Accrued Expenses On The Balance Sheet - Accrued expenses are recorded on the balance sheet as liabilities and are recognised under the accrual basis of accounting. Therefore, when you accrue an expense, it appears in the current liabilities portion of the balance sheet. Accrued expenses include items such as interest expenses, salaries, tax expenses, rental expenses, or any other expenses incurred.

Accrued expenses are recorded on the balance sheet as liabilities and are recognised under the accrual basis of accounting. Therefore, when you accrue an expense, it appears in the current liabilities portion of the balance sheet. Accrued expenses include items such as interest expenses, salaries, tax expenses, rental expenses, or any other expenses incurred.

Therefore, when you accrue an expense, it appears in the current liabilities portion of the balance sheet. Accrued expenses are recorded on the balance sheet as liabilities and are recognised under the accrual basis of accounting. Accrued expenses include items such as interest expenses, salaries, tax expenses, rental expenses, or any other expenses incurred.

What Is Accrued Expenses On A Balance Sheet LiveWell

Accrued expenses include items such as interest expenses, salaries, tax expenses, rental expenses, or any other expenses incurred. Therefore, when you accrue an expense, it appears in the current liabilities portion of the balance sheet. Accrued expenses are recorded on the balance sheet as liabilities and are recognised under the accrual basis of accounting.

Expenses Meaning

Accrued expenses include items such as interest expenses, salaries, tax expenses, rental expenses, or any other expenses incurred. Accrued expenses are recorded on the balance sheet as liabilities and are recognised under the accrual basis of accounting. Therefore, when you accrue an expense, it appears in the current liabilities portion of the balance sheet.

