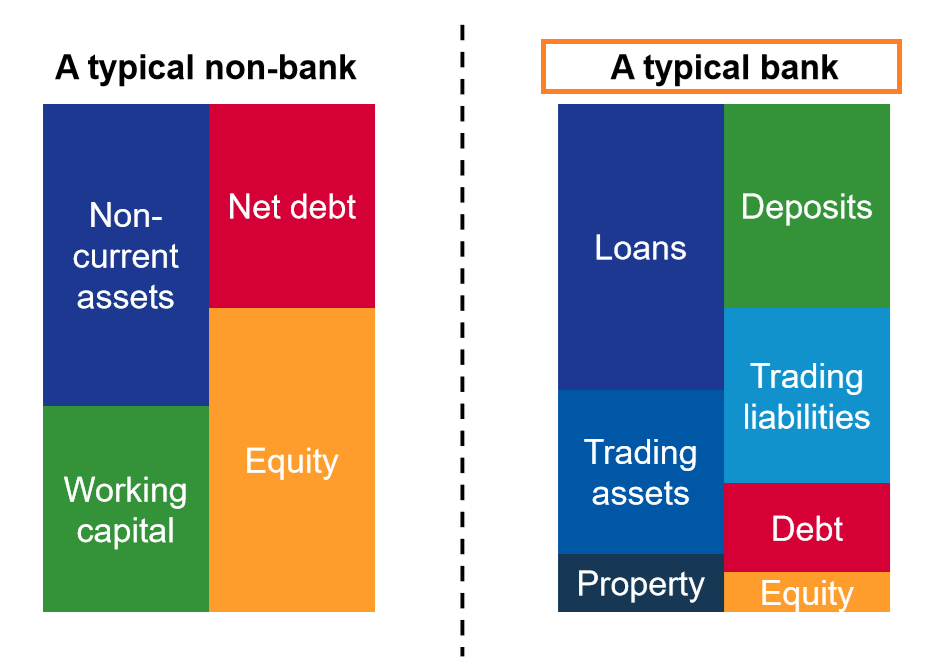

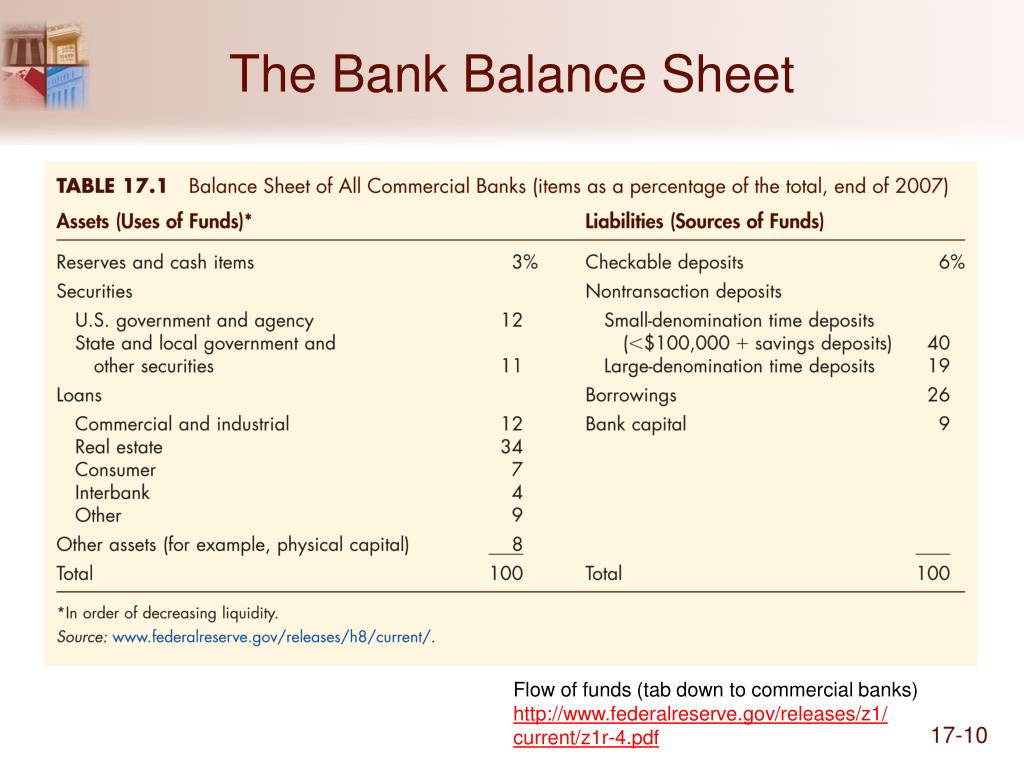

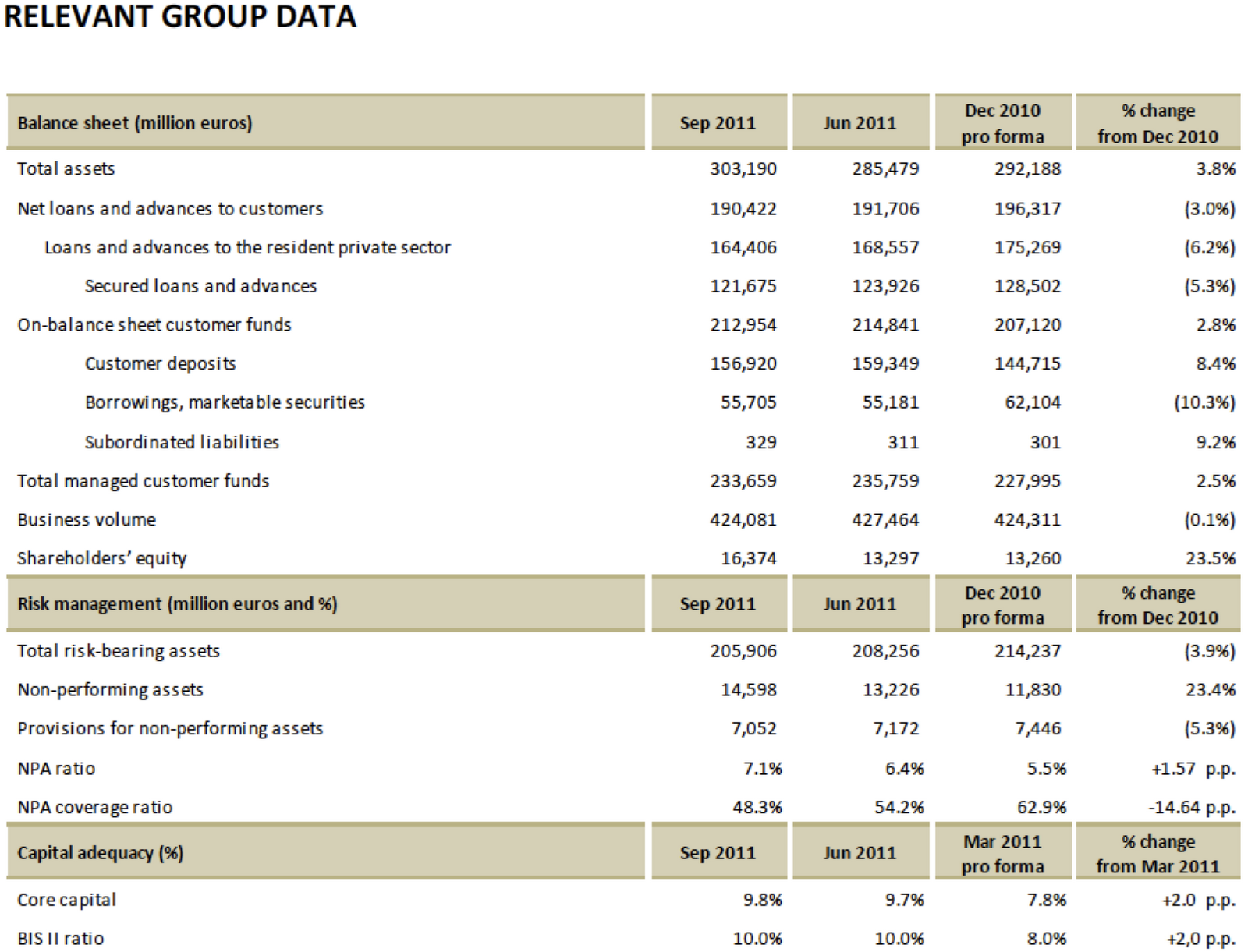

Bank Balance Sheet - A bank's balance sheet provides a snapshot of its financial position at a specific time. In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of the trickiest parts of learning macroeconomics. The table below combines a bank of america balance sheet and income statement to display the yield generated from earning assets and interest paid to customers on interest. It consists of assets, representing what the bank owns, and liabilities, describing what it owes to its. Below you will find a. Banks use much more leverage than other businesses and earn a spread between the interest income they generate on their assets (loans) and their cost of funds (customer.

