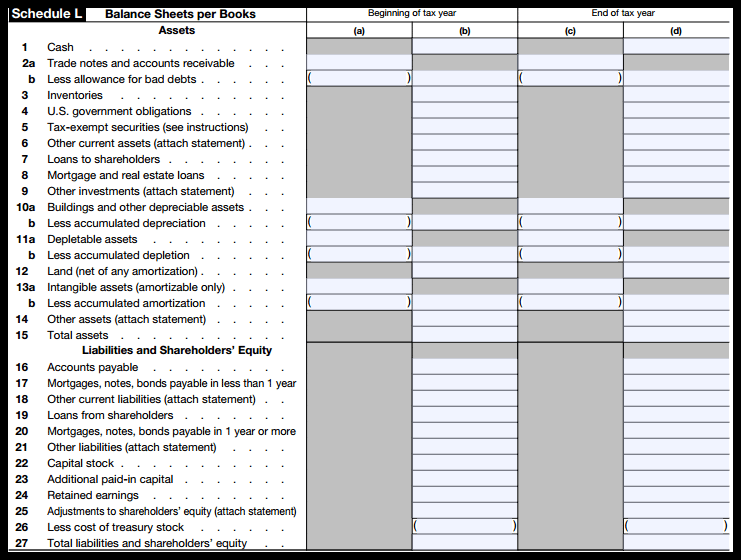

Balance Sheet Schedule L - You need to review the total on. A comparative balance sheet lists assets, liabilities and equity over two years. Income tax return for an s corporation where the corporation. Schedule l mirrors a standard balance sheet, dividing financial data into assets, liabilities, and shareholders’ equity. A schedule l is the equivalent of a comparative balance sheet.

Schedule l mirrors a standard balance sheet, dividing financial data into assets, liabilities, and shareholders’ equity. A comparative balance sheet lists assets, liabilities and equity over two years. A schedule l is the equivalent of a comparative balance sheet. You need to review the total on. Income tax return for an s corporation where the corporation.

Income tax return for an s corporation where the corporation. Schedule l mirrors a standard balance sheet, dividing financial data into assets, liabilities, and shareholders’ equity. A comparative balance sheet lists assets, liabilities and equity over two years. You need to review the total on. A schedule l is the equivalent of a comparative balance sheet.