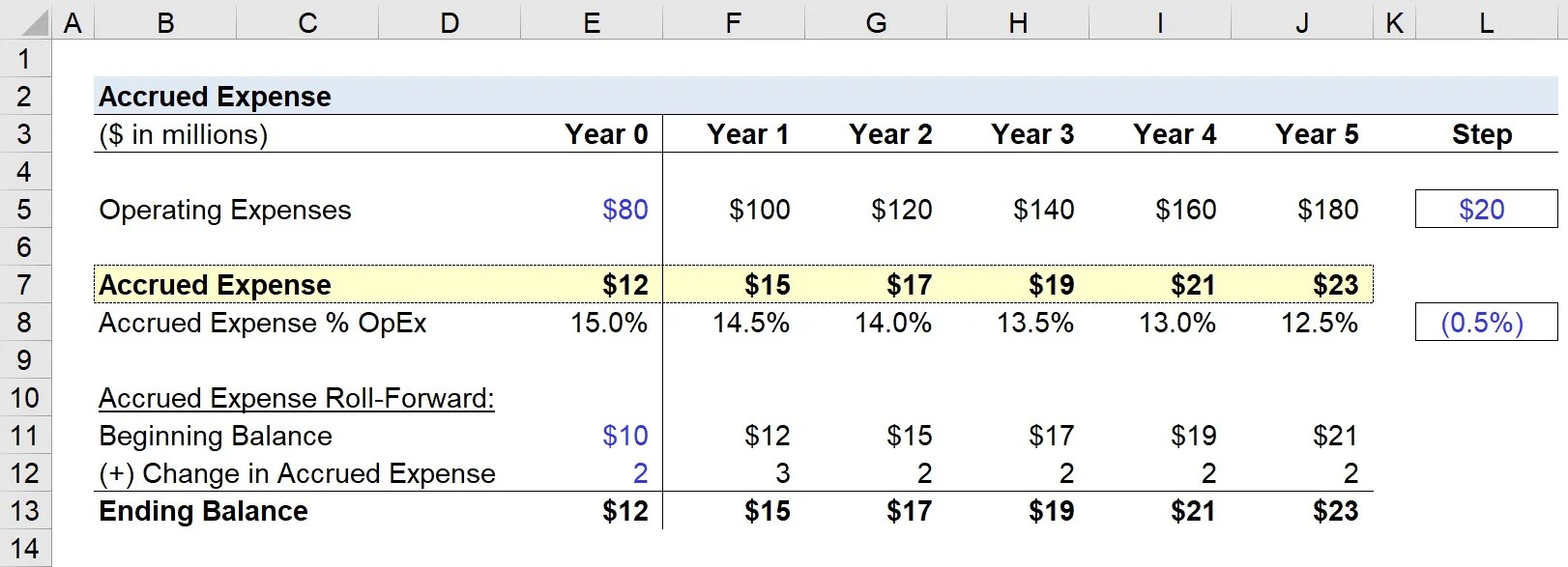

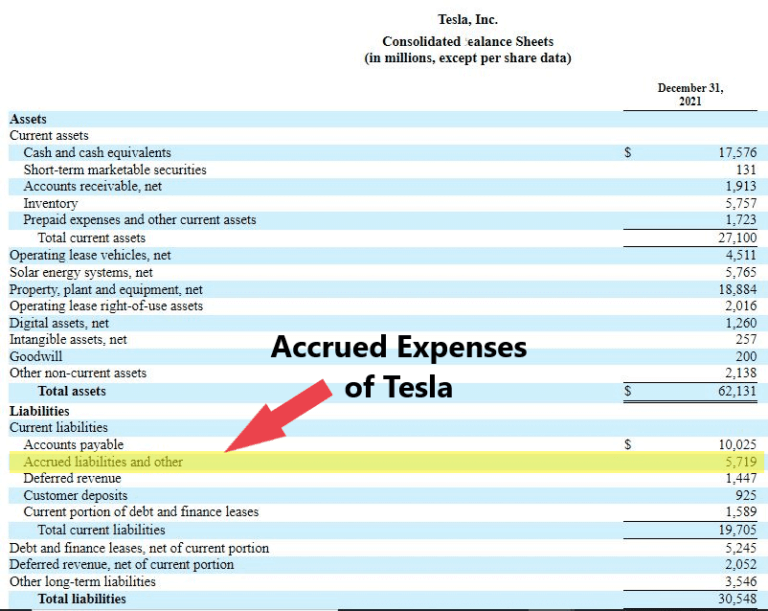

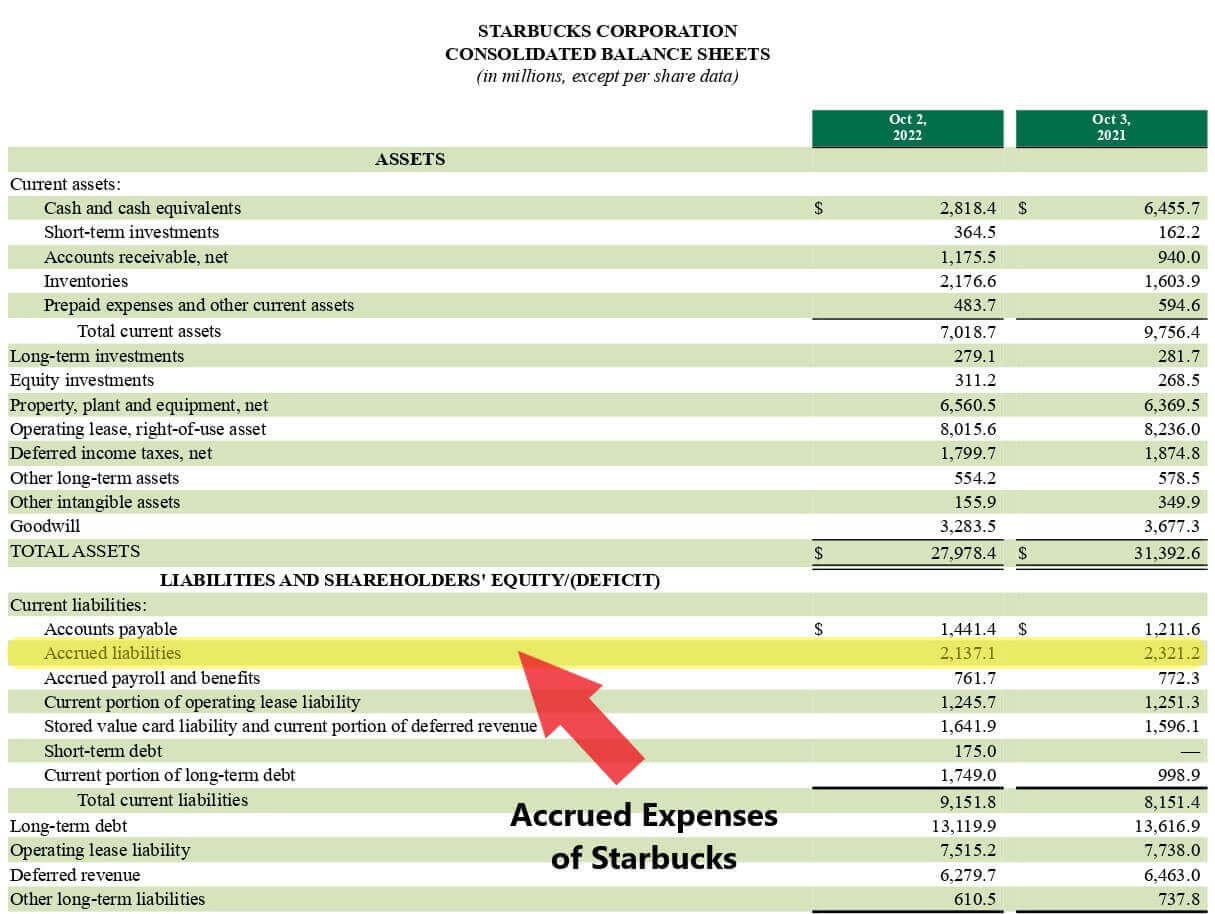

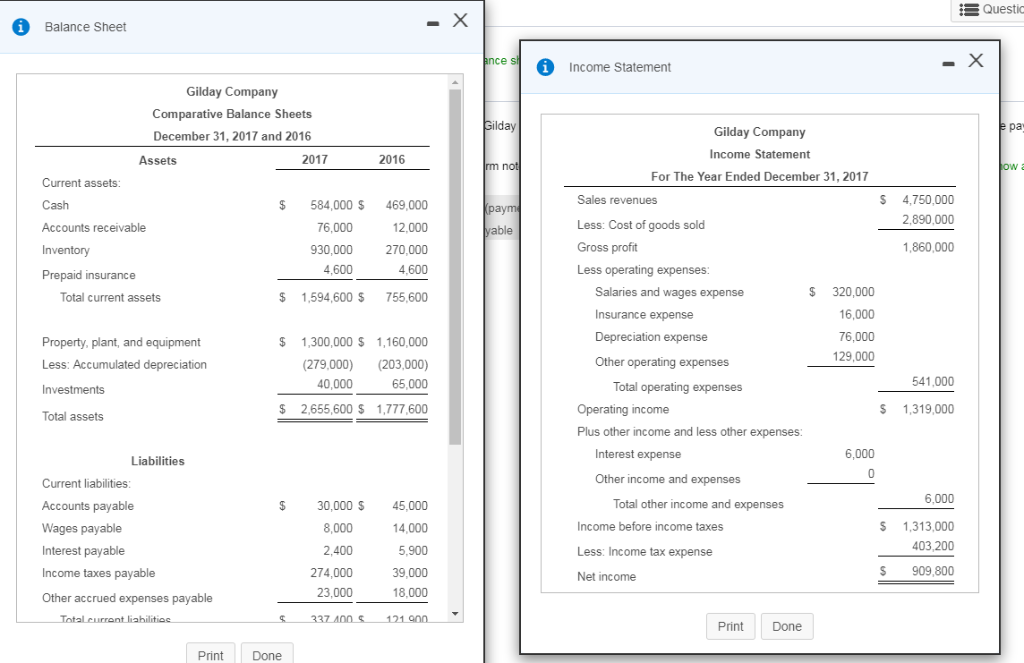

Accrued Expense Examples of Accrued Expenses

Accrued expenses are recorded on the balance sheet as liabilities and are recognised under the accrual basis of accounting. Accrued expenses include items such as interest expenses, salaries, tax expenses, rental expenses, or any other expenses incurred. Therefore, when you accrue an expense, it appears in the current liabilities portion of the balance sheet.

