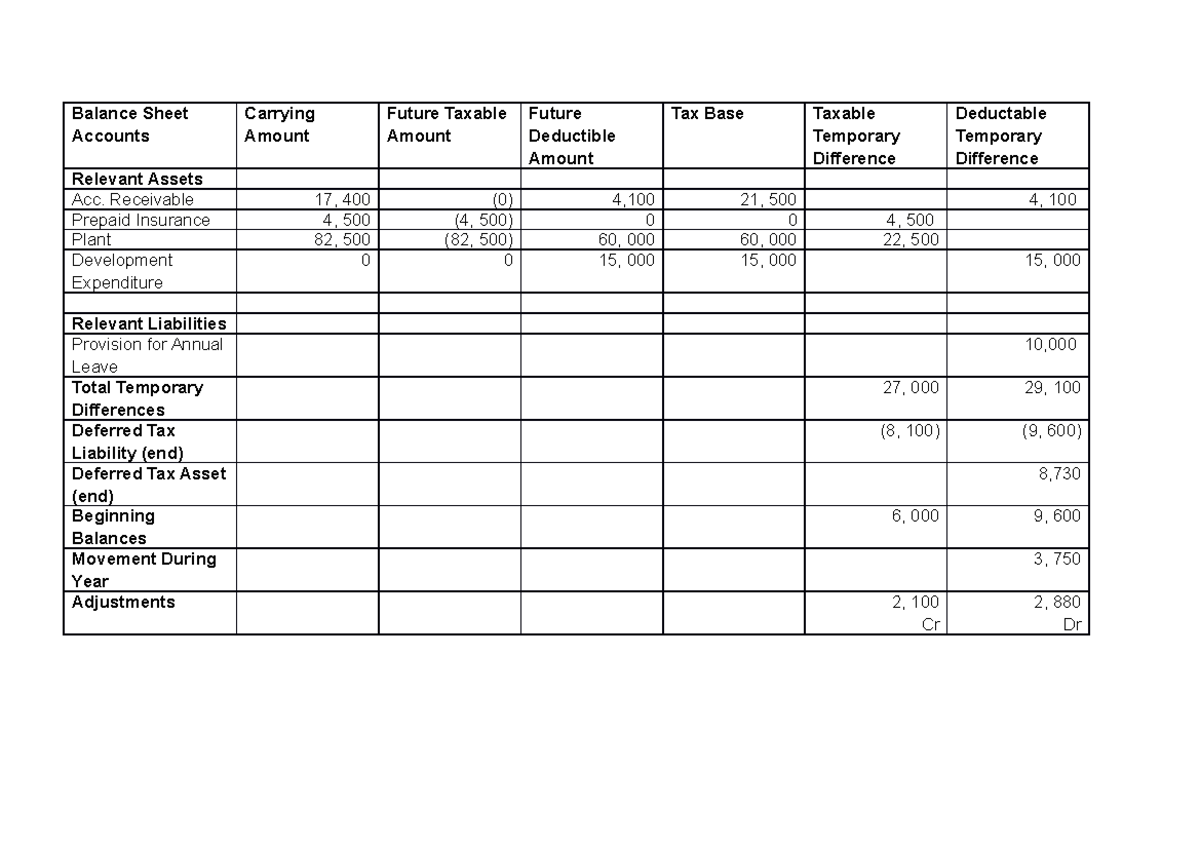

Deferred Tax Liabilities Explained (with RealLife Example in a

Also called unearned revenue, it appears as a liability on a. Learn what the difference is between accrued and deferred income, as well as how we adjust the journal entries for them, only at first intuition. Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. In simpler terms, a deferred.

