Balance Sheet In Quicken - If you have multiple businesses added, you can review the balance sheet for each. You generally need to provide one to your loan officer when requesting a loan. Within quicken a full balance sheet is generated by clicking reports > net worth & balances and then either account balances or. The balance sheet is a fundamental business report. Anytime you communicate with bankers, partners, advisors, or potential lenders, you need to provide complete and accurate records. Provides an overview of your business assets and liabilities.

Provides an overview of your business assets and liabilities. You generally need to provide one to your loan officer when requesting a loan. If you have multiple businesses added, you can review the balance sheet for each. The balance sheet is a fundamental business report. Anytime you communicate with bankers, partners, advisors, or potential lenders, you need to provide complete and accurate records. Within quicken a full balance sheet is generated by clicking reports > net worth & balances and then either account balances or.

Within quicken a full balance sheet is generated by clicking reports > net worth & balances and then either account balances or. You generally need to provide one to your loan officer when requesting a loan. If you have multiple businesses added, you can review the balance sheet for each. Provides an overview of your business assets and liabilities. Anytime you communicate with bankers, partners, advisors, or potential lenders, you need to provide complete and accurate records. The balance sheet is a fundamental business report.

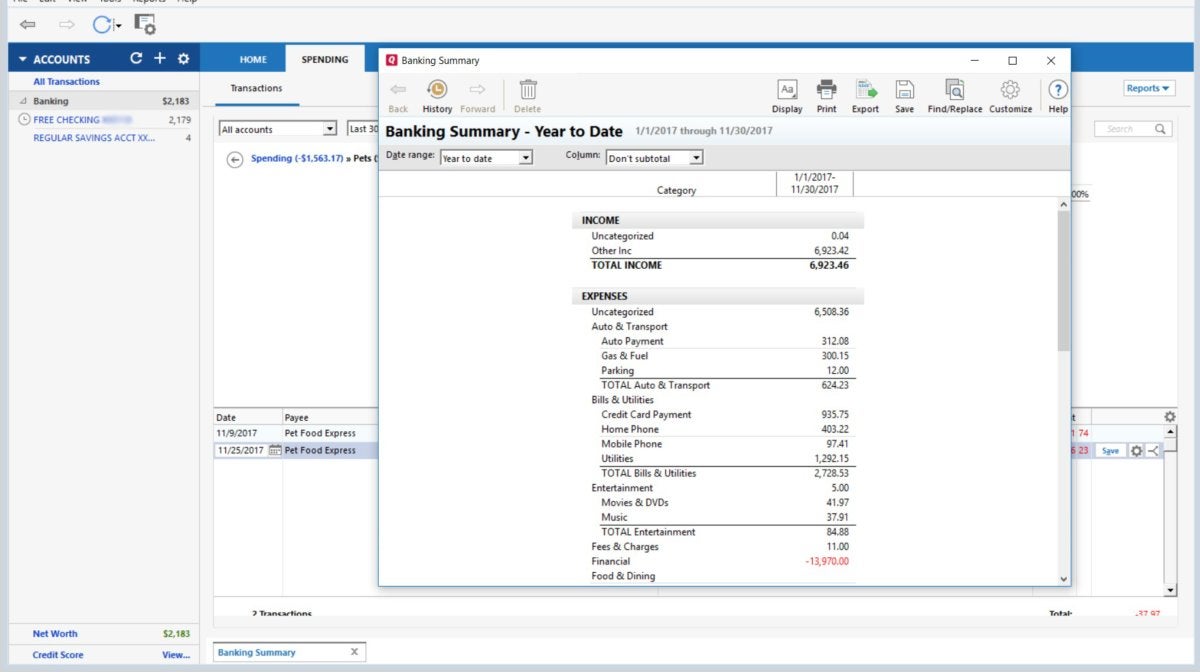

net worth vs balance sheet report investment balance different — Quicken

The balance sheet is a fundamental business report. Provides an overview of your business assets and liabilities. Anytime you communicate with bankers, partners, advisors, or potential lenders, you need to provide complete and accurate records. Within quicken a full balance sheet is generated by clicking reports > net worth & balances and then either account balances or. If you have.

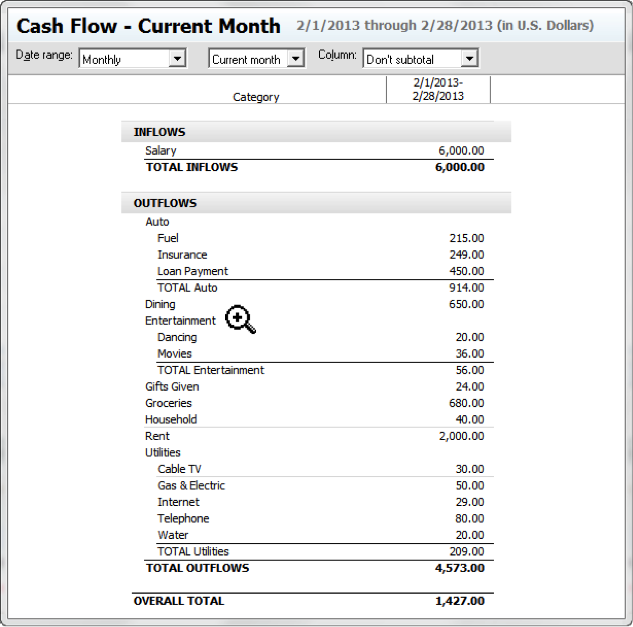

How to Project Balances and Cash Flow Quicken

Anytime you communicate with bankers, partners, advisors, or potential lenders, you need to provide complete and accurate records. Provides an overview of your business assets and liabilities. Within quicken a full balance sheet is generated by clicking reports > net worth & balances and then either account balances or. You generally need to provide one to your loan officer when.