Accrued Expense Examples of Accrued Expenses

Therefore, when you accrue an expense, it appears in the current liabilities portion of the balance sheet. Accrued expenses include items such as interest expenses, salaries, tax expenses, rental expenses, or any other expenses incurred. Accrued expenses are recorded on the balance sheet as liabilities and are recognised under the accrual basis of accounting.

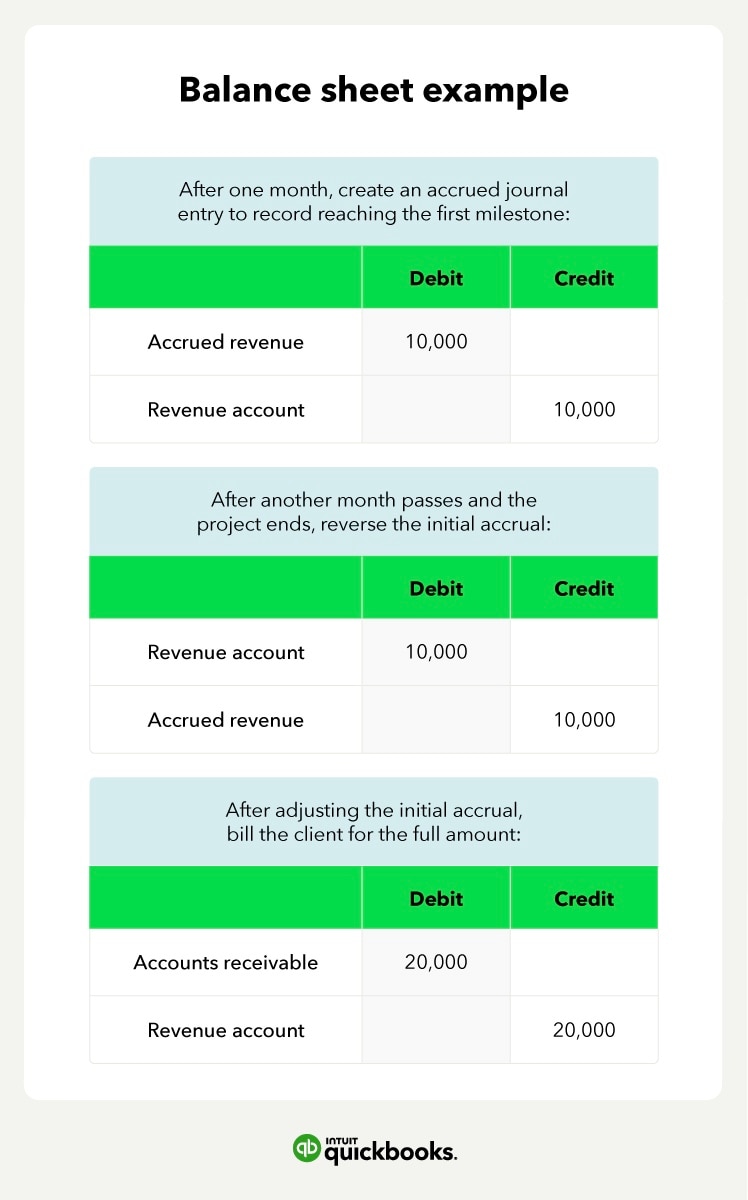

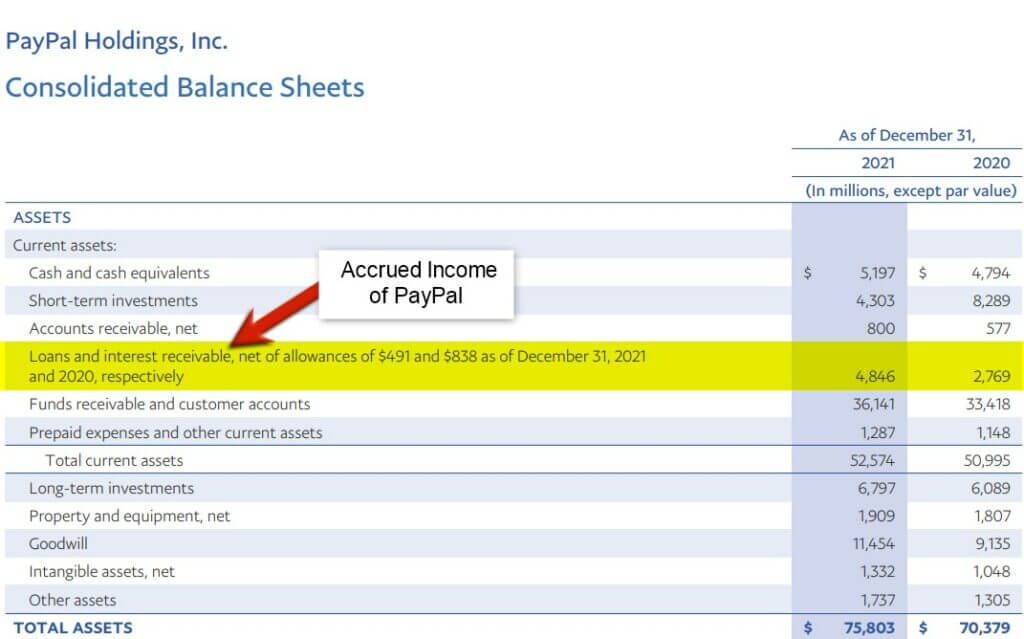

Accrued revenue how to record it in 2023 QuickBooks

Accrued expenses include items such as interest expenses, salaries, tax expenses, rental expenses, or any other expenses incurred. Accrued