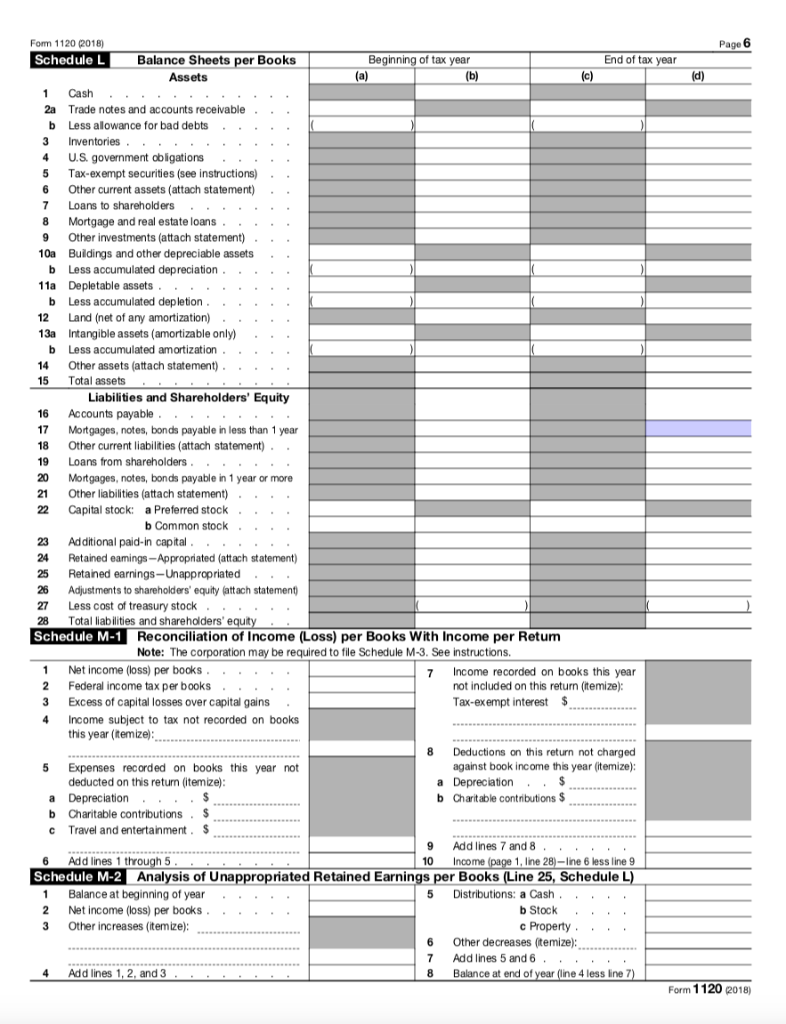

IRS Form 1120S Schedules L, M1, and M2 (2018) Balance Sheet (L

Income tax return for an s corporation where the corporation. A schedule l is the equivalent of a comparative balance sheet. A comparative balance sheet lists assets, liabilities and equity over two years. Schedule l mirrors a standard balance sheet, dividing financial data into assets, liabilities, and shareholders’ equity. You need to review the total on.

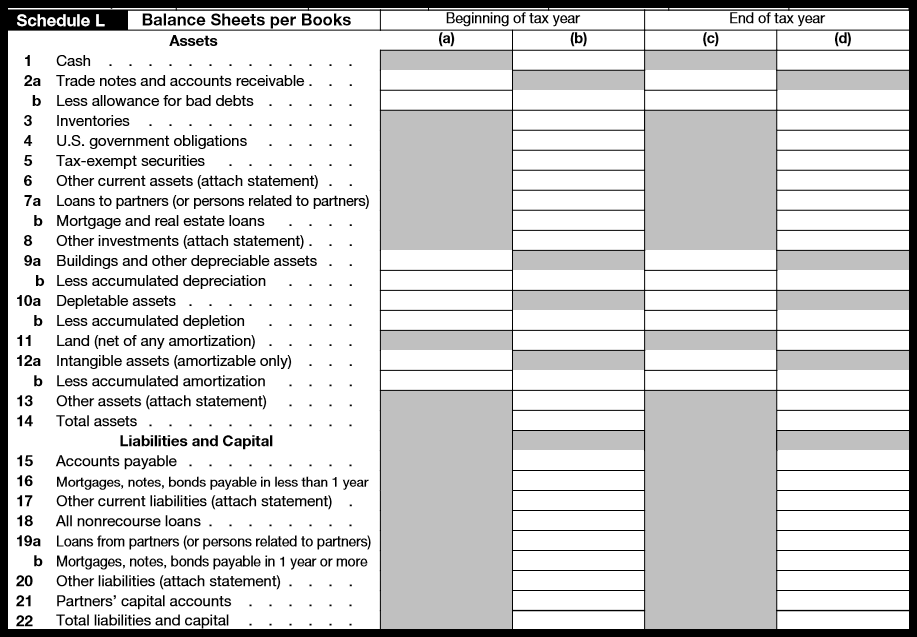

IRS Form 1120S Schedules L, M1, and M2 (2021) Balance Sheet (L

You need to review the total on. A schedule l is the equivalent of a comparative balance sheet. Schedule l mirrors a standard balance sheet, dividing financial data into assets, liabilities, and shareholders’ equity. Income tax return for an s corporation where the corporation. A comparative balance sheet lists assets, liabilities and equity over two years.

IRS Form 1120 Schedules L, M1, and M2 (2019) Balance Sheet (L

A schedule l is the equivalent of a comparative balance sheet. A comparative balance sheet lists assets, liabilities and equity over two years. You need to review the total on. Schedule l mirrors a standard balance sheet, dividing financial data into assets, liabilities, and shareholders’ equity. Income tax return for an s corporation where the corporation.

