Balance Sheet Cash Basis - Under the cash basis of accounting, you record transactions only when there is a change in cash. Cash basis accounting recognizes revenues when cash is received and expenses when cash is paid. This can lead to an. Cash basis accounting is the accounting method that recognizes transactions when actual cash is received or paid out. If there is no change in cash,.

If there is no change in cash,. Under the cash basis of accounting, you record transactions only when there is a change in cash. This can lead to an. Cash basis accounting recognizes revenues when cash is received and expenses when cash is paid. Cash basis accounting is the accounting method that recognizes transactions when actual cash is received or paid out.

This can lead to an. Cash basis accounting recognizes revenues when cash is received and expenses when cash is paid. Cash basis accounting is the accounting method that recognizes transactions when actual cash is received or paid out. Under the cash basis of accounting, you record transactions only when there is a change in cash. If there is no change in cash,.

Cash Basis Accounting Spreadsheet in Expert Advice On How To Make A

Under the cash basis of accounting, you record transactions only when there is a change in cash. Cash basis accounting is the accounting method that recognizes transactions when actual cash is received or paid out. If there is no change in cash,. This can lead to an. Cash basis accounting recognizes revenues when cash is received and expenses when cash.

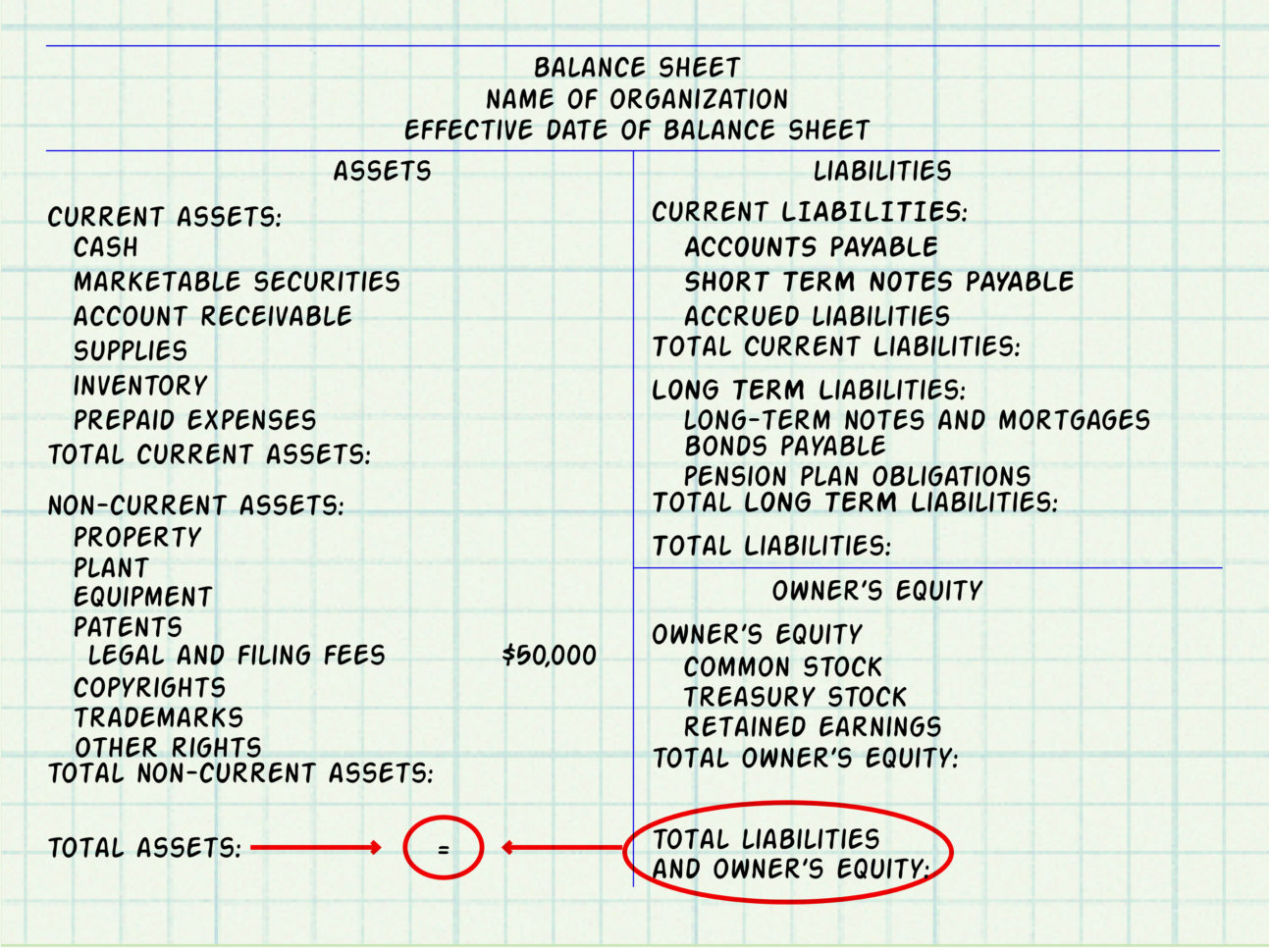

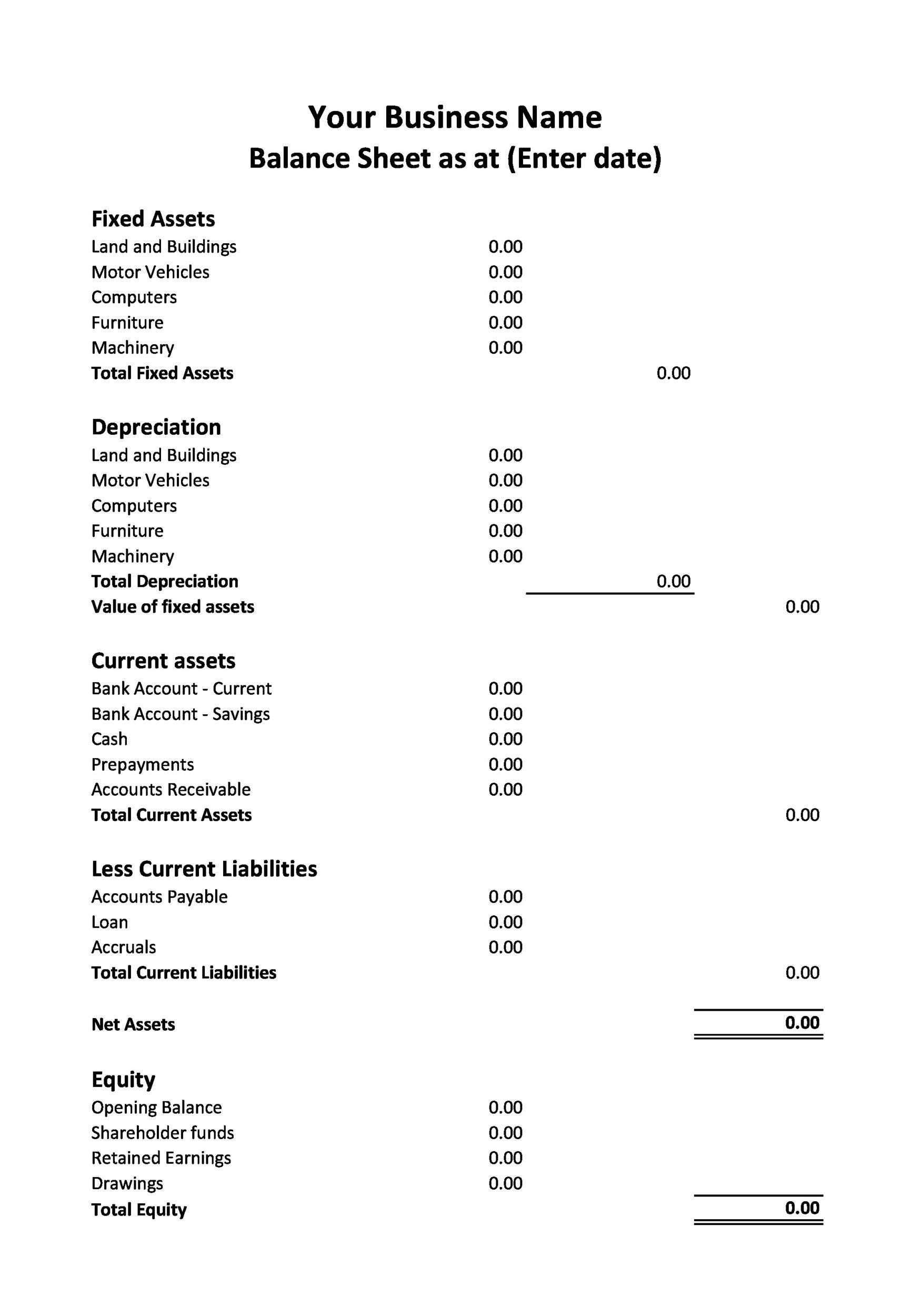

38 Free Balance Sheet Templates & Examples ᐅ TemplateLab

Cash basis accounting is the accounting method that recognizes transactions when actual cash is received or paid out. If there is no change in cash,. This can lead to an. Cash basis accounting recognizes revenues when cash is received and expenses when cash is paid. Under the cash basis of accounting, you record transactions only when there is a change.

Balance Sheet Format, Example & Free Template Basic Accounting Help

This can lead to an. If there is no change in cash,. Cash basis accounting is the accounting method that recognizes transactions when actual cash is received or paid out. Under the cash basis of accounting, you record transactions only when there is a change in cash. Cash basis accounting recognizes revenues when cash is received and expenses when cash.

Understanding Accrual to Cash Conversions

This can lead to an. Under the cash basis of accounting, you record transactions only when there is a change in cash. If there is no change in cash,. Cash basis accounting recognizes revenues when cash is received and expenses when cash is paid. Cash basis accounting is the accounting method that recognizes transactions when actual cash is received or.

What Is a Cash Basis Balance Sheet? Investment FAQ

This can lead to an. Under the cash basis of accounting, you record transactions only when there is a change in cash. If there is no change in cash,. Cash basis accounting is the accounting method that recognizes transactions when actual cash is received or paid out. Cash basis accounting recognizes revenues when cash is received and expenses when cash.

38 Free Balance Sheet Templates & Examples ᐅ TemplateLab

Under the cash basis of accounting, you record transactions only when there is a change in cash. Cash basis accounting recognizes revenues when cash is received and expenses when cash is paid. Cash basis accounting is the accounting method that recognizes transactions when actual cash is received or paid out. If there is no change in cash,. This can lead.