It consists of assets, representing what the bank owns, and liabilities, describing what it owes to its. Banks use much more leverage than other businesses and earn a spread between the interest income they generate on their assets (loans) and their cost of funds (customer. Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of the trickiest parts of learning macroeconomics. The table below combines a bank of america balance sheet and income statement to display the yield generated from earning assets and interest paid to customers on interest. A bank's balance sheet provides a snapshot of its financial position at a specific time. Below you will find a. In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders.

It consists of assets, representing what the bank owns, and liabilities, describing what it owes to its. Banks use much more leverage than other businesses and earn a spread between the interest income they generate on their assets (loans) and their cost of funds (customer. In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. The table below combines a bank of america balance sheet and income statement to display the yield generated from earning assets and interest paid to customers on interest. Below you will find a. A bank's balance sheet provides a snapshot of its financial position at a specific time. Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of the trickiest parts of learning macroeconomics.

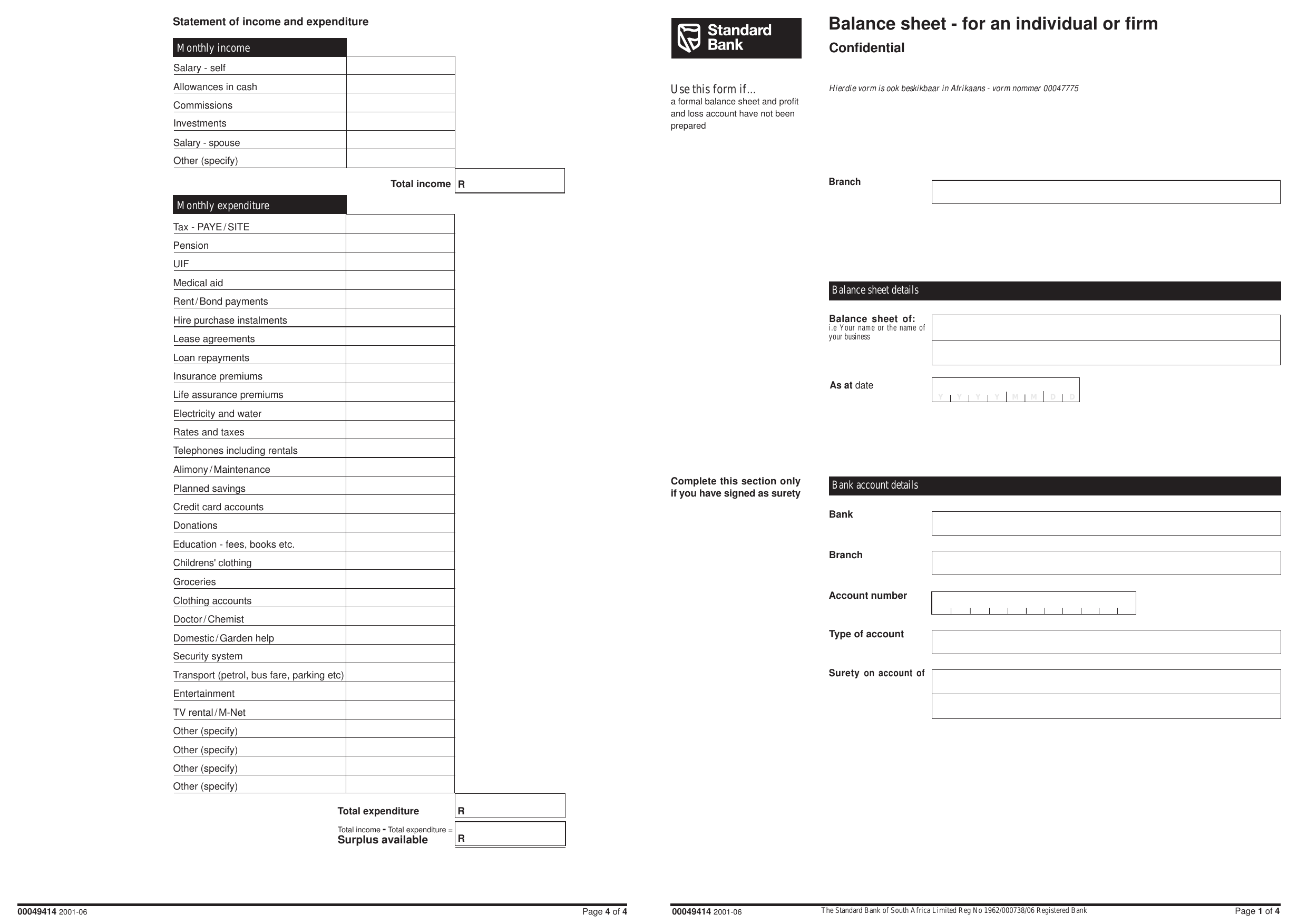

Download Bank Balance Sheet Template Excel PDF RTF Word

A bank's balance sheet provides a snapshot of its financial position at a specific time. Below you will find a. The table below combines a bank of america balance sheet and income statement to display the yield generated from earning assets and interest paid to customers on interest. Bank balance sheets are an accounting of a bank’s liabilities and assets.

First Republic Bank Balance Sheet 2024 Adah Linnie

Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of the trickiest parts of learning macroeconomics. In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. Banks use much more leverage than other businesses and.