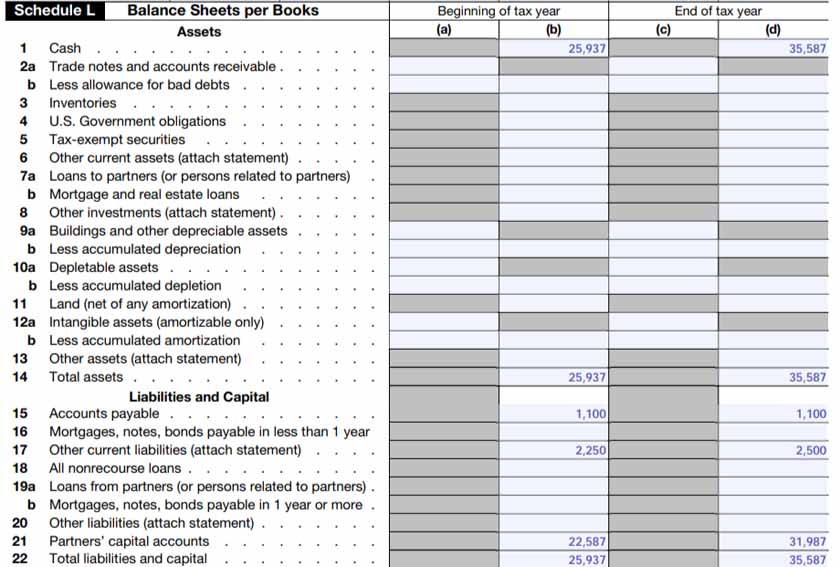

Form 1065 StepbyStep Instructions (+Free Checklist)

Schedule l mirrors a standard balance sheet, dividing financial data into assets, liabilities, and shareholders’ equity. A schedule l is the equivalent of a comparative balance sheet. A comparative balance sheet lists assets, liabilities and equity over two years. Income tax return for an s corporation where the corporation. You need to review the total on.