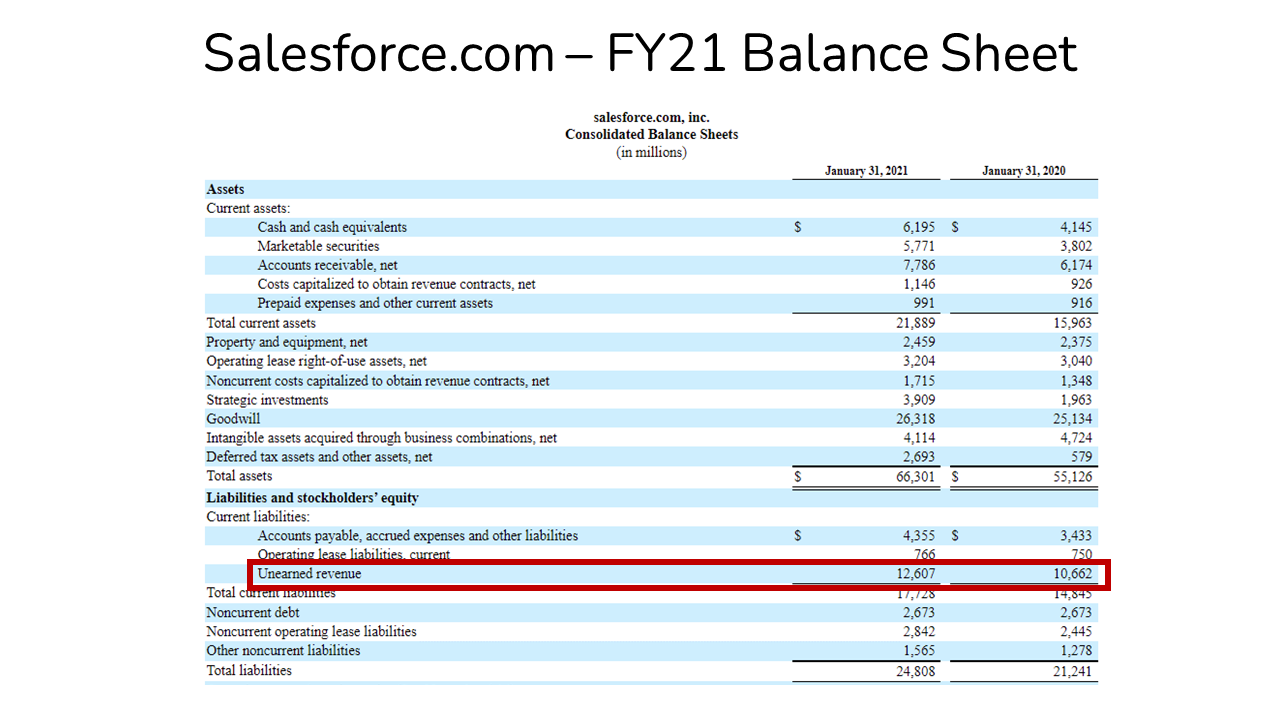

What is Deferred Revenue? The Ultimate Guide (2022)

Learn what the difference is between accrued and deferred income, as well as how we adjust the journal entries for them, only at first intuition. Also called unearned revenue, it appears as a liability on a. Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. In this article, we’ll explore.