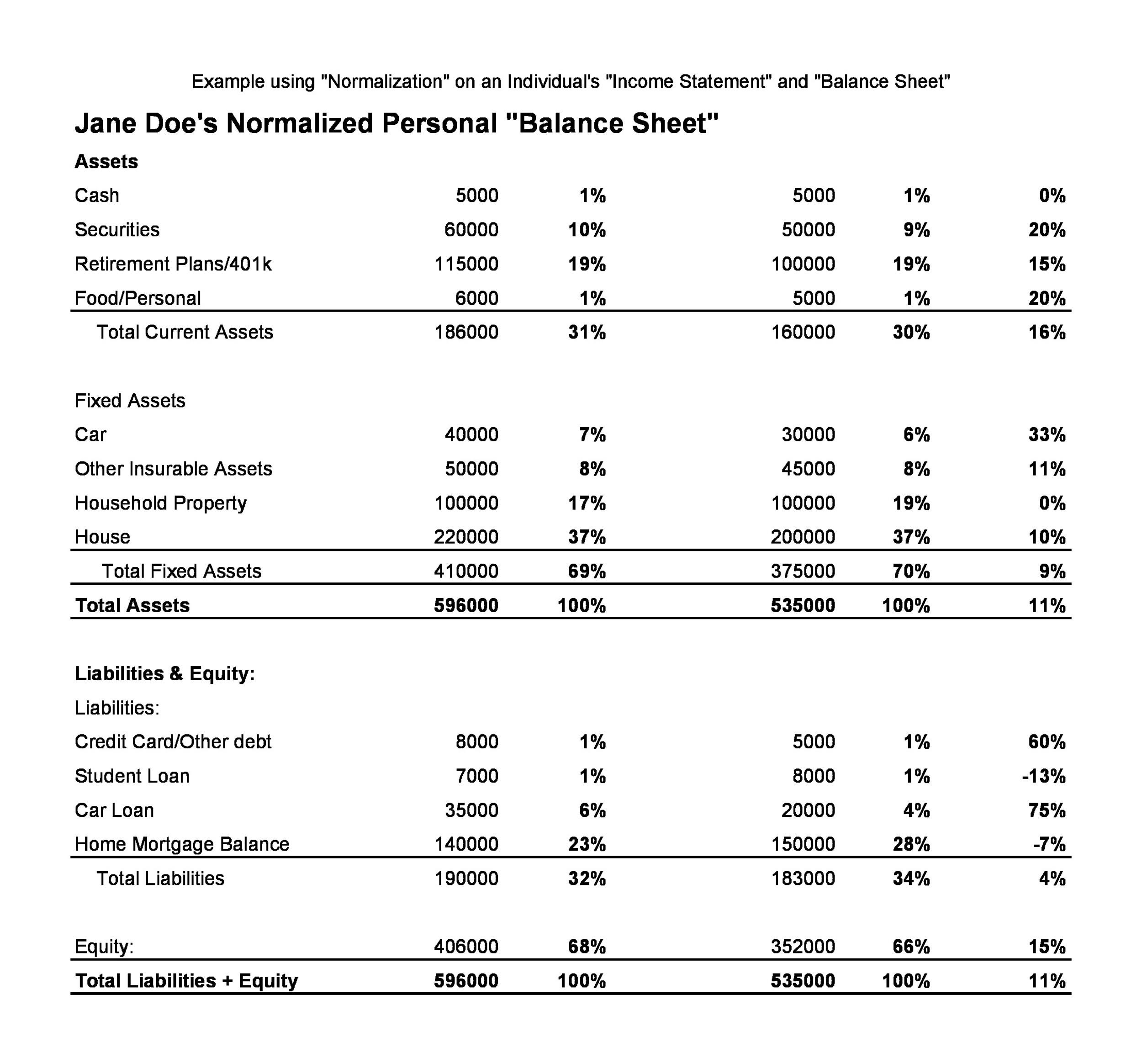

38 Free Balance Sheet Templates & Examples Template Lab

In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. It consists of assets, representing what the bank owns, and liabilities, describing what it owes to its. A bank's balance sheet provides a snapshot of its financial position at a specific time..

What are assets and liabilities of Central Bank Economics Class 12

Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of the trickiest parts of learning macroeconomics. In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. It consists of assets, representing what the bank owns,.

Balance Sheet

In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. The table below combines a bank of america balance sheet and income statement to display the yield generated from earning assets and interest paid to customers on interest. Banks use much more.

[Economics] What is Understanding Balance sheet of a Commercial Bank

A bank's balance sheet provides a snapshot of its financial position at a specific time. Below you will find a. The table below combines a bank of america balance sheet and income statement to display the yield generated from earning assets and interest paid to customers on interest. It consists of assets, representing what the bank owns, and liabilities, describing.

bank balance sheet explanation YouTube

Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of the trickiest parts of learning macroeconomics. Below you will find a. The table below combines a bank of america balance sheet and income statement to display the yield generated from earning assets and interest paid to customers on interest. In short, the balance.

[Economics] What is Understanding Balance sheet of a Commercial Bank

Banks use much more leverage than other businesses and earn a spread between the interest income they generate on their assets (loans) and their cost of funds (customer. A bank's balance sheet provides a snapshot of its financial position at a specific time. In short, the balance sheet is a financial statement that provides a snapshot of what a company.