I am trying to get a balance sheet report but it is showing all dates

Provides an overview of your business assets and liabilities. You generally need to provide one to your loan officer when requesting a loan. If you have multiple businesses added, you can review the balance sheet for each. The balance sheet is a fundamental business report. Within quicken a full balance sheet is generated by clicking reports > net worth &.

How do I add headings to a Balance sheet report (updated title) — Quicken

If you have multiple businesses added, you can review the balance sheet for each. The balance sheet is a fundamental business report. Provides an overview of your business assets and liabilities. You generally need to provide one to your loan officer when requesting a loan. Within quicken a full balance sheet is generated by clicking reports > net worth &.

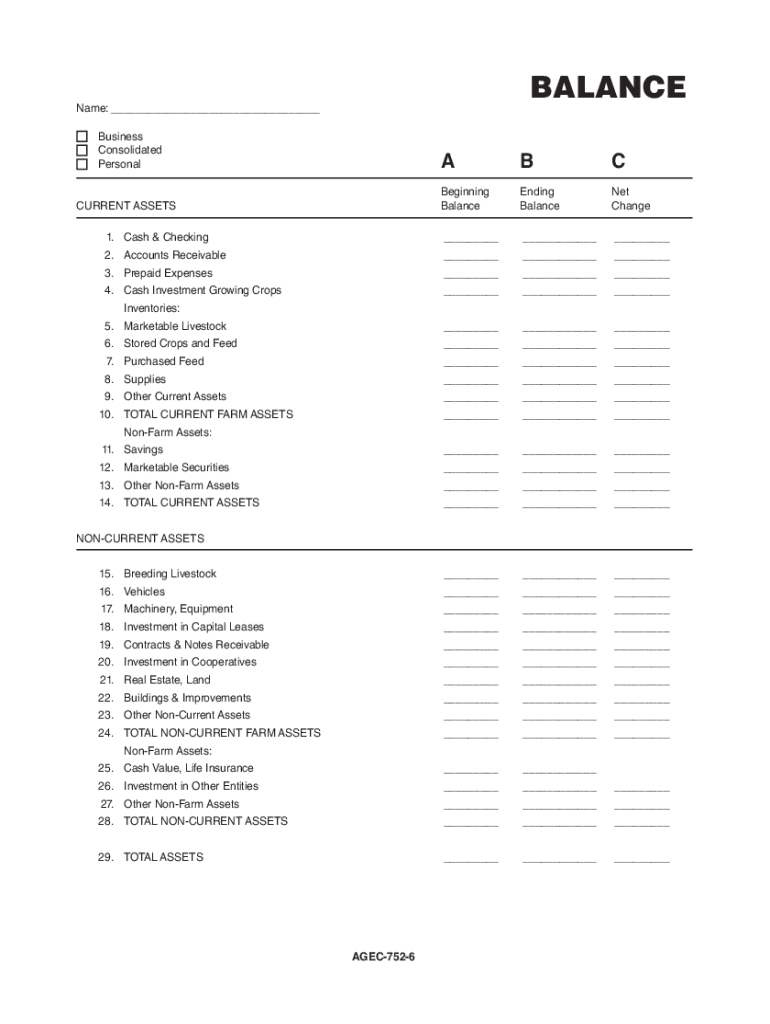

Fillable Online Building A Farm/Ranch Balance Sheet in Quicken Deluxe

Anytime you communicate with bankers, partners, advisors, or potential lenders, you need to provide complete and accurate records. If you have multiple businesses added, you can review the balance sheet for each. You generally need to provide one to your loan officer when requesting a loan. Within quicken a full balance sheet is generated by clicking reports > net worth.

checking account projected balances way off — Quicken

Provides an overview of your business assets and liabilities. The balance sheet is a fundamental business report. Within quicken a full balance sheet is generated by clicking reports > net worth & balances and then either account balances or. Anytime you communicate with bankers, partners, advisors, or potential lenders, you need to provide complete and accurate records. You generally need.

Spreadsheet Basics (CHECKBOOK, QUICKEN) YouTube

If you have multiple businesses added, you can review the balance sheet for each. Provides an overview of your business assets and liabilities. The balance sheet is a fundamental business report. You generally need to provide one to your loan officer when requesting a loan. Within quicken a full balance sheet is generated by clicking reports > net worth &.

HOW DO I GET a Balance Sheet and Statement? Where is Portfolio

If you have multiple businesses added, you can review the balance sheet for each. The balance sheet is a fundamental business report. Provides an overview of your business assets and liabilities. You generally need to provide one to your loan officer when requesting a loan. Within quicken a full balance sheet is generated by clicking reports > net worth &.

Quicken Deluxe review The dominant budgeting software still has plenty

You generally need to provide one to your loan officer when requesting a loan. Provides an overview of your business assets and liabilities. Anytime you communicate with bankers, partners, advisors, or potential lenders, you need to provide complete and accurate records. If you have multiple businesses added, you can review the balance sheet for each. Within quicken a full balance.

How do I create a standard balance sheet? — Quicken

The balance sheet is a fundamental business report. Within quicken a full balance sheet is generated by clicking reports > net worth & balances and then either account balances or. If you have multiple businesses added, you can review the balance sheet for each. You generally need to provide one to your loan officer when requesting a loan. Anytime you.

The Balance Sheet Is A Fundamental Business Report.

You generally need to provide one to your loan officer when requesting a loan. If you have multiple businesses added, you can review the balance sheet for each. Anytime you communicate with bankers, partners, advisors, or potential lenders, you need to provide complete and accurate records. Provides an overview of your business assets and liabilities.