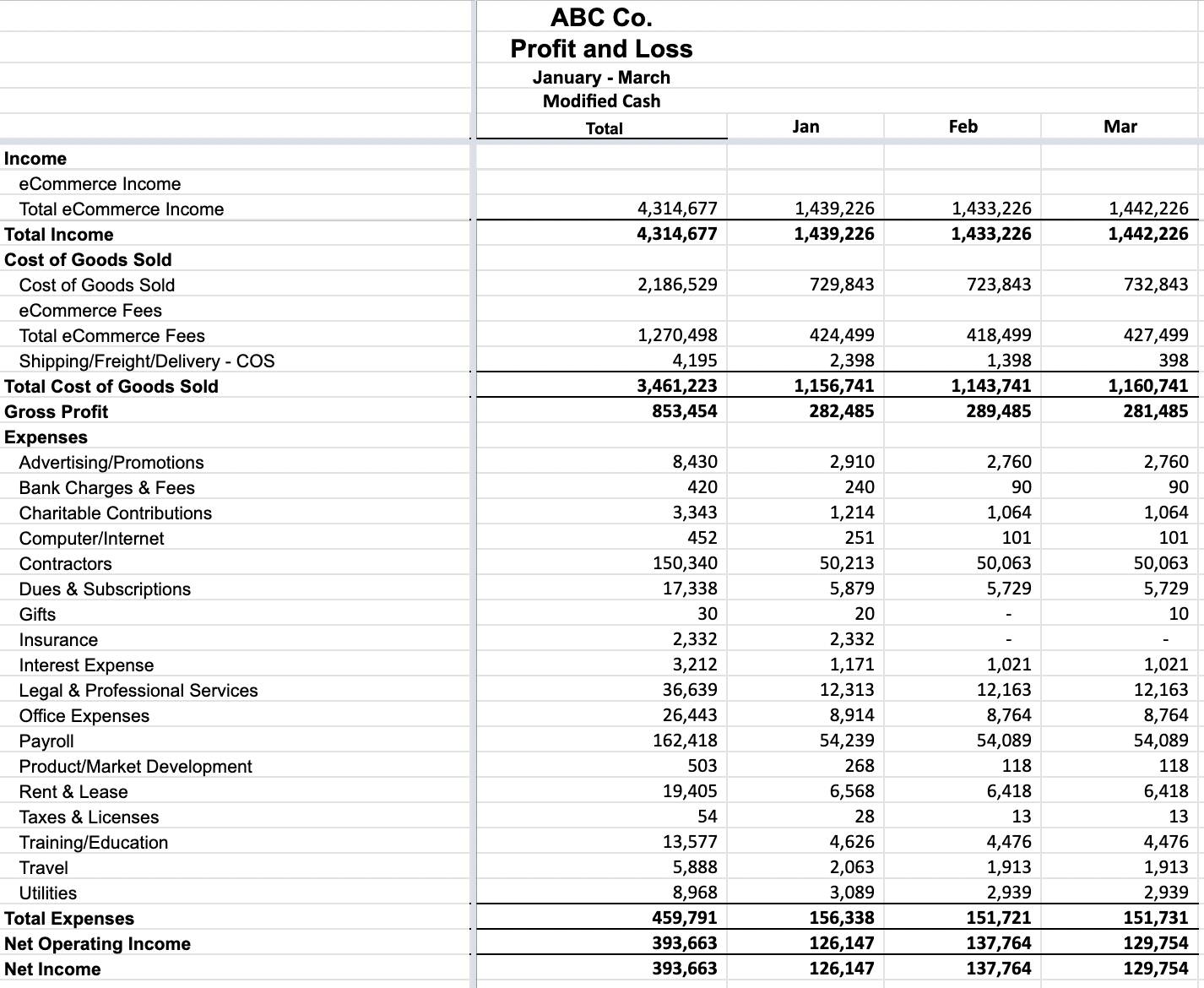

Our Greatest Hits A look at the modified cash basis The CPA Journal

If there is no change in cash,. Under the cash basis of accounting, you record transactions only when there is a change in cash. This can lead to an. Cash basis accounting recognizes revenues when cash is received and expenses when cash is paid. Cash basis accounting is the accounting method that recognizes transactions when actual cash is received or.

Modified Cash Basis Accounting for Business

Cash basis accounting recognizes revenues when cash is received and expenses when cash is paid. Under the cash basis of accounting, you record transactions only when there is a change in cash. This can lead to an. Cash basis accounting is the accounting method that recognizes transactions when actual cash is received or paid out. If there is no change.

Where’s the cash? Check your Balance Sheet CFO.University

Cash basis accounting recognizes revenues when cash is received and expenses when cash is paid. If there is no change in cash,. This can lead to an. Under the cash basis of accounting, you record transactions only when there is a change in cash. Cash basis accounting is the accounting method that recognizes transactions when actual cash is received or.

What is a Cash Basis Balance Sheet? SuperfastCPA CPA Review

If there is no change in cash,. Cash basis accounting is the accounting method that recognizes transactions when actual cash is received or paid out. Under the cash basis of accounting, you record transactions only when there is a change in cash. This can lead to an. Cash basis accounting recognizes revenues when cash is received and expenses when cash.

Cash Basis Accounting Is The Accounting Method That Recognizes Transactions When Actual Cash Is Received Or Paid Out.

Under the cash basis of accounting, you record transactions only when there is a change in cash. Cash basis accounting recognizes revenues when cash is received and expenses when cash is paid. This can lead to an. If there is no change in cash,.