Financial Statements for Banks

Banks use much more leverage than other businesses and earn a spread between the interest income they generate on their assets (loans) and their cost of funds (customer. Below you will find a. In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by.

PPT Chapter 17 PowerPoint Presentation ID74190

The table below combines a bank of america balance sheet and income statement to display the yield generated from earning assets and interest paid to customers on interest. In short, the balance sheet is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. Bank balance sheets are.

In Short, The Balance Sheet Is A Financial Statement That Provides A Snapshot Of What A Company Owns And Owes, As Well As The Amount Invested By Shareholders.

Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of the trickiest parts of learning macroeconomics. The table below combines a bank of america balance sheet and income statement to display the yield generated from earning assets and interest paid to customers on interest. It consists of assets, representing what the bank owns, and liabilities, describing what it owes to its. A bank's balance sheet provides a snapshot of its financial position at a specific time.

Below You Will Find A.

Banks use much more leverage than other businesses and earn a spread between the interest income they generate on their assets (loans) and their cost of funds (customer.

![[Economics] What is Understanding Balance sheet of a Commercial Bank](https://d1avenlh0i1xmr.cloudfront.net/775196c2-41d1-4e4b-8375-e87ae25ac777/different-assets-and-liabilities-of-a-commercial-bank---teachoo.jpg)

![[Economics] What is Understanding Balance sheet of a Commercial Bank](https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/d41d2102-4f84-4785-90c3-817a96d6ad2b/balance-sheet-of-a-company-vs-balance-sheet-of-bank---teachoo.jpg)