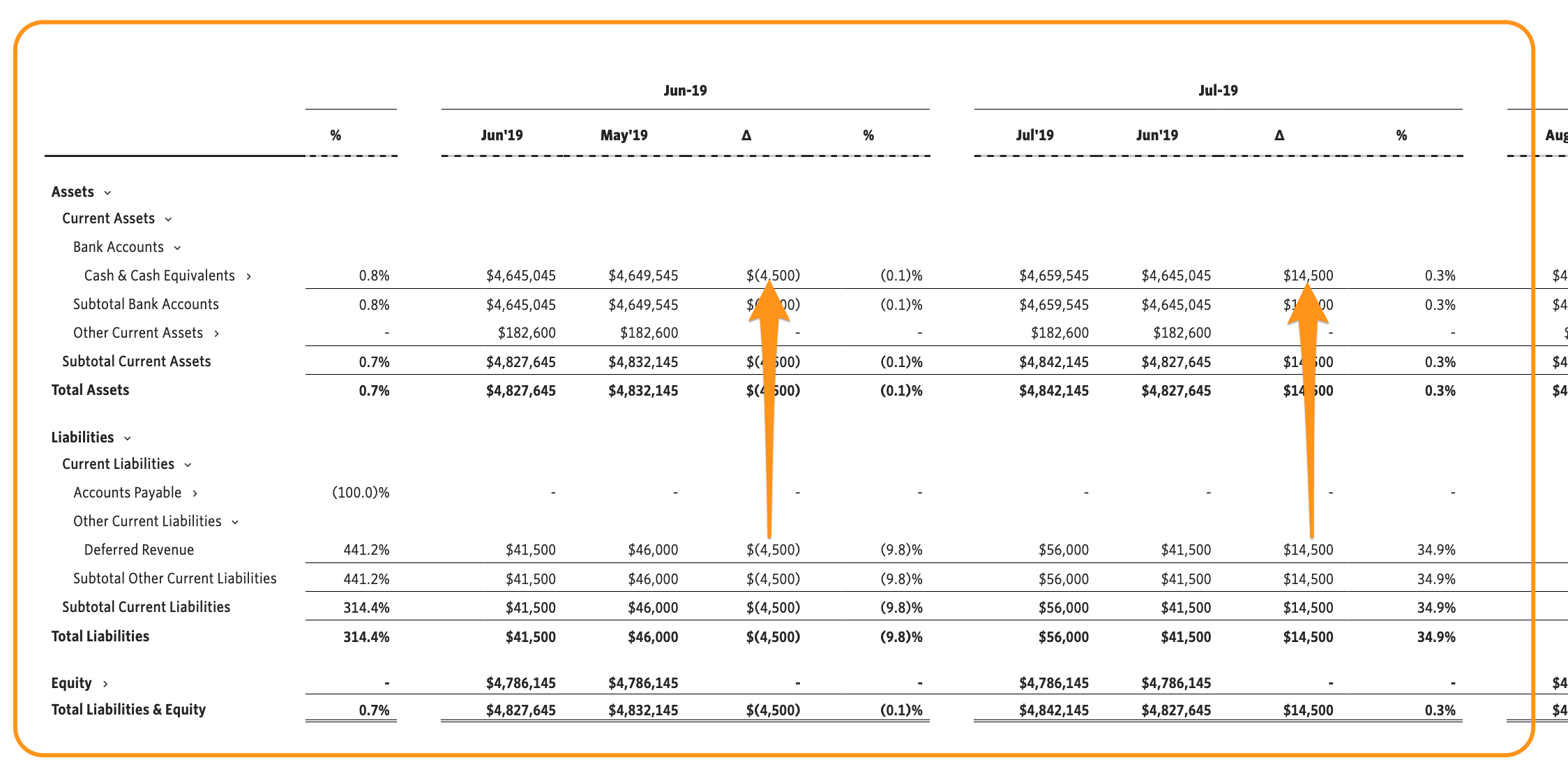

Simple Deferred Revenue with Jirav Pro

Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. In simpler terms, a deferred revenue journal entry represents income that the company has received but has not yet recognized as revenue on its income statement. With a fresh angle, a clear example, and. Also called unearned revenue, it appears as.

What Is Deferred Revenue? Complete Guide Pareto Labs

Also called unearned revenue, it appears as a liability on a. Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. In simpler terms, a deferred revenue journal entry represents income that the company has received but has not yet recognized as revenue on its income statement. With a fresh angle,.

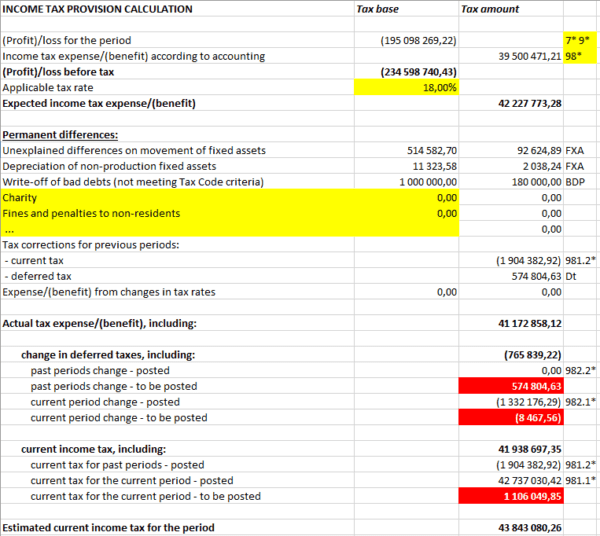

Current and deferred tax review and internal control methodology

Learn what the difference is between accrued and deferred income, as well as how we adjust the journal entries for them, only at first intuition. In simpler terms, a deferred revenue journal entry represents income that the company has received but has not yet recognized as revenue on its income statement. Deferred revenue is a payment a company receives in.

41 Balance Sheet Deferred Tax Expense

With a fresh angle, a clear example, and. Learn what the difference is between accrued and deferred income, as well as how we adjust the journal entries for them, only at first intuition. In this article, we’ll explore what deferred income is, how it lands on the balance sheet, and why it’s a bigger deal than it might seem. Deferred.

Deferred Tax Worksheet Balance Sheet Accounts Carrying Amount Future

In simpler terms, a deferred revenue journal entry represents income that the company has received but has not yet recognized as revenue on its income statement. In this article, we’ll explore what deferred income is, how it lands on the balance sheet, and why it’s a bigger deal than it might seem. Learn what the difference is between accrued and.

Deferred Revenue Schedule Excel Template, Web Choose The Icon, Enter

Learn what the difference is between accrued and deferred income, as well as how we adjust the journal entries for them, only at first intuition. In simpler terms, a deferred revenue journal entry represents income that the company has received but has not yet recognized as revenue on its income statement. Deferred revenue is a payment a company receives in.

Deferred Tax Liabilities Explained (with RealLife Example in a

With a fresh angle, a clear example, and. In this article, we’ll explore what deferred income is, how it lands on the balance sheet, and why it’s a bigger deal than it might seem. Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered. Also called unearned revenue, it appears as.

Deferred Revenue Debit or Credit and its Flow Through the Financials

Deferred revenue (also called unearned revenue) is generated when a company receives payment for goods and/or services that have not been delivered or completed. In this article, we’ll explore what deferred income is, how it lands on the balance sheet, and why it’s a bigger deal than it might seem. Also called unearned revenue, it appears as a liability on.

Learn What The Difference Is Between Accrued And Deferred Income, As Well As How We Adjust The Journal Entries For Them, Only At First Intuition.

With a fresh angle, a clear example, and. In simpler terms, a deferred revenue journal entry represents income that the company has received but has not yet recognized as revenue on its income statement. In this article, we’ll explore what deferred income is, how it lands on the balance sheet, and why it’s a bigger deal than it might seem. Also called unearned revenue, it appears as a liability on a.

Deferred Revenue (Also Called Unearned Revenue) Is Generated When A Company Receives Payment For Goods And/Or Services That Have Not Been Delivered Or Completed.

Deferred revenue is a payment a company receives in advance for products or services it has not yet delivered.