expenses are recorded on the balance sheet as liabilities and are recognised under the accrual basis of accounting. Therefore, when you accrue an expense, it appears in the current liabilities portion of the balance sheet.

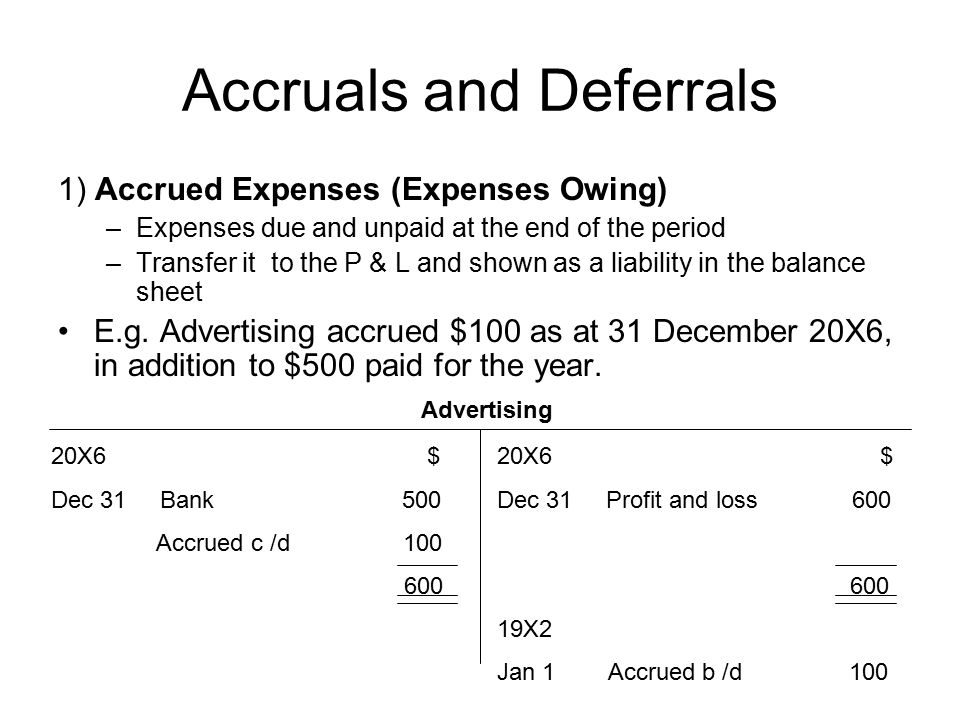

The accrual basis of accounting Business Accounting

Accrued expenses are recorded on the balance sheet as liabilities and are recognised under the accrual basis of accounting. Therefore, when you accrue an expense, it appears in the current liabilities portion of the balance sheet. Accrued expenses include items such as interest expenses, salaries, tax expenses, rental expenses, or any other expenses incurred.

