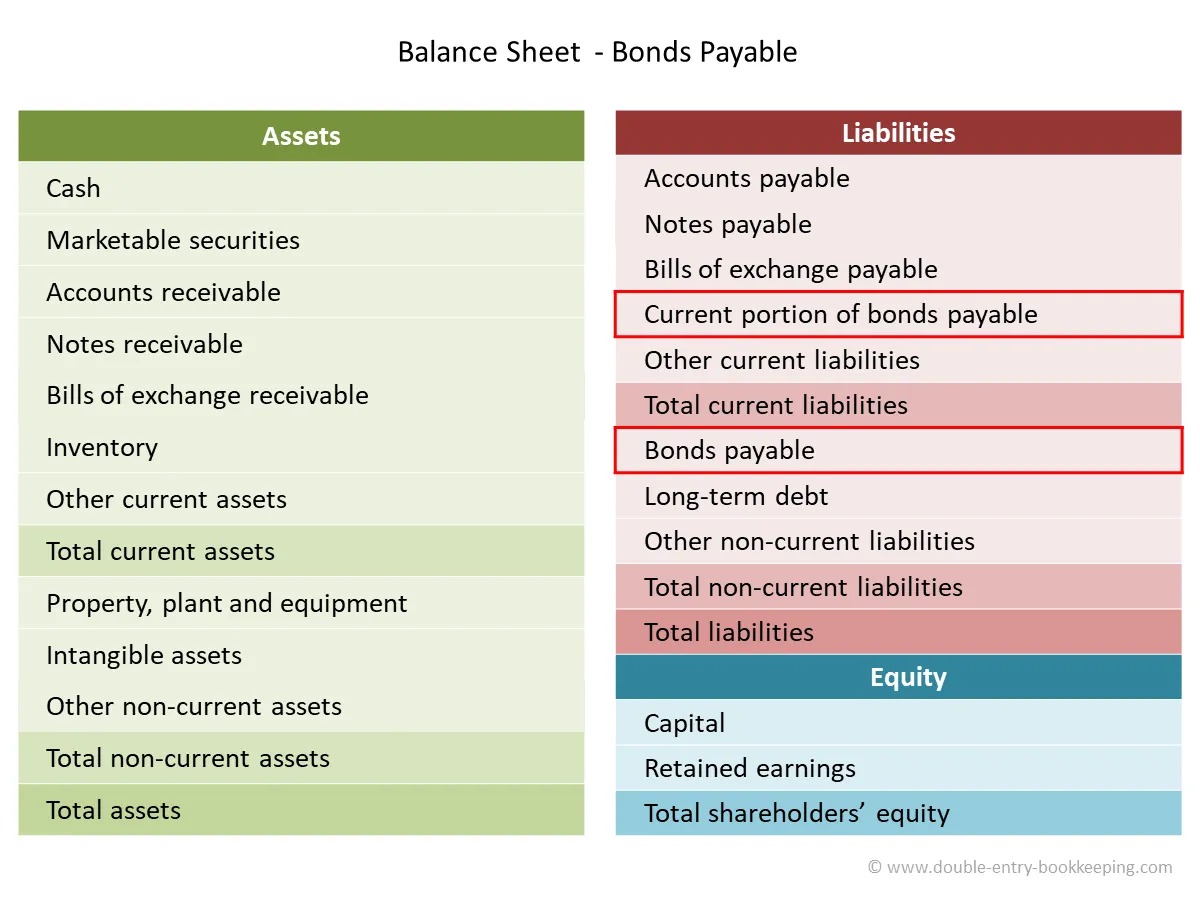

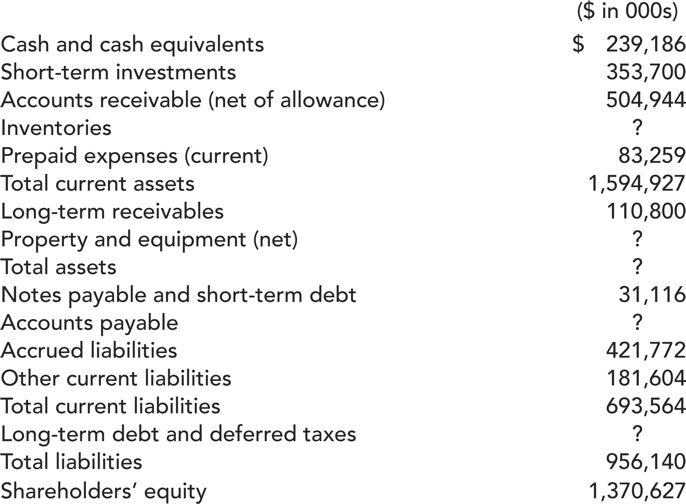

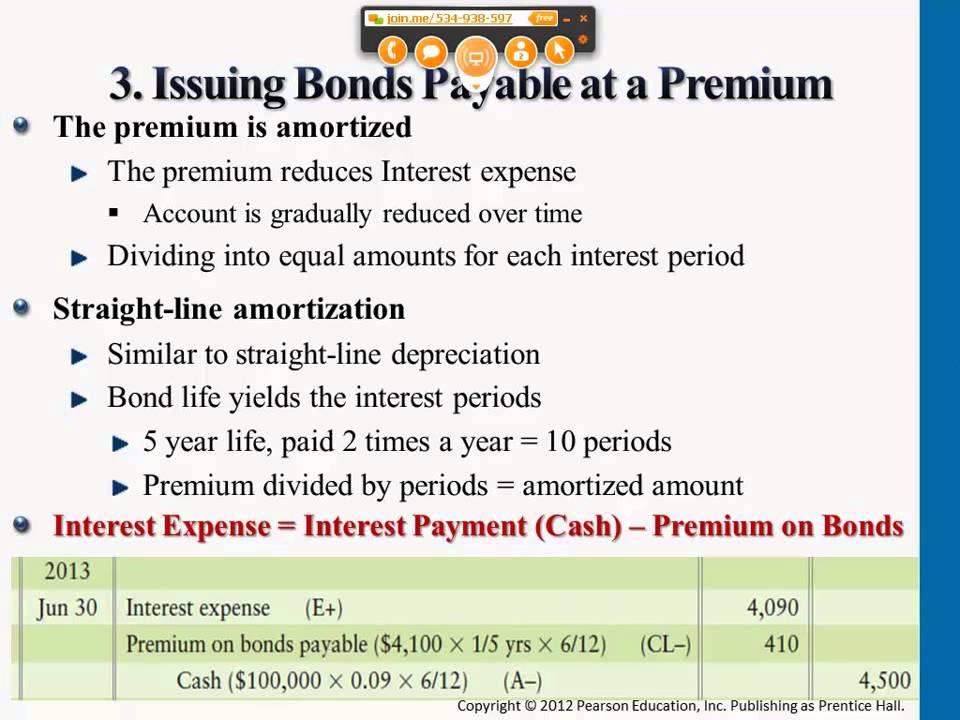

Balance Sheet Bonds - Learn about bonds payable, their types, amortization, interest calculations, and financial statement presentation in this detailed. The income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year); Bonds payable is a liability account that contains the amount owed to bond holders by the issuer.

Bonds payable is a liability account that contains the amount owed to bond holders by the issuer. Learn about bonds payable, their types, amortization, interest calculations, and financial statement presentation in this detailed. The income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year);

Bonds payable is a liability account that contains the amount owed to bond holders by the issuer. The income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year); Learn about bonds payable, their types, amortization, interest calculations, and financial statement presentation in this detailed.

Bond Sinking Fund On Balance Sheet amulette

Learn about bonds payable, their types, amortization, interest calculations, and financial statement presentation in this detailed. The income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year); Bonds payable is a liability account that contains the amount owed to bond holders by the issuer.

What Is Bonds Payable On A Balance Sheet LiveWell

Bonds payable is a liability account that contains the amount owed to bond holders by the issuer. The income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year); Learn about bonds payable, their types, amortization, interest calculations, and financial statement presentation in this detailed.