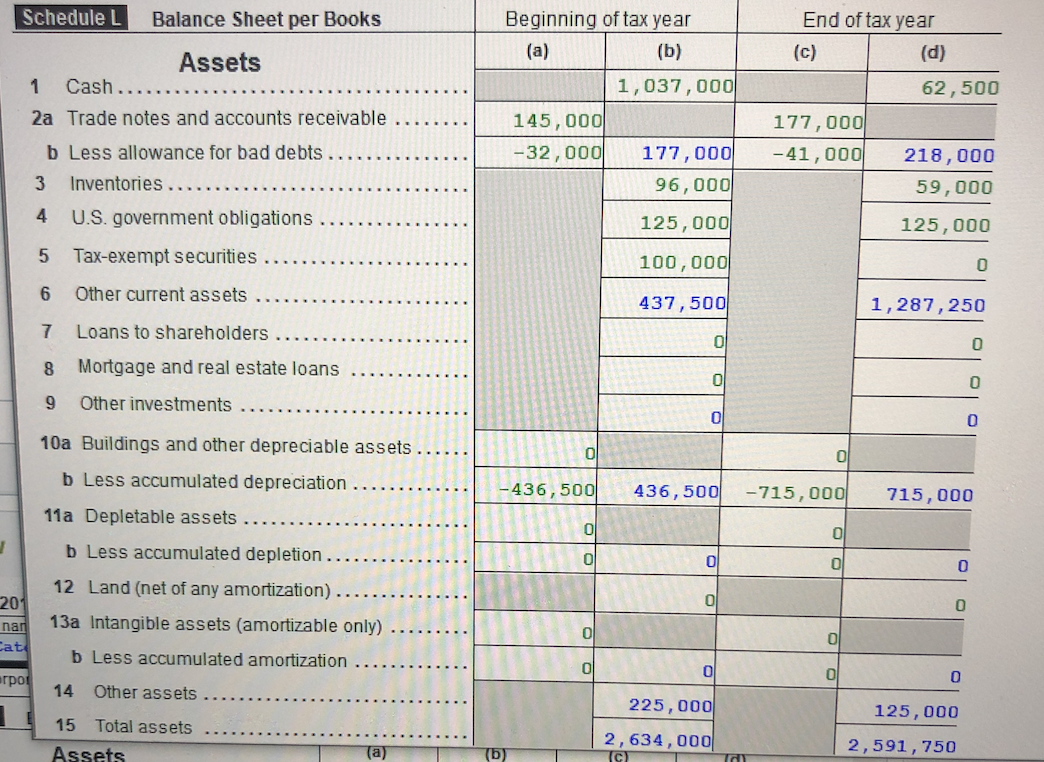

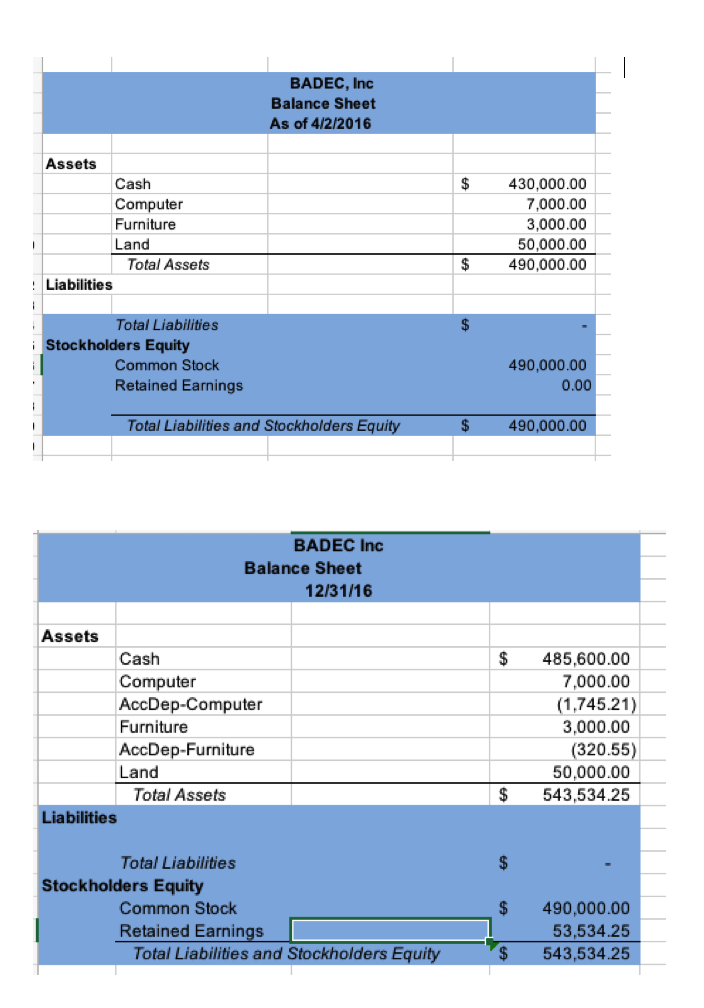

Solved Form complete Schedule L for the balance sheet

Schedule l mirrors a standard balance sheet, dividing financial data into assets, liabilities, and shareholders’ equity. Income tax return for an s corporation where the corporation. You need to review the total on. A schedule l is the equivalent of a comparative balance sheet. A comparative balance sheet lists assets, liabilities and equity over two years.

IRS Form 1065 Schedules L, M1, and M2 (2020) Balance Sheets (L

A schedule l is the equivalent of a comparative balance sheet. You need to review the total on. Income tax return for an s corporation where the corporation. Schedule l mirrors a standard balance sheet, dividing financial data into assets, liabilities, and shareholders’ equity. A comparative balance sheet lists assets, liabilities and equity over two years.

Form 1065 Instructions in 8 Steps (+ Free Checklist)

Schedule l mirrors a standard balance sheet, dividing financial data into assets, liabilities, and shareholders’ equity. A comparative balance sheet lists assets, liabilities and equity over two years. You need to review the total on. Income tax return for an s corporation where the corporation. A schedule l is the equivalent of a comparative balance sheet.

Solved Schedule L Balance Sheet per Books Assets 1 Cash.. 2a

You need to review the total on. Schedule l mirrors a standard balance sheet, dividing financial data into assets, liabilities, and shareholders’ equity. A comparative balance sheet lists assets, liabilities and equity over two years. Income tax return for an s corporation where the corporation. A schedule l is the equivalent of a comparative balance sheet.

Solved Form complete Schedule L for the balance sheet

A schedule l is the equivalent of a comparative balance sheet. Schedule l mirrors a standard balance sheet, dividing financial data into assets, liabilities, and shareholders’ equity. A comparative balance sheet lists assets, liabilities and equity over two years. You need to review the total on. Income tax return for an s corporation where the corporation.

How to Complete Form 1120S Tax Return for an S Corp

A comparative balance sheet lists assets, liabilities and equity over two years. You need to review the total on. Schedule l mirrors a standard balance sheet, dividing financial data into assets, liabilities, and shareholders’ equity. A schedule l is the equivalent of a comparative balance sheet. Income tax return for an s corporation where the corporation.

A Schedule L Is The Equivalent Of A Comparative Balance Sheet.

Schedule l mirrors a standard balance sheet, dividing financial data into assets, liabilities, and shareholders’ equity. You need to review the total on. A comparative balance sheet lists assets, liabilities and equity over two years. Income tax return for an s corporation where the corporation.