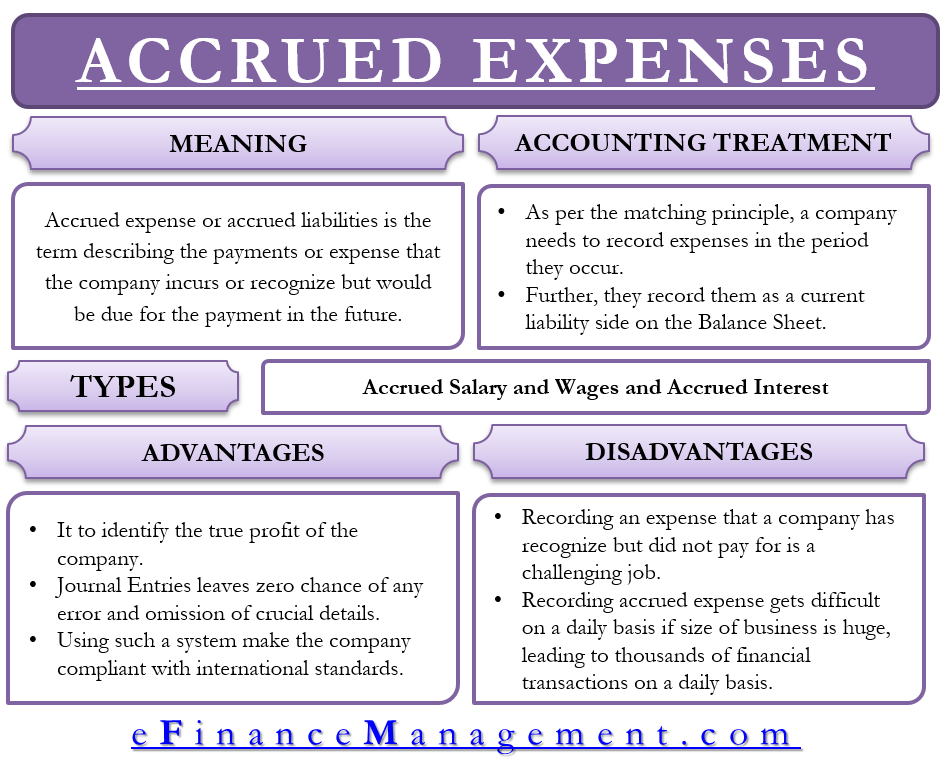

Accrued Expense Meaning, Accounting Treatment And More

Therefore, when you accrue an expense, it appears in the current liabilities portion of the balance sheet. Accrued expenses are recorded on the balance sheet as liabilities and are recognised under the accrual basis of accounting. Accrued expenses include items such as interest expenses, salaries, tax expenses, rental expenses, or any other expenses incurred.

Accrued Liability

Accrued expenses include items such as interest expenses, salaries, tax expenses, rental expenses, or any other expenses incurred. Accrued expenses are recorded on the balance sheet as liabilities and are recognised under the accrual basis of accounting. Therefore, when you accrue an expense, it appears in the current liabilities portion of the balance sheet.

Accrued Expense ⋆ Accounting Services

Accrued expenses include items such as interest expenses, salaries, tax expenses, rental expenses, or any other expenses incurred. Therefore, when you accrue an expense, it appears in the current liabilities portion of the balance sheet. Accrued expenses are recorded on the balance sheet as liabilities and are recognised under the accrual basis of accounting.

What is Accrued Journal Entry, Examples, How it Works?

Accrued expenses include items such as interest expenses, salaries, tax expenses, rental expenses, or any other expenses incurred. Accrued expenses are recorded on the balance sheet as liabilities and are recognised under the accrual basis of accounting. Therefore, when you accrue an expense, it appears in the current liabilities portion of the balance sheet.

Accrued Expenses Are Recorded On The Balance Sheet As Liabilities And Are Recognised Under The Accrual Basis Of Accounting.

Therefore, when you accrue an expense, it appears in the current liabilities portion of the balance sheet. Accrued expenses include items such as interest expenses, salaries, tax expenses, rental expenses, or any other expenses incurred.