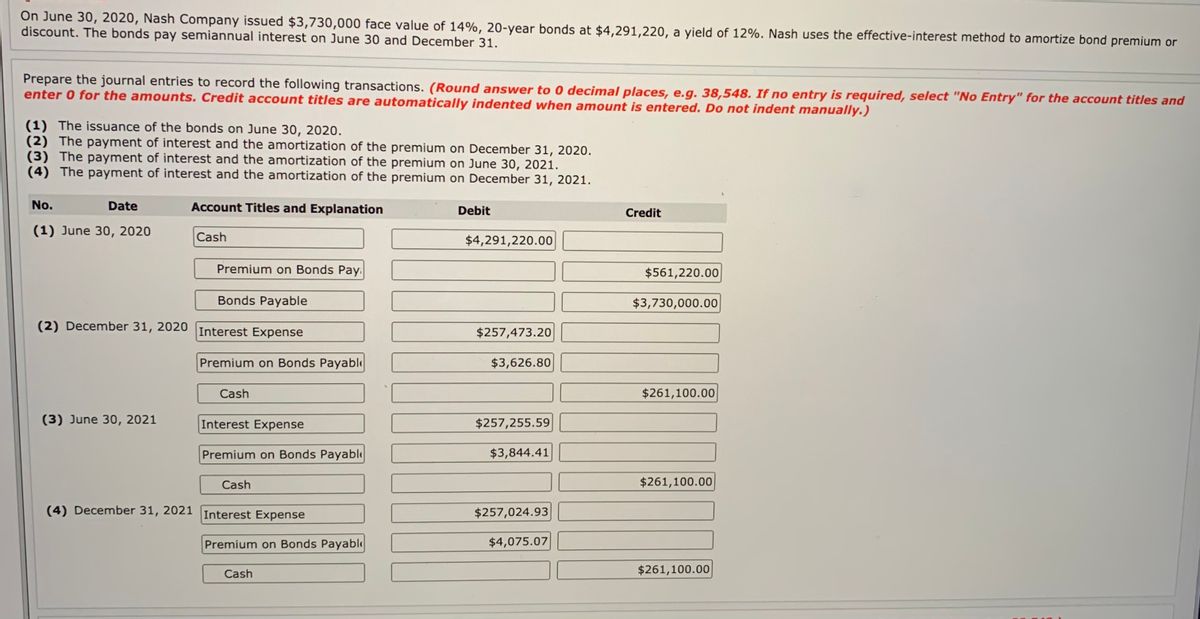

Answered Show the proper balance sheet… bartleby

Bonds payable is a liability account that contains the amount owed to bond holders by the issuer. The income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year); Learn about bonds payable, their types, amortization, interest calculations, and financial statement presentation in this detailed.

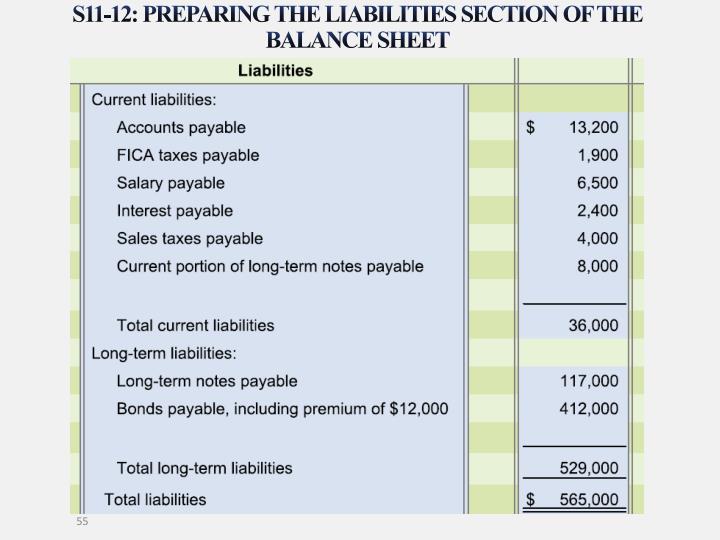

PPT LongTerm Liabilities , Bonds Payable, and Classification of

The income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year); Learn about bonds payable, their types, amortization, interest calculations, and financial statement presentation in this detailed. Bonds payable is a liability account that contains the amount owed to bond holders by the issuer.

Activity4CL PDF Balance Sheet Bonds (Finance)

The income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year); Bonds payable is a liability account that contains the amount owed to bond holders by the issuer. Learn about bonds payable, their types, amortization, interest calculations, and financial statement presentation in this detailed.

PPT LongTerm Liabilities , Bonds Payable, and Classification of

Bonds payable is a liability account that contains the amount owed to bond holders by the issuer. The income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year); Learn about bonds payable, their types, amortization, interest calculations, and financial statement presentation in this detailed.

Are bonds payable reported as a current liability if they mature in six

The income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year); Bonds payable is a liability account that contains the amount owed to bond holders by the issuer. Learn about bonds payable, their types, amortization, interest calculations, and financial statement presentation in this detailed.

Accounting For Bonds Payable

The income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year); Bonds payable is a liability account that contains the amount owed to bond holders by the issuer. Learn about bonds payable, their types, amortization, interest calculations, and financial statement presentation in this detailed.

Bond Related Accounts on the Balance Sheet Wize University

The income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year); Bonds payable is a liability account that contains the amount owed to bond holders by the issuer. Learn about bonds payable, their types, amortization, interest calculations, and financial statement presentation in this detailed.

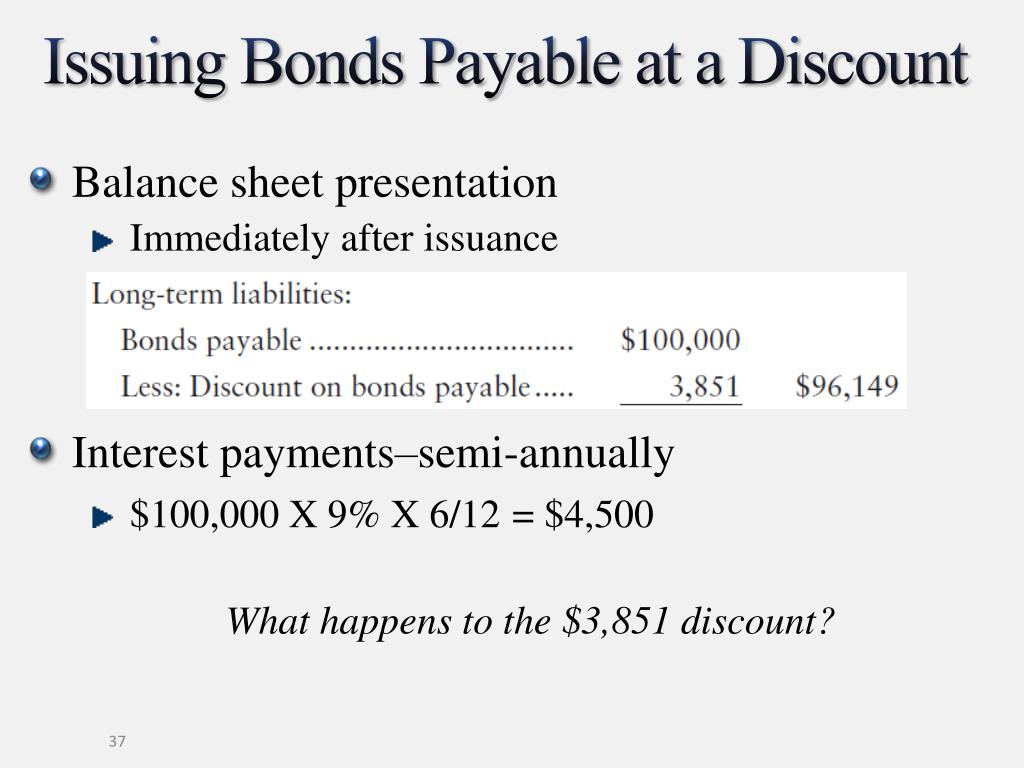

Bonds Payable at Premium Balance Sheet Presentation YouTube

Learn about bonds payable, their types, amortization, interest calculations, and financial statement presentation in this detailed. Bonds payable is a liability account that contains the amount owed to bond holders by the issuer. The income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year);

Bonds Payable Is A Liability Account That Contains The Amount Owed To Bond Holders By The Issuer.

The income statement for each of the 10 years would show bond interest expense of $12,000 ($ 6,000 x 2 payments per year); Learn about bonds payable, their types, amortization, interest calculations, and financial statement presentation in this detailed.